Global economic update: any sign of a bottom?

Amid current deep gloom, are there any signs that global economic clouds could lift later in 2009?

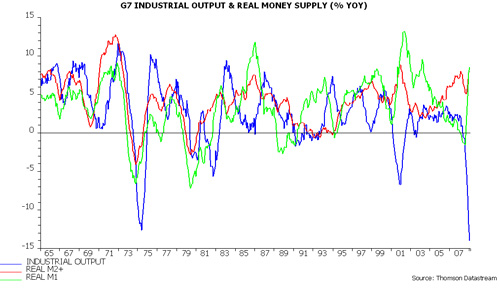

The most hopeful message continues to come from monetary trends. Annual growth in G7 real narrow and broad money has been picking up since August / September last year, rising further in January – see first chart. Money growth typically leads industrial output momentum by 6-12 months, suggesting a bottom in the latter by late summer at the latest.

One reservation is that the monetary acceleration has been heavily dependent on the US, reflecting Fed asset purchases. Similar action is needed in other G7 economies, though the Bank of England should step up to the plate this week. In addition, the Fed must sustain the pace of asset purchases to prevent a relapse in money growth – buying has slowed in recent weeks.

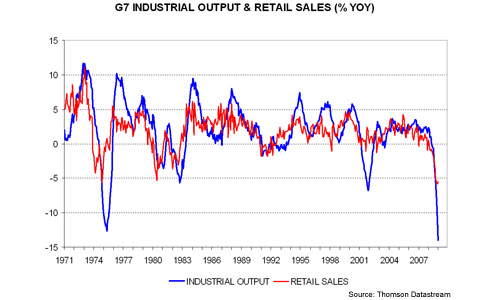

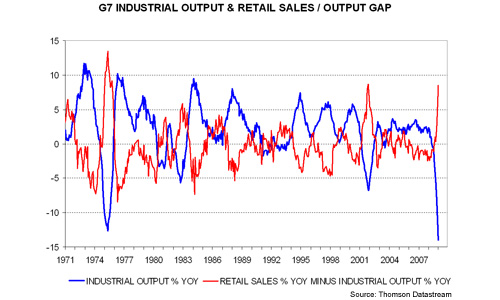

Another glimmer of hope is that output has been falling much faster than final demand, allowing inventories to decline. While G7 industrial output plunged by an estimated 14% in the year to January, retail sales volumes were “only” 5.5% lower – second and third charts. GDP reports show significant declines in inventories in the US, France and the UK in the fourth quarter (Japan was a notable exception). This supports expectations that the stocks cycle will act to support economic activity later in 2009 – a positive impact requires only a slowdown in the pace of destocking, not an actual rise in inventories.

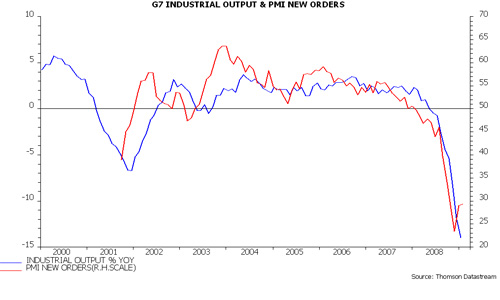

Shorter-term indicators remain mostly grim and labour market news should be especially awful over the next few months. Nevertheless, this week’s purchasing managers surveys at least suggest some slowdown in the pace of industrial contraction – fourth chart.

Reader Comments