1969-70 replay?

The current constellation of economic cycles resembles the late 1960s, according to the framework employed here. The similarities in terms of US interest rates and labour market trends are striking and suggest major reversals next year.

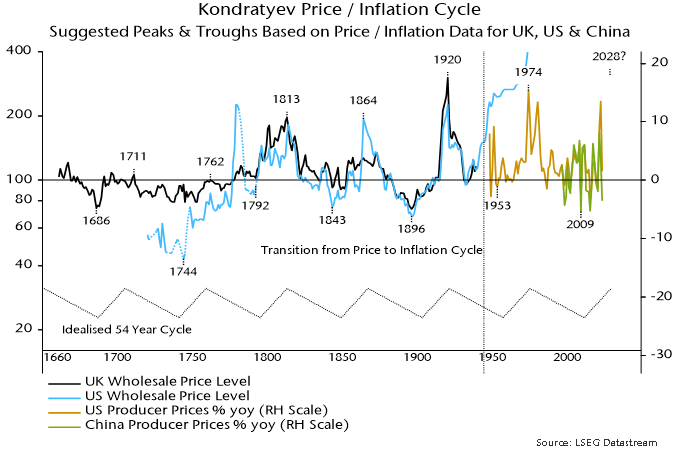

The longest cycle in the framework is the Kondratyev price / inflation cycle. Kondratyev’s research in the 1920s found evidence of “long waves” lasting about 50 years in global prices and interest rates. Chart 1 shows suggested Kondratyev peaks and troughs in US / UK wholesale price data from the late seventeenth century through WW2.

Chart 1

The breakdown of the gold standard in the 1930s untethered monetary expansion, resulting in the price level embarking on a secular rise. The cycle, however, remained visible in rate of change (i.e. inflation) data, with a 1974 peak occurring 54 years after the prior price level peak.

2009 fits the characteristics of a Kondratyev trough and occurred 323 years after the first identified low in 1686. There were five intervening lows, implying an average cycle length (measured from low to low) of 54 years.

Was the 2021-22 inflation spike the culmination of another Kondratyev upswing? A 2022 peak would imply an interval of 48 years from the prior high. The minimum peak-to-peak gap historically was 51 years. The suggestion is that another inflationary upsurge lies ahead, although not until the second half of the decade – current monetary weakness signals a downswing into 2025.

The 54-year periodicity of the Kondratyev cycle harmonises with the average 18-year length of the housing cycle. One Kondratyev cycle, measured from peak to peak, contains three housing cycles, measured from low to low. The first housing cycle of the triad is disinflationary, the second deflationary and the third inflationary.

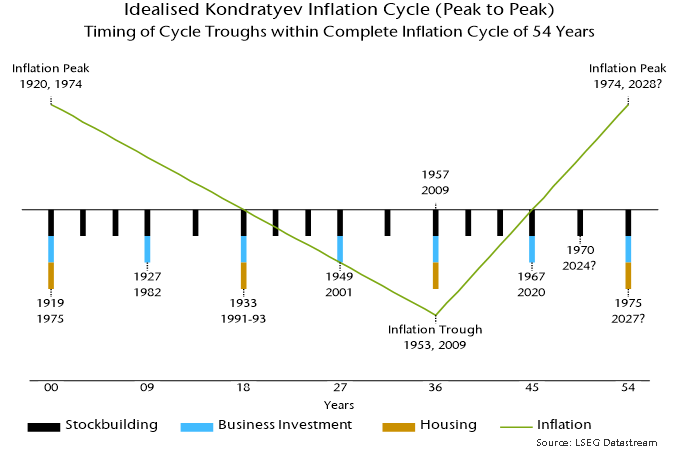

Chart 2 shows how the housing, business investment and stockbuilding cycles “nest” within the Kondratyev cycle, giving suggested dates for troughs of former three cycles in the previous (1920-74) and current (1974-2028?) Kondratyev cycles.

Chart 2

The template implies that cyclical conditions in 2023-24 most closely resemble 1969-70. The stockbuilding cycle was in a downswing within the second half of the final (inflationary) housing cycle since the prior Kondratyev peak.

