Global real money momentum at new low on BRIC weakness

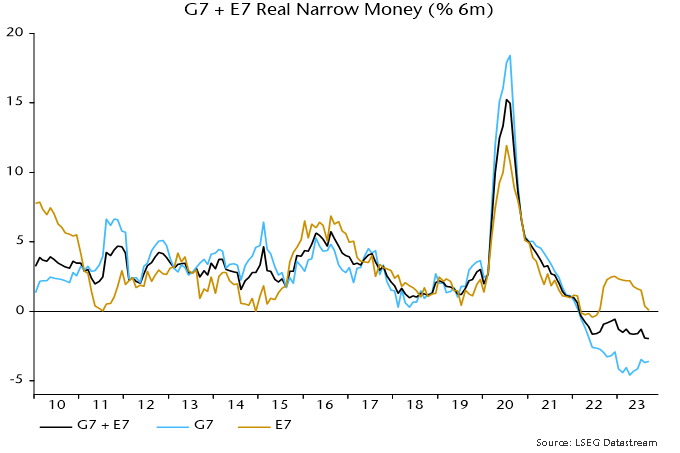

Additional monetary information confirms an earlier estimate here that global (i.e. G7 plus E7) six-month real narrow money momentum reached a new low in September, extending a decline from a local peak in December 2022 and suggesting further economic deceleration through spring 2024.

The September decline reflects a further fall in E7 momentum, which offset a small G7 recovery and reduced the E7-G7 gap to its narrowest since August 2022 – see chart 1.

Chart 1

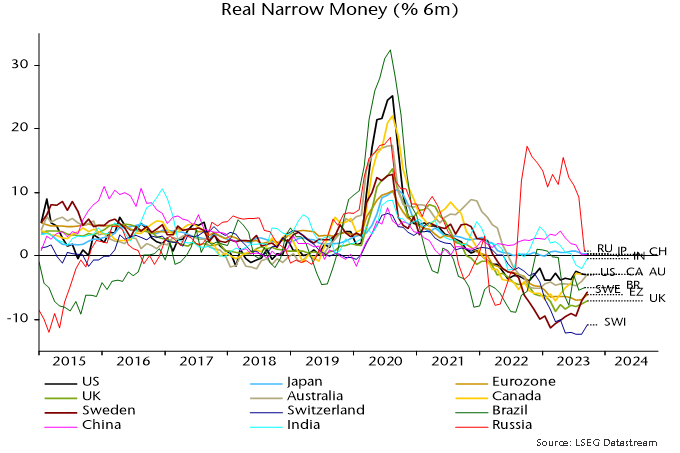

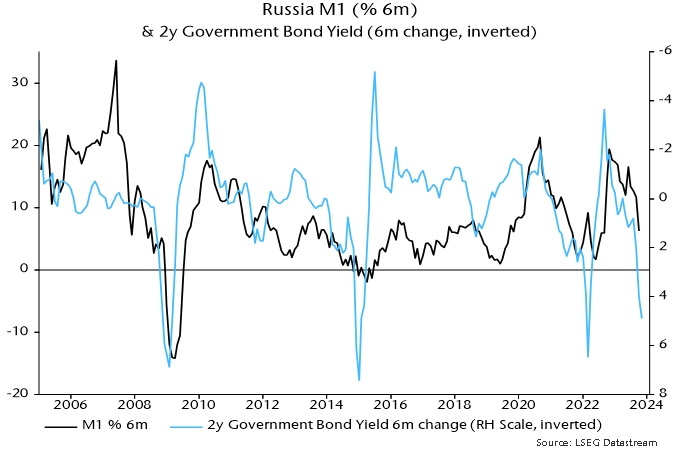

E7 and G7 gauges have moved in opposite directions since April. The E7 decline over May-August was driven by China, India and Brazil, with the September fall due to a plunge in Russia – chart 2. Russian weakness is likely to intensify given a recent surge in rates – chart 3.

Chart 2

Chart 3

The G7 recovery since April has been due to a minor reduction in the pace of nominal narrow money contraction coupled with a further slowdown in six-month consumer price inflation. The change of direction has occurred in most DM economies and momentum remains weaker in the Eurozone / UK than the US, Canada and Australia – chart 2. Still-extreme negative readings argue against much diminution of recessionary prospects.

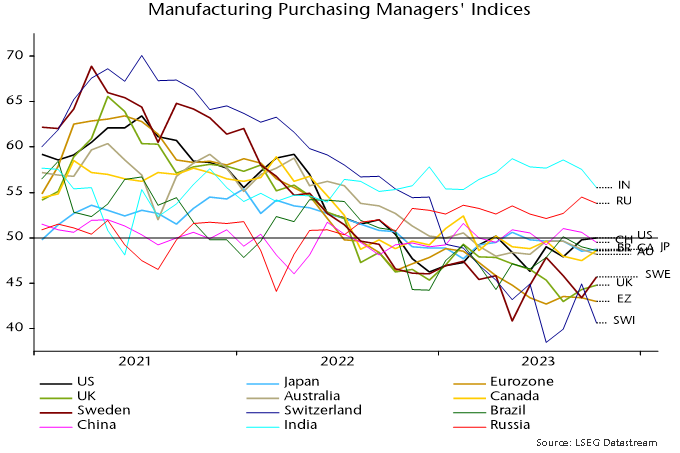

Cross-country S&P Global manufacturing PMI results are broadly consistent with the real narrow money momentum ranking – chart 4 (rank correlation coefficient of latest data points in charts 2 and 4 = 0.85). October PMI falls in India, China, Brazil and particularly Russia may extend given weaker monetary readings. A recent recovery in the US PMI, meanwhile, appears out of line with negative / little changed real money momentum and could reverse (as did the ISM manufacturing PMI last month).

Chart 4

Reader Comments