UK inflation: "monetarist" forecast on track

The MPC’s November inflation projections are ancient history. Price pressures have plunged in line with a simplistic monetarist forecast suggesting a return to target in Q2 2024 and an undershoot in H2.

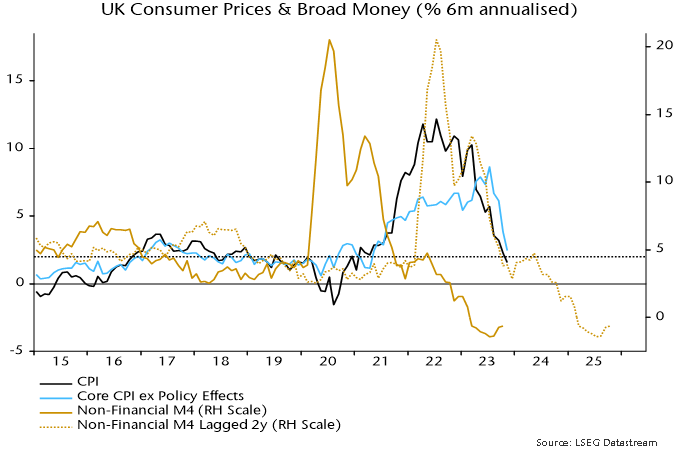

The simplistic forecast is based on the Friedmanite rule that inflation directionally follows money growth with an average lag of two years. This is converted to a numerical profile by assuming a one-for-one relationship of deviations in inflation and money growth from 2% and 4.5% respectively.

Friedman emphasised the variability of the money growth / inflation lag but a two-year assumption has proved accurate in timing the inflation peak and subsequent decline – see chart 1.

Chart 1

A post in July suggested that the six-month rate of increase in the CPI, seasonally adjusted, would fall to 2% annualised or lower around end-2023, reflecting a decline in six-month broad money growth to below 4.5% annualised in Q4 2021. The fall is ahead of schedule, with the six-month CPI increase at 1.6% in November.

The simplistic forecast suggests that six-month inflation will fluctuate around the current level through mid-2024 before dropping further in H2 – chart 1. The implication is that the annual rate will return to target in Q2 and undershoot during H2.

By contrast, the modal forecast for annual inflation in Q4 2024 in the November Monetary Policy Report was 3.1%, with the mean forecast (incorporating an upside risk assessment) at 3.4%.

Broad money momentum remains negative, suggesting that an inflation revival is unlikely before mid-2025.

Bottom-up considerations support the view that annual inflation will return to target by next spring, assuming no adverse shocks:

-

Annual inflation of food, alcohol and tobacco of 9.4% in November could fall to 3% by Q2. Annual producer output price inflation of food, beverages and tobacco is already down to 2.1%, while input prices of home-produced food are falling year-on-year.

-

The energy price cap will rise by 5% in January but Cornwall Insight currently projects a 14% cut in April.

-

Annual core goods inflation of 3.3% in November could fall to 1%. Core producer output prices are flatlining, while base effects are favourable through May.

-

Slowing food prices will feed through to catering services, with the historical sensitivity suggesting a fall in annual inflation from 7.8% in November to 4.5%. This would cut services inflation by 0.75 pp, based on the 23% weight of catering in the services basket.

-

The above two assumptions coupled with a 1 pp slowdown in the rest of the services basket would imply a 1.75 pp fall in annual core inflation by Q2 (5.1% in November). This would be sufficient to generate a 2% headline rate given the assumed food slowdown and a large year-on-year decline household energy bills.

Reader Comments (1)

It probably won't be long before the BOE and central banks generally start focussing on labour markets, not inflation?