What do US money trends suggest about "neutral" rates?

US economic “resilience” in 2023, recent inflation stabilisation and buoyant risk asset markets raise the question of whether the current level of policy rates is restrictive.

A “neutral” level of rates, according to the monetarist view, results in monetary growth consistent with target inflation. Based on 2010s experience, US broad money expansion of about 5% pa could reasonably be expected to yield medium-term inflation of 2%. (“Broad money” here refers to an expanded M2 measure – “M2+” – incorporating large time deposits at commercial banks and institutional money funds.)

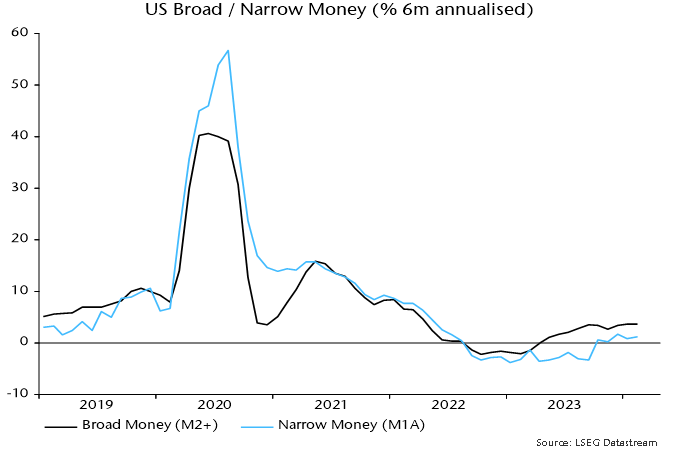

The six-month rate of change of broad money recovered from negative territory in early 2023 to 3.7% annualised in January, remaining at this level in February – see chart 1. This might be taken to suggest that the economy is adjusting to the higher level of rates and the current deviation from “neutral” is modest.

Chart 1

Money growth over the past year, however, was boosted by unusual deficit financing operations, which more than offset monetary destruction due to the Fed’s QT. The Treasury’s plans to scale back bill issuance imply a sharp reversal in Q2, as previously discussed.

Put differently, the “neutral” level of rates may have been temporarily lifted by the Treasury’s financing operations but a relapse is now likely.

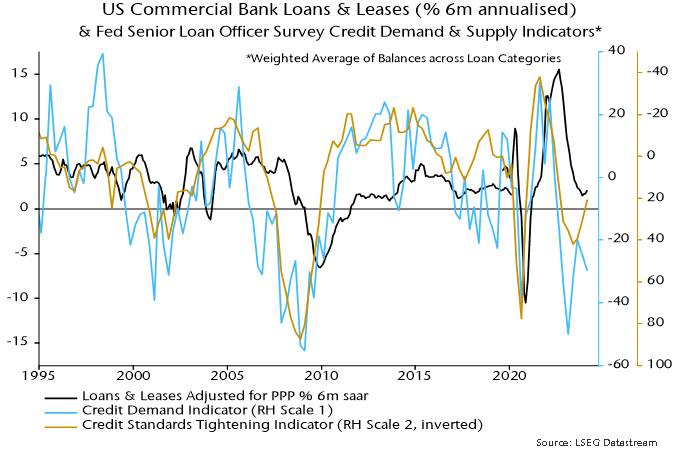

Could a recovery in bank lending offset a near-term drag on money growth from less expansionary Treasury operations and ongoing QT? Six-month growth of commercial bank loans appears to have bottomed in late 2023 but was only 2.1% annualised in February, while the last Fed loan officer survey remained downbeat – chart 2.

Chart 2

The suggestion that “neutral” is significantly lower than the current level of policy rates is supported by narrow money trends. (“Narrow money” = M1A = currency in circulation plus demand deposits.) Six-month momentum also recovered during 2023 but peaked at only 1.7% annualised in December, easing to 1.2% in February – chart 1.

Narrow money may be re-entering contraction – monthly changes were negative in January and February.

The latest US data support concern that a minor recovery in global six-month real narrow money momentum is about to go into reverse.

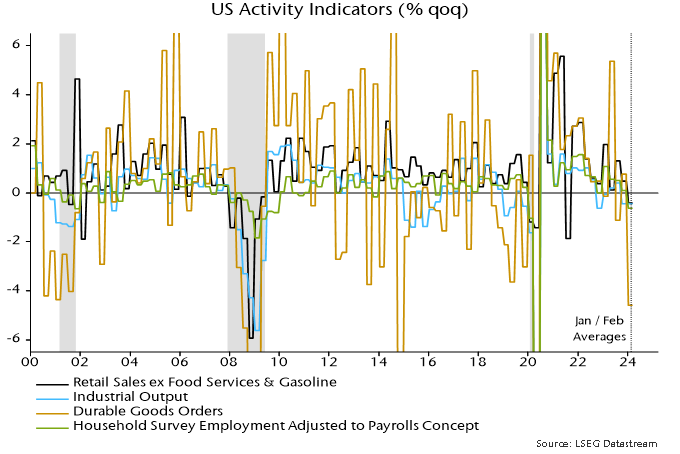

Meanwhile, weakness in US “hard” economic data for January / February has, perhaps, received less attention than it deserves. Average levels of retail sales, industrial production, durable goods orders and household survey employment were lower than in Q4 – chart 3. March data could change the story but joint quarterly declines were historically characteristic of recessions.

Chart 3

Reader Comments (1)

Once more we are confronted by firm and possibly even rising long end yields combined with upward pressure from supply cuts and geopolitical issues on oil and other commodities.

Possibly squeezing real money growth from both subdued or outright contractionary nominal growth and sticky or even rising inflation.