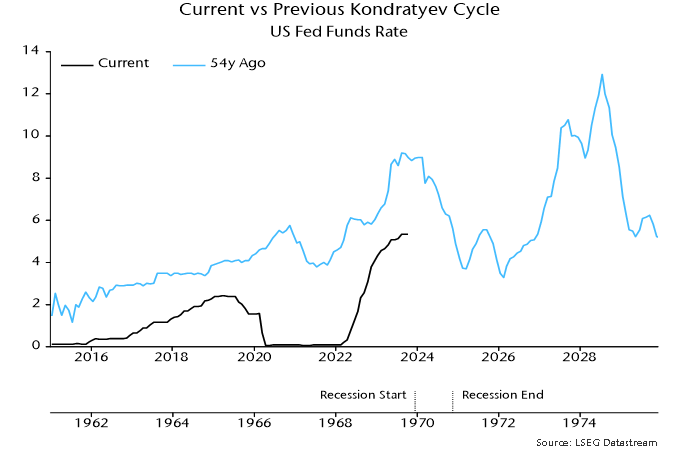

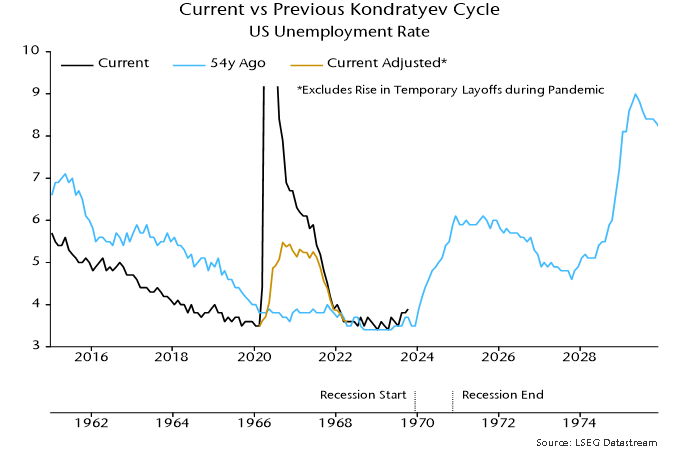

Charts 3 and 4 compare the US Fed funds and unemployment rates with their behaviour 54 years ago. The similarities are striking. The Fed funds rate rose by a cumulative 540 bp over 1967-69, peaking in August. The increase in the current cycle has been 530 bp, with the most recent – final? – hike occurring in July.

Chart 3

Chart 4

Monetary trends weakened sharply in 1969, causing Milton Friedman to warn of a recession, which started in December. The Fed began cutting rates in March 1970, unwinding the entire 1967-69 rise by February 1971.

The unemployment rate bottomed in the late 1960s at the same level as recently – 3.4% – and had edged up to 3.7% by October 1969 compared with 3.9% this October. It surged after the economy entered recession, peaking at 6.1% in December 1970.

The suggested takeaway is that cycle considerations support the current message from monetary trends – that recession risk remains high and a major Fed policy reversal is likely in 2024.

Chinese money trends reflecting PBoC caution

Chinese six-month money growth rates were little changed in September / October following a sharp slowdown over the summer, suggesting weak economic prospects through end-Q1 2024. A small consolation is that recent monetary softness is partly explained by a rise in government deposits at the PBoC, representing yet-to-be-deployed fiscal firepower.

