Hard landing watch: US employment report

US September non-farm payrolls blew through the consensus expectation but the totality of evidence from the employment report suggests that the labour market continues to cool.

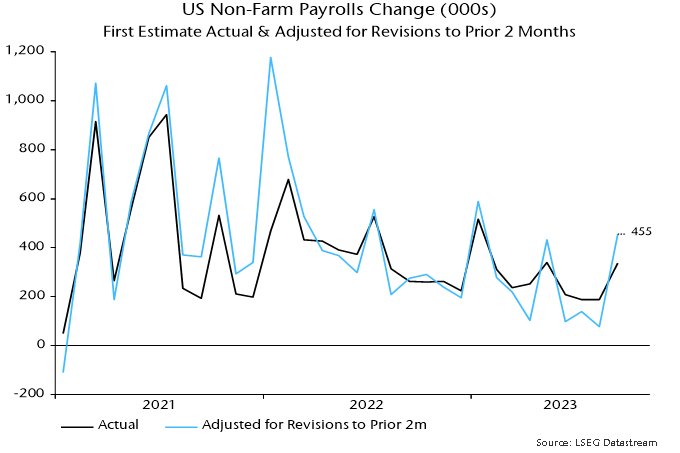

Including upward revisions to the prior two months, 455,000 jobs were added to the payrolls tally in September. However, this follows three weak months when the revisions-adjusted gain averaged 105,000 – see chart 1.

Chart 1

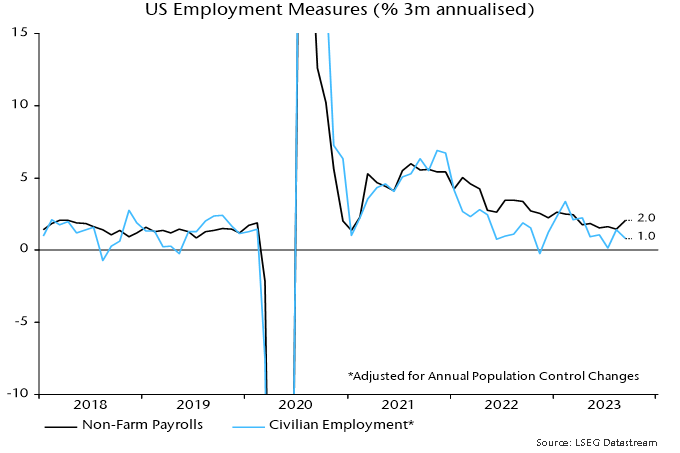

The alternative household survey employment measure – which counts people rather than jobs – grew at half the pace of payrolls in the three months to September – chart 2.

Chart 2

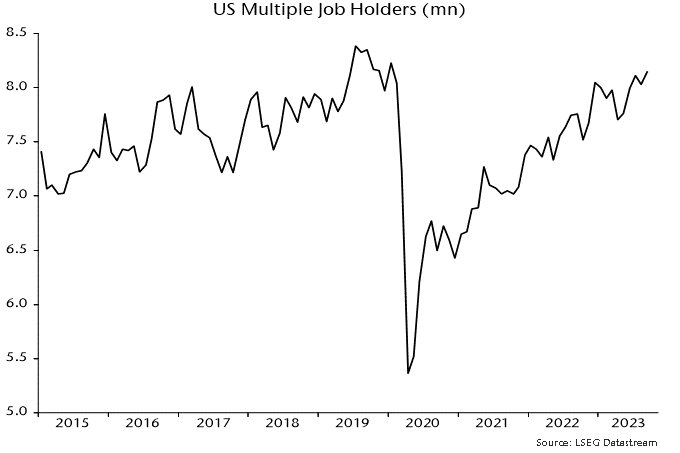

The relative strength of payrolls partly reflects a further rise in multiple job-holding, which is approaching its pre-pandemic peak, i.e. the relative boost may be ending – chart 3.

