Bank margin squeeze argues for MPC hold

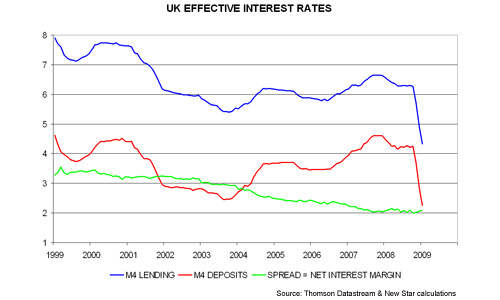

The spread between UK banks' average lending and deposit rates – a measure of their net interest margin – remained close to its historical low in January, according to estimates derived from Bank of England data published today. The spread stood at 2.08%, little changed from 2.09% in September before the MPC began slashing Bank rate and well below its average of 2.77% over 1999-2008 – see chart.

Some commentators accuse banks of widening margins by increasing the spread between lending rates and Bank rate, particularly for new and refinancing borrowers. The effect, however, has been offset by a rise in deposit rates relative to Bank rate. For example, the spread between Bank rate and the average rate paid on interest-bearing sight (i.e. instant access) deposits from households fell to just 0.47% in January versus an average of 2.20% over 1999-2008. In effect, banks have been forced to charge borrowers more in order to keep deposit rates high enough to retain funds.

The sight deposit rate stood at just 1.14% in January, a level that does not fully reflect the 0.5 percentage point reduction in Bank rate to 1.5% at the start of the month. The MPC cut by a further 0.5 pp in February and the consensus expects another 0.5 pp this week. If this is delivered, banks will face a choice between lowering sight deposit rates almost to zero, thereby risking a significant outflow of funds in favour of government-sponsored savings (National Savings / Northern Rock), or allowing a further narrowing of the Bank / deposit rate spread, with negative implications for profitability. Either way, their ability / willingness to lend may be impaired.

The MPC discussed possible adverse effects of a larger Bank rate cut at the February meeting. “There was a great deal of uncertainty about what would happen to banks’ and building societies’ willingness to lend at low levels of interest rates. It was possible that the negative impact on profitability could be significant for some banks as Bank rate fell further. Taking that into account, a majority of members concluded that a cut of 50 basis points was appropriate this month.”

If a sub-1% Bank rate was judged inappropriate last month, despite the MPC’s forecast of a significant inflation undershoot over the medium term, it would seem difficult to justify a further cut this week. Contrary to popular assertion, there is no technical requirement to reduce Bank rate towards zero before embarking on asset purchases designed to boost the money supply – see previous post for more discussion.

Reader Comments