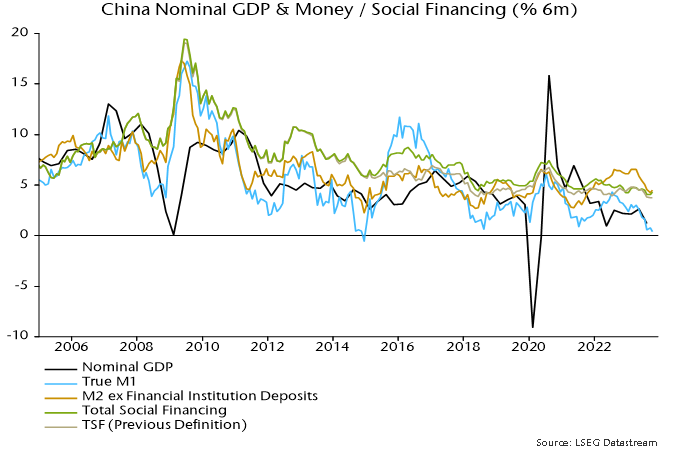

Narrow money trends are most concerning. Six-month growth of true M1 in October was the weakest since late 2014, ahead of the 2015-16 hard landing scare – see chart 1. Sectoral figures show a contraction of demand deposits of non-financial enterprises partly offset by weak but rising household deposit growth. This divergence was echoed in October activity data, with retail sales modestly better but private fixed asset investment continuing to flatline.

Chart 1

Credit growth has held up better than monetary expansion but total social financing has been supported by record issuance of local government special bonds. These were excluded from the previous TSF definition, which is a better guide to non-government credit trends and has fallen further – chart 1.

The spring / summer slowdown in money / credit reflects PBoC tightening around end-2022 and an associated sharp rise in money market rates. A reversal of this increase into August warranted a hope that money growth would recover in late 2023 but term rates have since returned to their high, though may be peaking – chart 2.

Chart 2

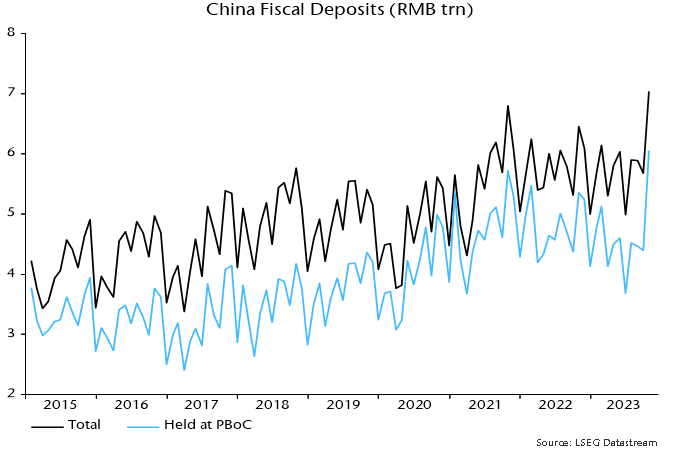

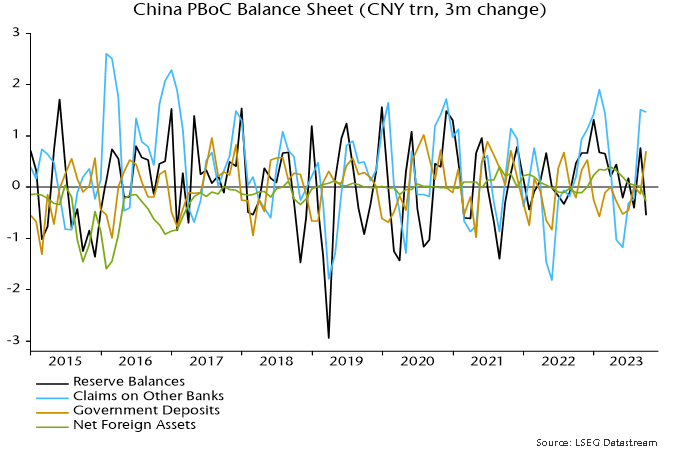

A previous post based on data through September argued that money market tightness had been partly caused by “overfunding” of the budget deficit, i.e. bond issuance to finance future spending. Excess borrowing accelerated in October, with fiscal deposits at the PBoC rising by a whopping RMB 1.7 trillion on the month – chart 3. This explains why large-scale PBoC injections have yet to bring down market rates.

Chart 3

The silver lining is that bank reserves and money growth will benefit as this fiscal firepower is deployed.

The potential boost to narrow money is modest – a fall in fiscal deposits from the current RMB 7.0 trillion to their 2022 average of RMB 5.8 trillion would, if fully reflected, add 1.2% to true M1. Additional PBoC easing measures are needed for a material improvement in monetary and economic prospects.

