Global monetary update: minor recovery stalling?

Global six-month real narrow money momentum – a key leading indicator in the forecasting approach employed here – has recovered from a low in September 2023 but remains negative and could be stalling. Allowing for the typical lead, this suggests a slide in economic momentum into mid-year with limited subsequent revival.

Monetary trends, therefore, cast doubt on the current market consensus view that a global cyclical upswing is under way.

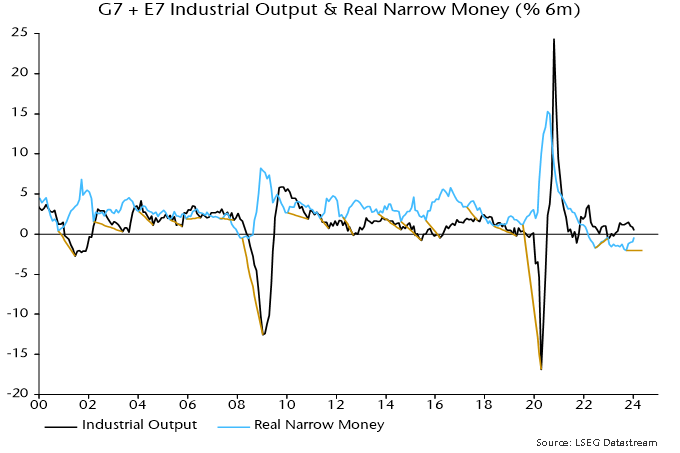

The real money / economic momentum relationship is primarily directional, i.e. involving turning points rather than levels. Chart 1 highlights related troughs in six-month rates of change of global (i.e. G7 plus E7) real narrow money and industrial output since 2000. The average lead time at these lows was eight months, with a range of four to 14.

Chart 1

So the September 2023 low in real money momentum could be associated with an output momentum low any time between January and December 2024.

The directional relationship was briefly disrupted during the pandemic but has since been reestablished: a trough in real money momentum in June 2022 was followed by an output momentum low in December 2022, with subsequent peaks in December 2022 and October 2023 respectively.

Six-month output growth in January was the slowest since May.

While the directional relationship is intact, output momentum in 2022-23 was much stronger than suggested by prior levels of real money momentum. As previously discussed, this is probably attributable to a monetary “overhang” from rapid growth in 2020-21. The ratio of the stock of global real narrow money to industrial output returned to its March 2020 level in September last year and has since moved sideways, arguing for a normalisation of the levels relationship of real money and economic momentum.

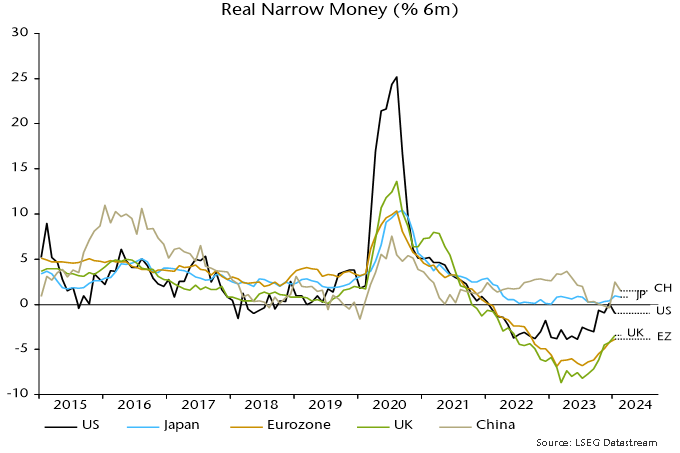

The recovery in real money momentum between September 2023 and January 2024 was broadly based across countries but the US pick-up reversed in January – see previous post – while Chinese / Japanese momentum declined in February – chart 2. So the global revival could be stalling with momentum still negative. (A February update will be provided following release of US / Eurozone monetary data next week.)

Chart 2

How do monetary signals compare with messages from the yield curve?

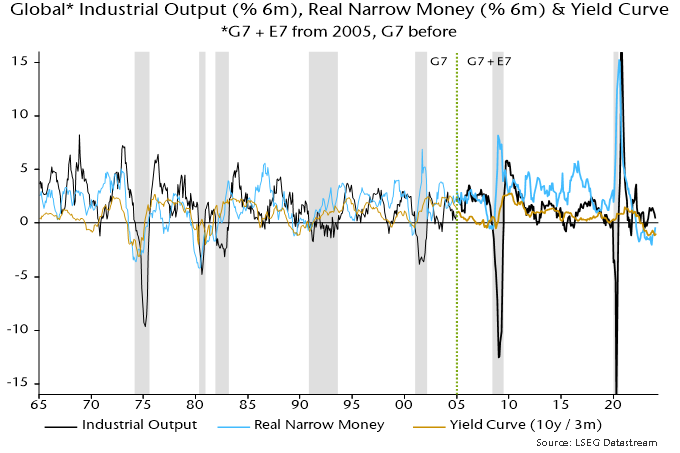

Chart 3 shows a longer-term history of six-month rates of change of global industrial output and real narrow money, along with the differential between GDP-weighted averages of 10-year government bond yields and three-month money rates. (The chart splices together G7 data through 2004 with subsequent G7 plus E7 numbers.)

Chart 3

The directional leading relationship between real money and economic momentum is equally convincing pre-2000, with a similar average lead time.

The yield curve has broadly mirrored trends in real money momentum, with a slight tendency for money to lead. However, the curve predicted fewer output momentum turning points, particularly in recent years, i.e. monetary signals have been more informative and reliable.

Continued yield curve inversion is consistent with still-negative real money momentum. An increase in inversion since October, moreover, contrasts with the recent monetary recovery, supporting concern that the latter may be stalling.

Combinations of negative real money momentum and an inverted curve were always followed by global recessions. The longest interval between a joint signal and recession onset was in 1989-90: real money momentum and the yield curve were both negative in April 1989, with a recession judged to have started in November 1990*.

The most recent joint signal occurred in October 2022, when the yield curve moved into inversion. Based on history, a recession would be expected by May 2024 at the latest. Are markets premature in sounding the all-clear? Assuming no downturn through May, should the signal be disregarded? Do I feel lucky?

*The recession bands in the chart begin when the six-month change in industrial output turns negative ahead of a fall to below -1.25% (not annualised).

Reader Comments (1)

Most likely. The difference this cycle is the longer lag between unemployment rising and output falling. This can be seen most obviously looking at US real GDI with Household employment.

The consensus will probably be wrong, as it usually is in the early stages of recession. H1 08 being the most obvious recent cyclical precedent.