Has the Chinese economy bottomed?

The Chinese economy regained some momentum around year-end, as had been suggested by a turnaround in six-month real money growth in mid-2021. Monetary trends remain moderately hopeful but the recovery faces challenges from covid disruption, slowing global demand and ongoing property sector weakness.

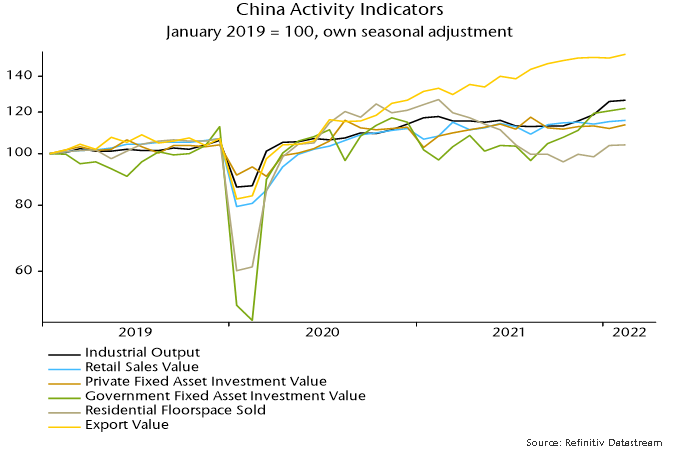

Most official economic data are presented as year-on-year growth rates. Chart 1 shows estimates of seasonally adjusted levels for key series derived from the year-on-year numbers. Industrial output rose strongly between October and January / February, more than reversing weakness earlier in 2021. From the demand side, exports and government investment appear to have been key drivers, possibly supplemented by stockbuilding. Retail sales and private investment rose slightly in value terms, while home sales recovered following a precipitous drop.

Chart 1

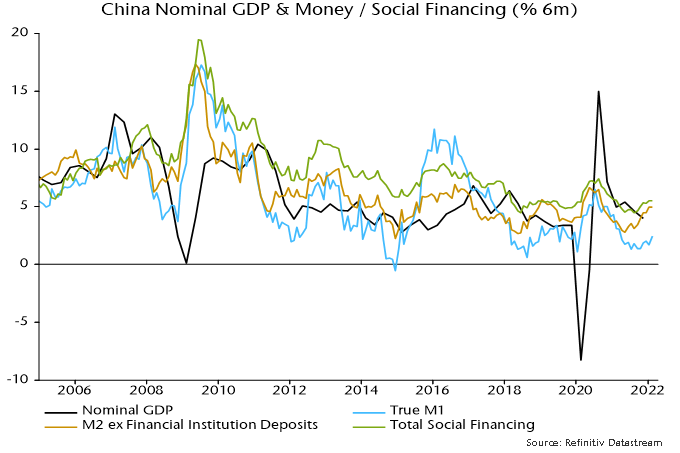

Six-month growth rates of money and credit bottomed over May-July 2021 but a strong rebound in broad money expansion during H2 wasn’t matched by narrow money, tempering optimism here about a likely economic reacceleration. Narrow money growth firmed in February but a further rise is necessary to warrant a positive view – chart 2.

Chart 2

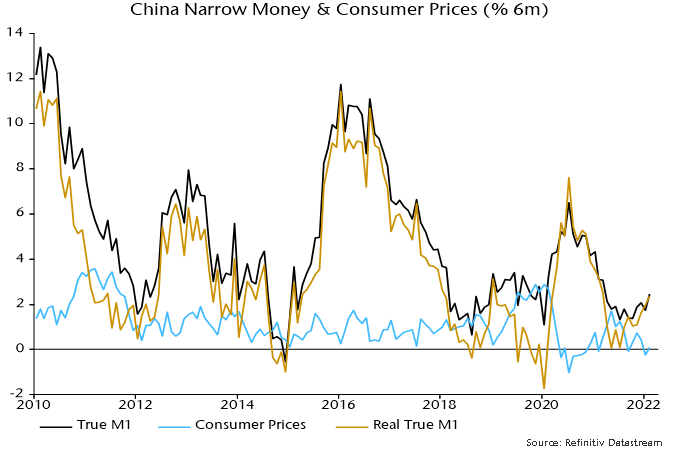

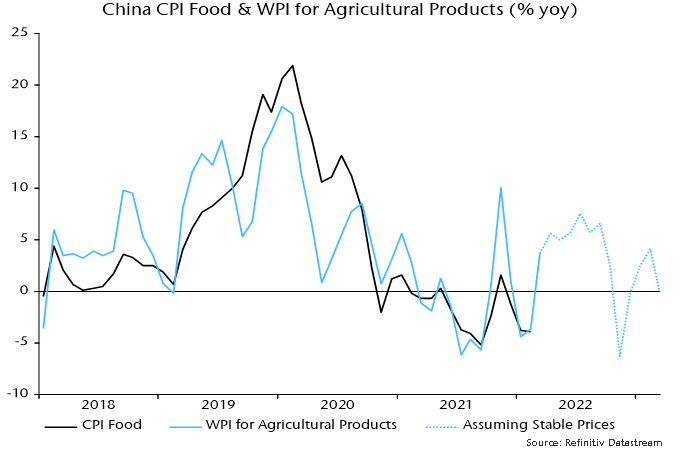

The money growth recovery has been larger in real terms because of a slowdown in six-month consumer price momentum since mid-2021, with higher energy costs more than offset by weakness in food prices – chart 3. This tailwind may be about to reverse, with wholesale price data suggesting a rebound in food inflation – chart 4.

Chart 3

Chart 4

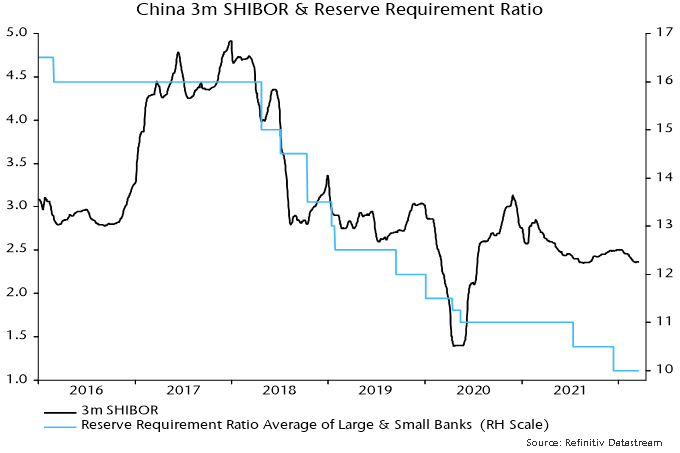

The Evergrande crisis threatened to tighten financial conditions and abort the money growth recovery. Three-month SHIBOR firmed in late 2021 but retraced the move in January / February, stabilising recently – chart 5. A further fall would be welcome confirmation that the PBoC remains on an easing tack, supporting hopes of further monetary improvement.

Chart 5

Reader Comments (1)

China's inflation data is surprising to say the least. It has to re-couple with the rest of the world, eventually.