Hard landing watch: full PMI results, OECD G7 leading indicator

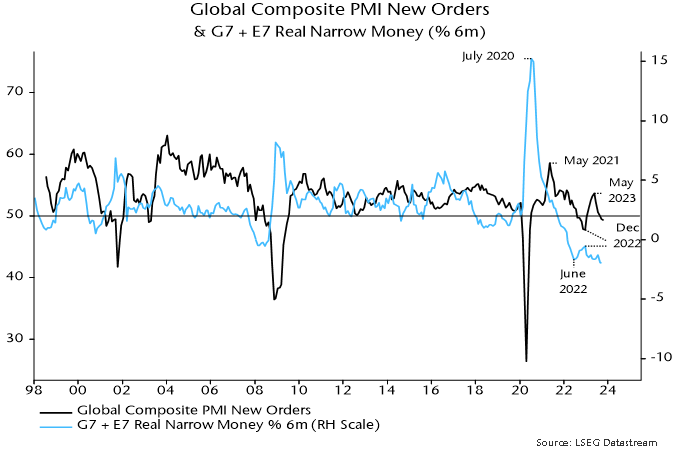

The global composite PMI new orders index fell from 49.5 in September to 49.3 in October, extending a decline from a local peak in May. Recent weakness was signalled by a fall in six-month real narrow money momentum, which reached a new low in September, suggesting a further PMI decline into end-Q1 – see chart 1.

Chart 1

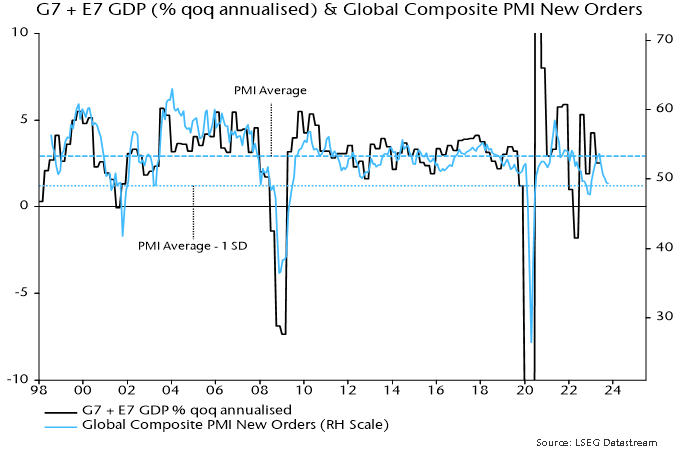

The new orders index is 1 standard deviation below its historical average, consistent with slow global GDP expansion – chart 2.

Chart 2

The index would need to fall to 46-47 to signal a full-blown global recession. The current level, however, is weak enough to suggest “hard landings” in selected economies. It is, for example, below the low reached in 2012 during the Eurozone recession / financial crisis.

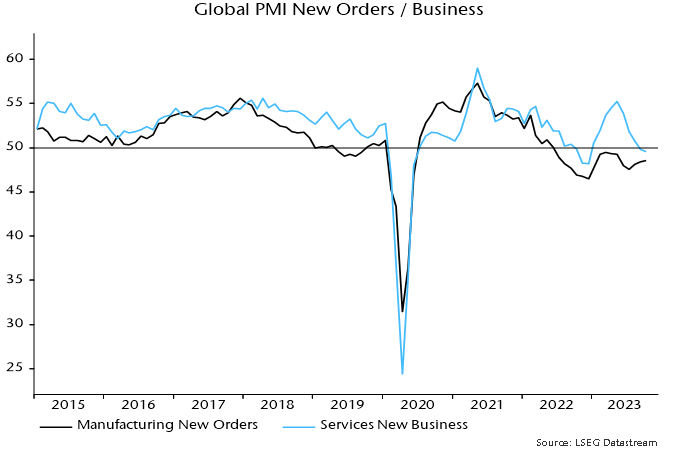

The October fall in the index was again driven by services new business, with manufacturing new orders extending a minor recovery since July – chart 3.

Chart 3

The suggestion here has been that manufacturing would receive support from a lessening of a drag from the stockbuilding cycle but a recovery was likely to prove modest and temporary, reflecting offsetting weakness in final demand.

