UK labour market data weak not "mixed"

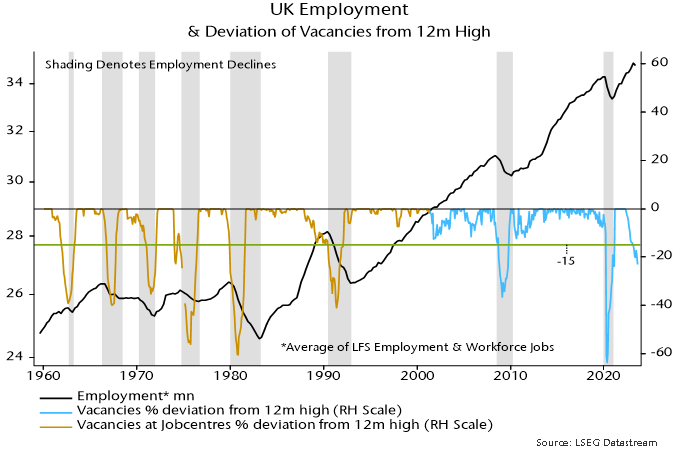

A post in May suggested that UK employment would embark on a sustained decline in Q2. This was based on the stock of vacancies having fallen 17% from its 12-month peak – declines of more than 15% historically were always associated with sustained employment falls.

Labour Force Survey employment fell by 207,000 in the three months centred on June from three months earlier, while the workforce jobs measure (of positions rather than people) was down by 153,000 between March and June.

Vacancies have continued to collapse, with the August stock down by 23% from its 12-month high and 29% below the April 2022 peak – see chart 1.

Chart 1

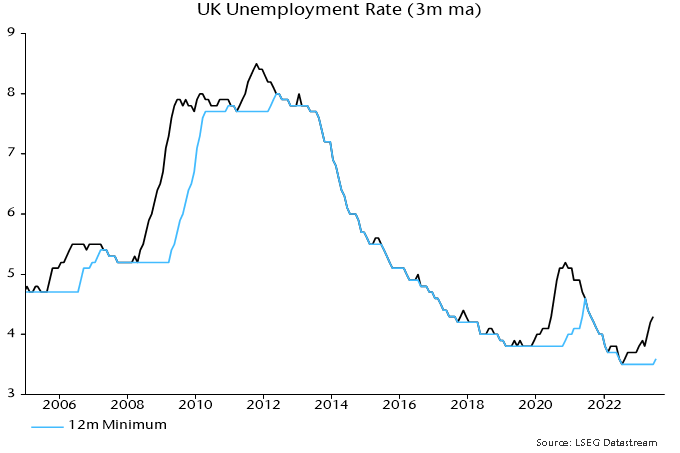

The three-month average unemployment rate, meanwhile, rose further to 4.3% in July versus an August 2022 low of 3.5%, confirming a Sahm rule recession signal (an increase of more than 0.5 pp from the 12-month minimum) – chart 2.

Chart 2

A July post noted that the Sahm rule has an imperfect record as an indicator of UK recessions but signals were always associated with a slowdown in average earnings growth.

Annual growth of regular earnings ticked down from 8.0% in June to 7.8% in July, while median pay growth in the more timely PAYE dataset eased to 6.7% in August – chart 3. (Caveat: the PAYE numbers are subject to significant revision.)

Chart 3

In light of the above, claims that the latest labour market news is “mixed” and shouldn’t deflect the MPC from another rate hike next week are odd and appear to reflect confirmation bias.

Money / credit contraction argues that current policy is much too restrictive. The ongoing collapse in vacancies and faster-than-expected deterioration in more lagging labour market indicators are consistent with this interpretation.

MPC member Catherine Mann argues for erring on the side of overtightening because rates can be cut swiftly if a mistake becomes apparent. If only the economic damage from bad policy-making were so easily reversed.

Reader Comments (1)

The group think between central bank decision makers is remarkable.

Crucially they seem to have forgotten there is a long and variable lag to policy.

Once they realise their mistake and ease, it will take 12-18 months to feed through in to monetary aggregates and activity!

There are enormous medium term downside risks from overtightening.