US business money diverging positively from weak Europe

Recent US / European monetary weakness gives a negative signal for economic prospects through mid-2024, at least. US trends, however, are showing signs of improvement in aggregate and in terms of sectoral developments, suggesting smaller downside risk and earlier recovery prospects.

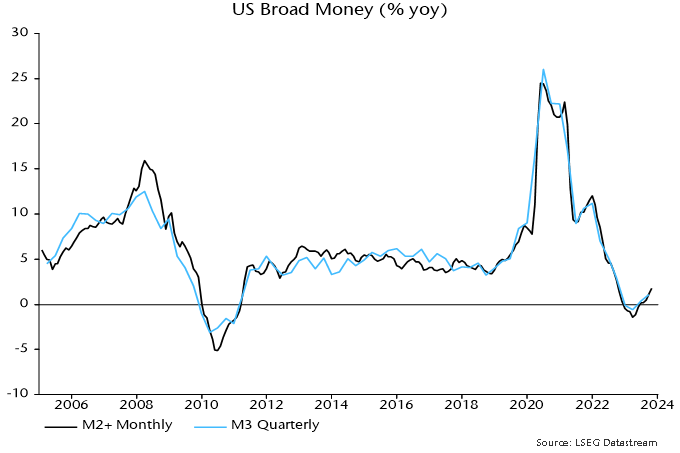

The monthly measure of US broad money tracked here adds commercial bank large time deposits and institutional money funds to the Fed’s M2 aggregate (“M2+”). The former items are important for capturing corporate and institutional money holdings.

The monthly aggregate can be cross-checked against a quarterly M3 measure derived from the Fed’s financial accounts, which additionally includes repurchase agreements. Annual rates of change of the two measures bottomed in March and have recovered to weak positive territory (1.8% for M2+ in October, 1.1% for M3 in September) – see chart 1.

Chart 1

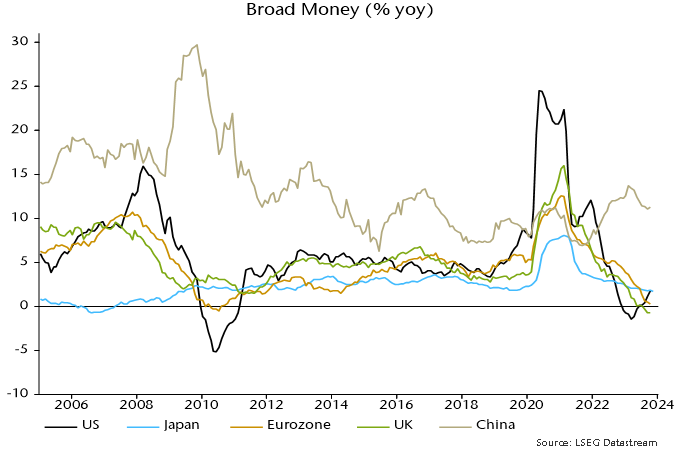

This recovery contrasts with a further decline in annual rates of change of Eurozone and UK broad money, as measured by non-financial M3 and non-financial M4 respectively. The UK series crossed below the US level in July, with the Eurozone following in September – chart 2.

Chart 2

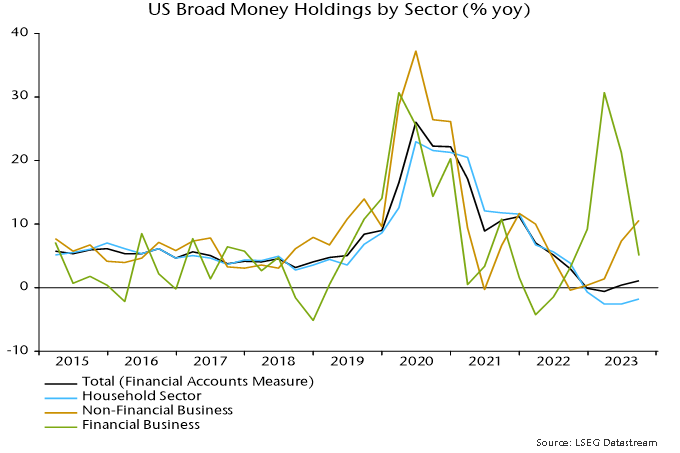

The suggestion that US economic prospects for later in 2024 are less bad than in Europe and improving at the margin is supported by sectoral money developments. Aggregate money is the best guide to economic prospects but changes in business / corporate liquidity usually carry more significance than fluctuations in household money holdings, reflecting their influence on decisions about investment and hiring.

The sectoral M3 breakdown in the Fed’s financial accounts shows that still-weak aggregate broad money growth is explained by a continued fall in the household component, while money holdings of non-financial businesses have bounced back, rising by 10.6% in the year to September – chart 3*.

Chart 3

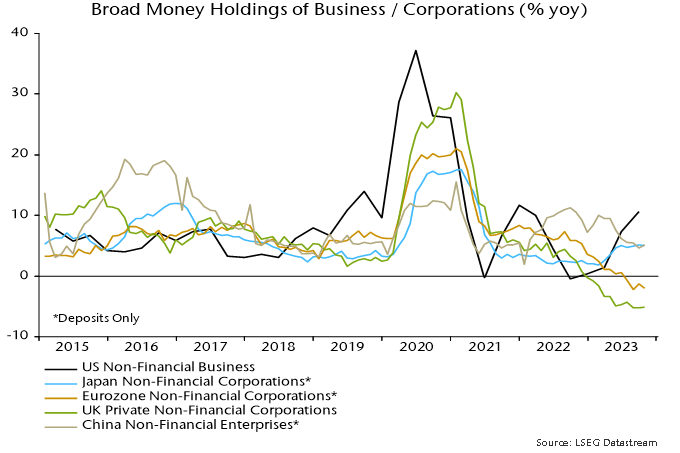

By contrast, annual rates of change of money holdings of Eurozone / UK non-financial corporations remain negative, with no sign of recovery – chart 4.

Chart 4

The pick-up in US business money holdings is surprising and may not be sustained but current US / European monetary divergence suggests that US economic outperformance will continue, while a reversal of policy tightening is more urgently required in the Eurozone / UK.

*The pick-up in business money is not fully captured by M2 (because much of the inflow has been into large time deposits and institutional money funds), explaining why M2 is lagging M2+ / M3, falling by 3.3% in the year to October (versus 1.8% growth of M2+).

Reader Comments (3)

Hi,

Is there a FRED series for non-financial monetary aggregates to keep an eye on? I've not seen this one before.

Nonfinancial Corporate Business; Checkable Deposits and Currency seems to be a close one.

Broad money stock = sum of:

Nonfinancial Business; Checkable Deposits and Currency; Asset, Level (BOGZ1FL143020005Q)

Nonfinancial Business; Total Time and Savings Deposits; Asset, Level (BOGZ1FL143030005Q)

Nonfinancial Business; Money Market Fund Shares; Asset, Level (BOGZ1FL143034005Q)

Nonfinancial Corporate Business; Security Repurchase Agreements; Asset, Level (SRPSABSNNCB)

Is it possibly related to the trade balance in services, which has surged in the last 6 months. Just thinking about sectoral balances...