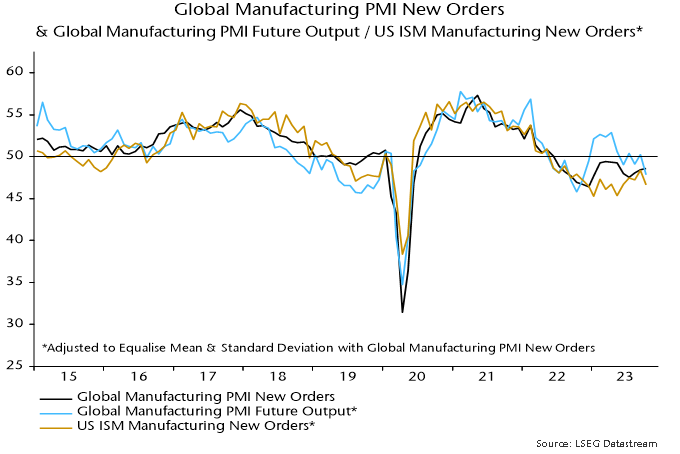

The small further rise in global manufacturing PMI new orders in October was not mirrored by output expectations or US ISM manufacturing new orders, both of which reversed lower – chart 4.

Chart 4

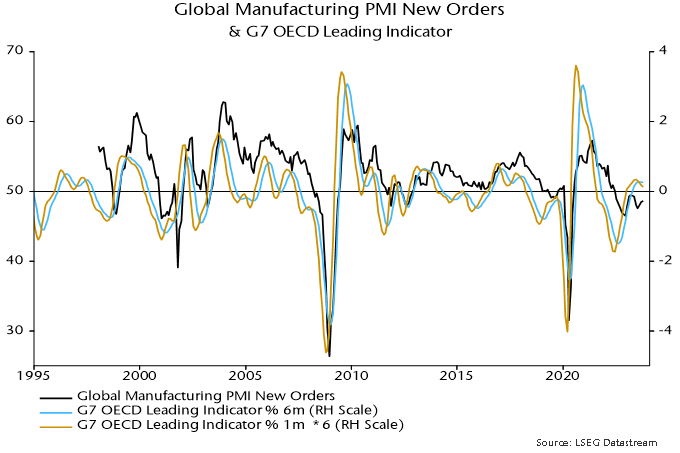

The possibility that manufacturing is on the brink of renewed weakness is tentatively supported by the OECD’s G7 leading indicator. The rate of change of the indicator* appears to be inflecting lower and has led peaks and troughs in global manufacturing PMI new orders historically – chart 5.

Chart 5

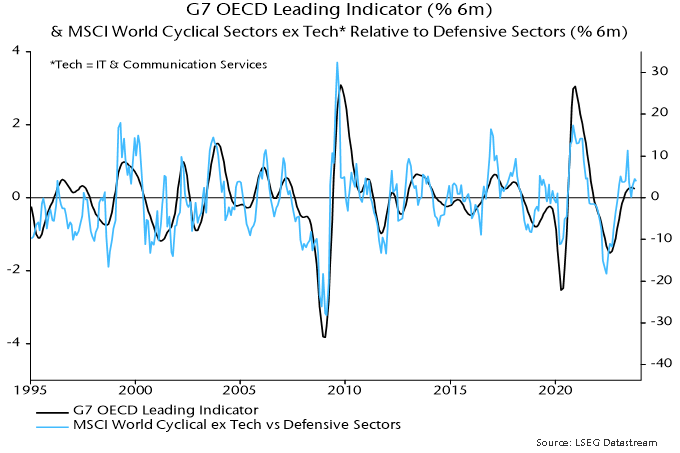

The above evidence casts doubt on last week’s strong rally in equity market cyclical sectors, apparently due to rising rate peak / soft landing hopes. The rate of change of the leading indicator has correlated with the relative performance of cyclical sectors historically, suggesting cyclical underperformance if the momentum reversal is confirmed – chart 6.

Chart 6

Verdict: consistent with developing hard landing.

*The indicator is calculated independently using the OECD's historical methodology, i.e. excluding a temporary reduction in data smoothing applied by statisticians in 2020 in response to the covid shock.

