Puzzling Chinese money market developments

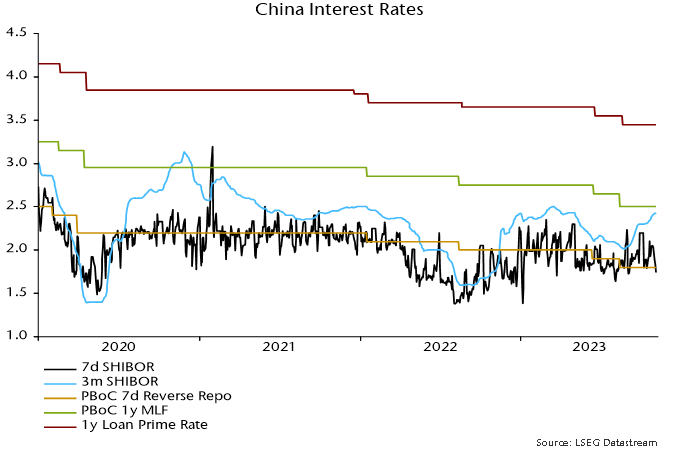

The PBoC has, ostensibly, been easing monetary policy – it reduced official rates in August, cut reserve requirements in September and has been injecting large sums in its regular lending operations. Yet three-month SHIBOR has risen since late August and is almost back to its March high – see chart 1. What’s going on?

Chart 1

The rise in rates indicates that money market conditions have tightened despite the PBoC’s actions. This could reflect 1) other contractionary influences on bank reserves that have offset the PBoC’s expansionary measures and / or 2) increased reluctance of banks with excess reserves to lend to liquidity-short market participants, i.e. a reduced velocity of circulation of reserves.

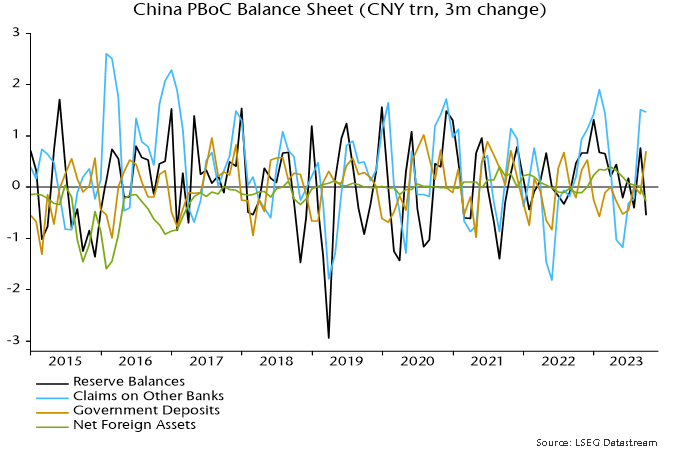

Explanation 1) appears to be at least part of the story. The latest published PBoC balance sheet is for end-September. The PBoC expanded its lending to banks by CNY1.47 trillion between end-June and end-September but bank reserves fell by CNY550 billion over this period – chart 2.

Chart 2

The PBoC’s injections were offset by:

-

A rise in currency in circulation of CNY420 billion (i.e. banks swapped reserves of this value for currency on behalf of their customers).

-

A CNY930 billion increase in government deposits at the PBoC (i.e. there was “overfunding” of the budget deficit over the period, resulting in a transfer from bank reserves).

-

A fall of CNY270 billion in the PBoC’s net foreign assets, consistent with foreign exchange intervention to support the currency (i.e. the PBoC sold dollars etc., with transactions settled by a transfer from bank reserves).

-

Other unspecified movements within the “other assets” and “other liabilities” categories, which reduced net assets by a further CNY680 billion.

The PBoC has expanded its lending to banks further since end-September, judging from data on reverse repo transactions and lending via its standing and medium-term facilities, but three-month SHIBOR has continued to firm.

It should be emphasised that the PBoC has ultimate control over short-term interest rates because there is no theoretical or practical limit to its ability to supply additional reserves.

Why has it chosen to undersupply market demand for liquidity? A plausible explanation is that officials are concerned that even larger injections would increase downward pressure on the currency.

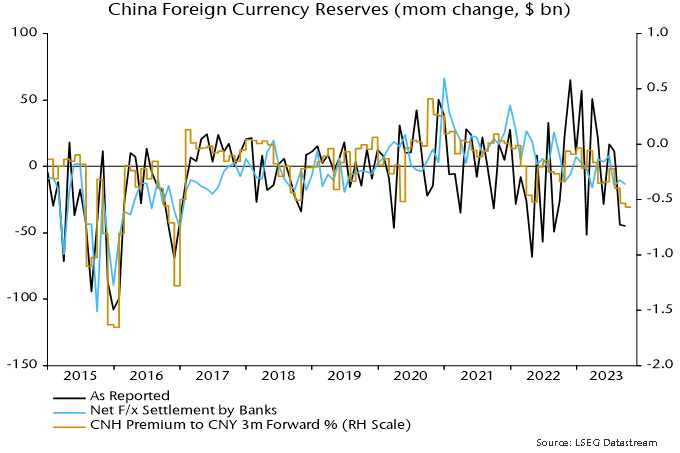

Foreign exchange reserves fell by $78 billion during Q3 but this overstates PBoC intervention because of valuation effects (stronger dollar, weaker Treasuries). Banks purchased a net $39 billion of foreign exchange over the three months, which is a better guide to official sales and tallies with the fall in net foreign assets on the PBoC’s balance sheet (CNY270 billion = $37 billion at a Q3 average exchange rate of 7.25).

The forward premium or discount on the offshore yuan is an indirect measure of pressure on the currency. The discount widened in October, which may indicate that intervention had to be stepped up – chart 3.

Chart 3

The reserves outflow is much less than before / after the 2015 devaluation, when monthly intervention appears to have peaked at over $100 billion.

The rise in money rates is worrying for monetary prospects. Six-month narrow money growth slowed sharply over the summer, a movement judged here to reflect an increase in rates in late 2022 / early 2023 caused by the PBoC withdrawing liquidity on concern about a reopening boost to inflation.

Rates fell back between March and August, warranting hopes of a rebound in money growth later in 2023. That prospect has been pushed back and could be cancelled unless rates swiftly reverse the recent rise.

Addendum: Another puzzle is that the PBoC has yet to release the results of its Q3 surveys of enterprises, urban depositors and banks, which should have appeared weeks ago based on the historical schedule. The surveys provide important information, e.g. export orders from the enterprise survey is one of the six components of the OECD’s Chinese leading indicator.

Reader Comments (1)

These monetary developments are particularly troubling in the face of monetary weakness elsewhere.

Doesn't seem like China will ride to the rescue this cycle.