Hard landing watch: US ISM manufacturing survey

This is the second in a series of short posts focusing on whether incoming economic news supports or contradicts the forecast of a global “hard landing” suggested by monetary trends.

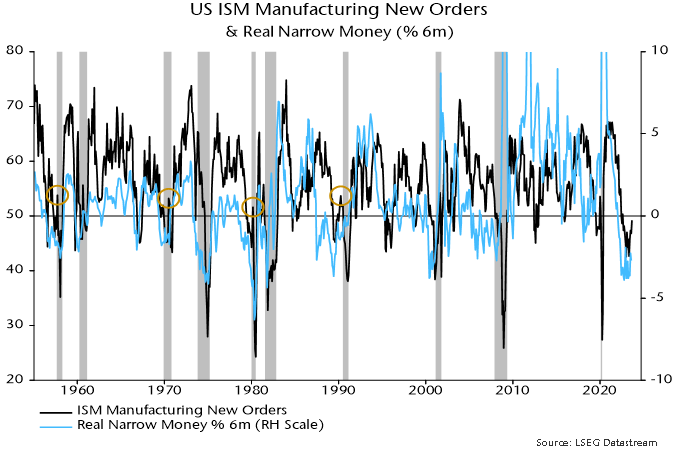

The US ISM manufacturing new orders index rose to a 13-month high of 49.2 in September, apparently supporting soft landing hopes.

A post in July flagged the possibility of a near-term rebound but suggested that this would prove to be a “head fake” preceding a move back below 45.

The main reason for expecting a recovery was that the stockbuilding cycle was judged to be moving towards a low, i.e. a drag on new orders from customer inventory adjustment was likely to abate.

The reason for expecting the recovery to be brief and followed by a relapse was that US real narrow money momentum remained heavily negative, suggesting that a stockbuilding boost would be outweighed by weakness in final demand.

Historical instances of ISM new orders recovering through 50 when real money contraction was negative include 1957, 1970, 1980 and 1990. The orders index subsequently fell back below 45, with the relapses associated with recessions – see chart 1.

Chart 1

Six-month real narrow money momentum has recovered since mid-year but remains significantly negative.

The earlier suggestion of a recovery in ISM new orders was supported by a sharp rebound in Korean FKI manufacturing expectations between February and July – Korean exports are sensitive to changes in global industrial momentum. FKI expectations relinquished most of the February-July gain in August / September.

Verdict: inconclusive.

Reader Comments (2)

Looking at the long end rising. I'd be surprised if nominal money growth doesn't weaken quite a bit more.

So then should ISM next year.

Thank you, Simon.