Puzzling Chinese money market developments

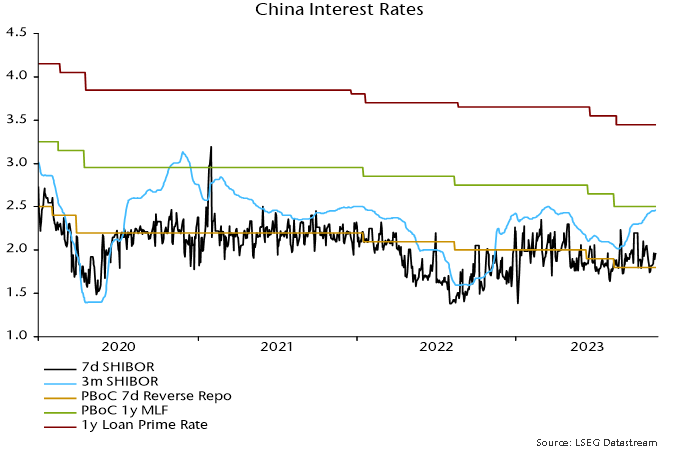

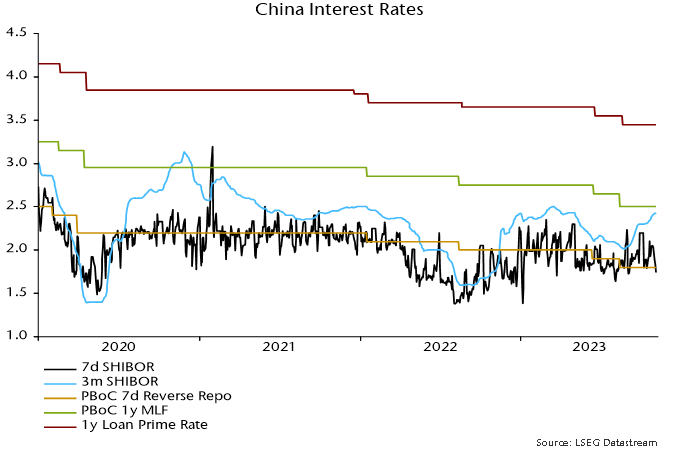

The PBoC has, ostensibly, been easing monetary policy – it reduced official rates in August, cut reserve requirements in September and has been injecting large sums in its regular lending operations. Yet three-month SHIBOR has risen since late August and is almost back to its March high – see chart 1. What’s going on?

Chart 1

The rise in rates indicates that money market conditions have tightened despite the PBoC’s actions. This could reflect 1) other contractionary influences on bank reserves that have offset the PBoC’s expansionary measures and / or 2) increased reluctance of banks with excess reserves to lend to liquidity-short market participants, i.e. a reduced velocity of circulation of reserves.

Explanation 1) appears to be at least part of the story. The latest published PBoC balance sheet is for end-September. The PBoC expanded its lending to banks by CNY1.47 trillion between end-June and end-September but bank reserves fell by CNY550 billion over this period – chart 2.

Chart 2

The PBoC’s injections were offset by:

-

A rise in currency in circulation of CNY420 billion (i.e. banks swapped reserves of this value for currency on behalf of their customers).

-

A CNY930 billion increase in government deposits at the PBoC (i.e. there was “overfunding” of the budget deficit over the period, resulting in a transfer from bank reserves).

-

A fall of CNY270 billion in the PBoC’s net foreign assets, consistent with foreign exchange intervention to support the currency (i.e. the PBoC sold dollars etc., with transactions settled by a transfer from bank reserves).

-

Other unspecified movements within the “other assets” and “other liabilities” categories, which reduced net assets by a further CNY680 billion.

The PBoC has expanded its lending to banks further since end-September, judging from data on reverse repo transactions and lending via its standing and medium-term facilities, but three-month SHIBOR has continued to firm.

It should be emphasised that the PBoC has ultimate control over short-term interest rates because there is no theoretical or practical limit to its ability to supply additional reserves.

Why has it chosen to undersupply market demand for liquidity? A plausible explanation is that officials are concerned that even larger injections would increase downward pressure on the currency.