Chart 3

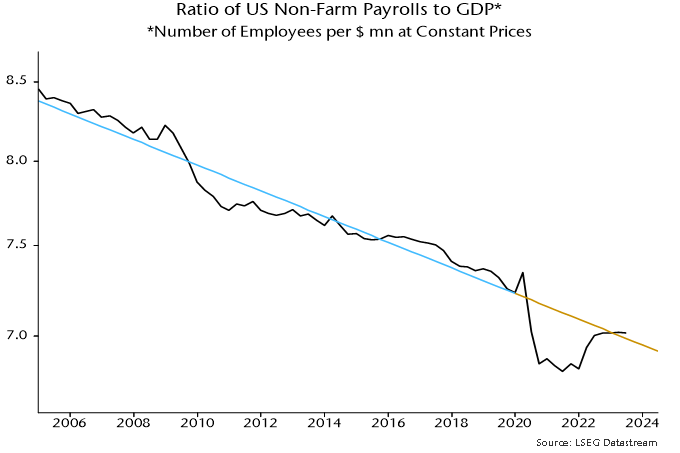

Stepping back, stronger growth of payrolls than GDP since end-2021 represents a catch-up following a big undershoot of trend during the pandemic – chart 4.

Chart 4

The catch-up appears complete, suggesting that payrolls will resume slower growth than GDP. The slope of the trend line implies a fall in payrolls if GDP growth declines below 1% annualised.

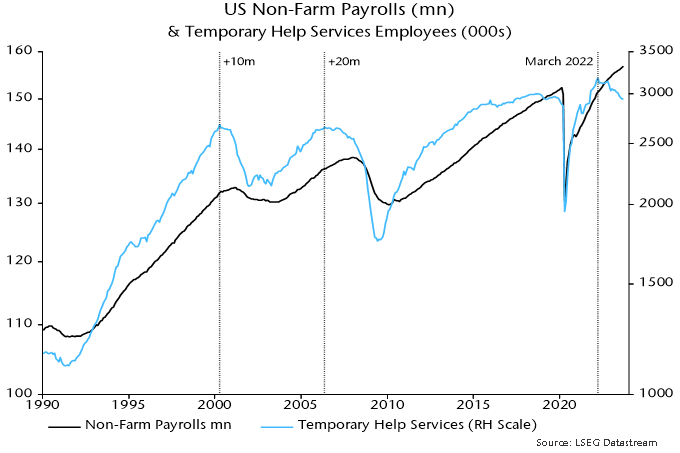

Temporary help jobs have led at prior peaks and troughs in payrolls and continued to decline in September – chart 5.

Chart 5

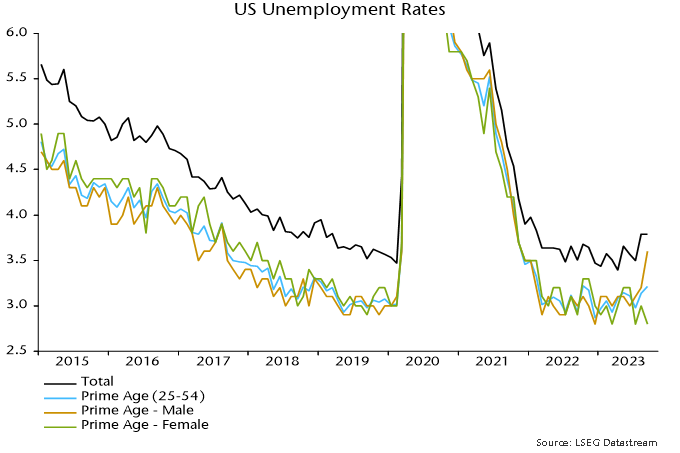

The unemployment rate, meanwhile, held at its higher August level, with the demographic breakdown showing a sharp jump among prime-age males – chart 6.

Chart 6

Verdict: neutral / negative – headline surprise offset by weaker internals.

Reader Comments (1)

I am puzzled by falling y/y Federal government current tax receipt combined with pretty reasonable y/y all total non farm employee growth.