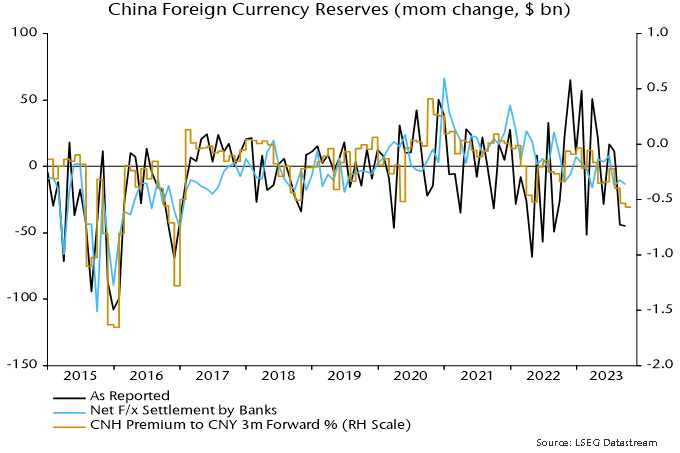

Foreign exchange reserves fell by $78 billion during Q3 but this overstates PBoC intervention because of valuation effects (stronger dollar, weaker Treasuries). Banks purchased a net $39 billion of foreign exchange over the three months, which is a better guide to official sales and tallies with the fall in net foreign assets on the PBoC’s balance sheet (CNY270 billion = $37 billion at a Q3 average exchange rate of 7.25).

The forward premium or discount on the offshore yuan is an indirect measure of pressure on the currency. The discount widened in October, which may indicate that intervention had to be stepped up – chart 3.

Chart 3

The reserves outflow is much less than before / after the 2015 devaluation, when monthly intervention appears to have peaked at over $100 billion.

The rise in money rates is worrying for monetary prospects. Six-month narrow money growth slowed sharply over the summer, a movement judged here to reflect an increase in rates in late 2022 / early 2023 caused by the PBoC withdrawing liquidity on concern about a reopening boost to inflation.

Rates fell back between March and August, warranting hopes of a rebound in money growth later in 2023. That prospect has been pushed back and could be cancelled unless rates swiftly reverse the recent rise.

Addendum: Another puzzle is that the PBoC has yet to release the results of its Q3 surveys of enterprises, urban depositors and banks, which should have appeared weeks ago based on the historical schedule. The surveys provide important information, e.g. export orders from the enterprise survey is one of the six components of the OECD’s Chinese leading indicator.

Global real money momentum at new low on BRIC weakness

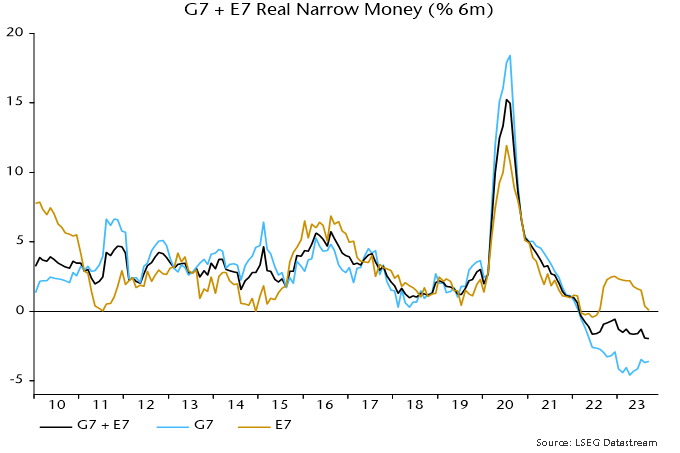

Additional monetary information confirms an earlier estimate here that global (i.e. G7 plus E7) six-month real narrow money momentum reached a new low in September, extending a decline from a local peak in December 2022 and suggesting further economic deceleration through spring 2024.

The September decline reflects a further fall in E7 momentum, which offset a small G7 recovery and reduced the E7-G7 gap to its narrowest since August 2022 – see chart 1.

Chart 1

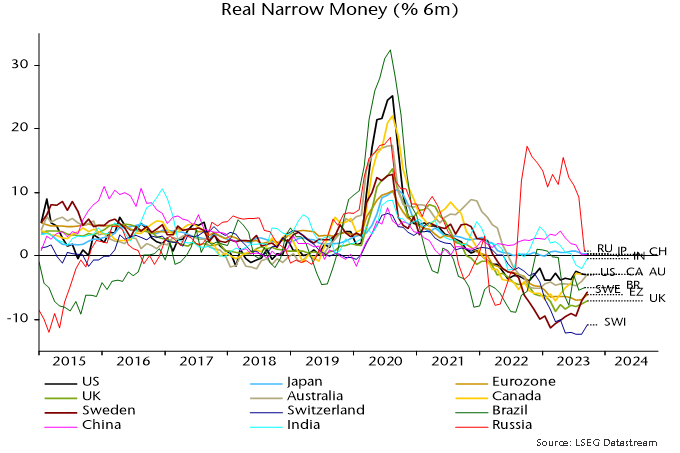

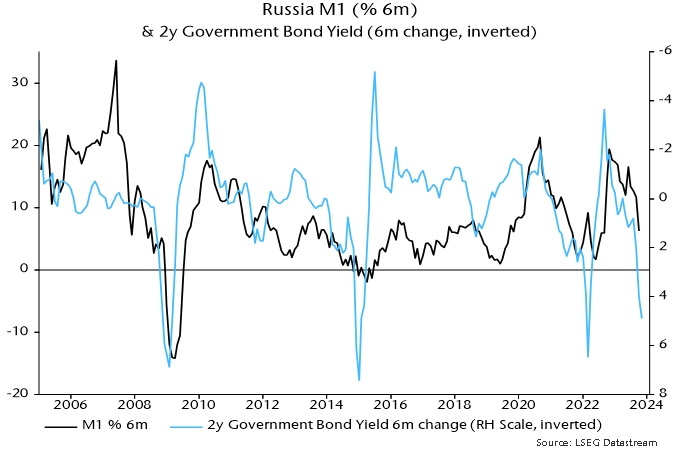

E7 and G7 gauges have moved in opposite directions since April. The E7 decline over May-August was driven by China, India and Brazil, with the September fall due to a plunge in Russia – chart 2. Russian weakness is likely to intensify given a recent surge in rates – chart 3.

Chart 2

Chart 3

The G7 recovery since April has been due to a minor reduction in the pace of nominal narrow money contraction coupled with a further slowdown in six-month consumer price inflation. The change of direction has occurred in most DM economies and momentum remains weaker in the Eurozone / UK than the US, Canada and Australia – chart 2. Still-extreme negative readings argue against much diminution of recessionary prospects.

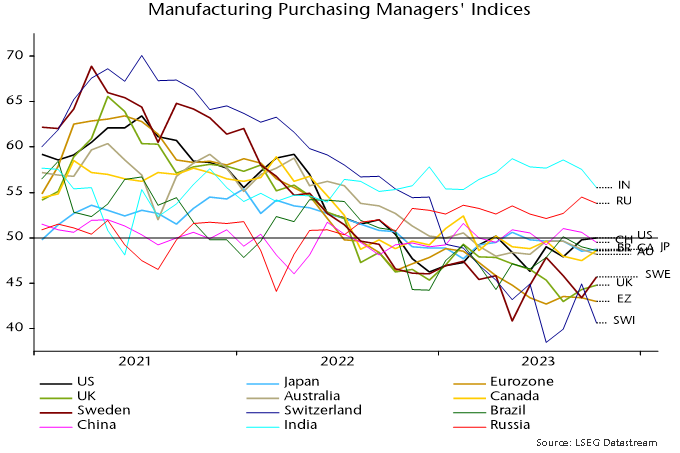

Cross-country S&P Global manufacturing PMI results are broadly consistent with the real narrow money momentum ranking – chart 4 (rank correlation coefficient of latest data points in charts 2 and 4 = 0.85). October PMI falls in India, China, Brazil and particularly Russia may extend given weaker monetary readings. A recent recovery in the US PMI, meanwhile, appears out of line with negative / little changed real money momentum and could reverse (as did the ISM manufacturing PMI last month).

Chart 4