UK economy still stagnant / recessionary

UK monthly GDP / gross value added (GVA) for October will be released on 10 December, two days before the election. GDP is currently estimated to have fallen by 0.16% in August and 0.07% in September, with the September level 0.10% below the Q3 average.

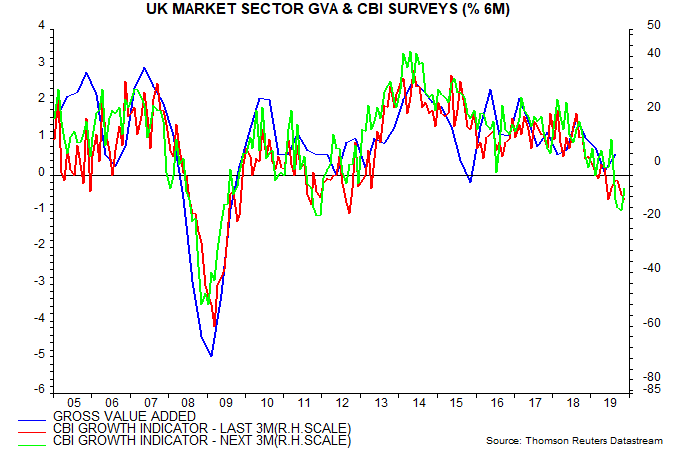

October / November PMIs are consistent with economic contraction. So are the CBI’s past and future growth indicators, based on their monthly surveys of industry, distributive trades and services – see first chart.

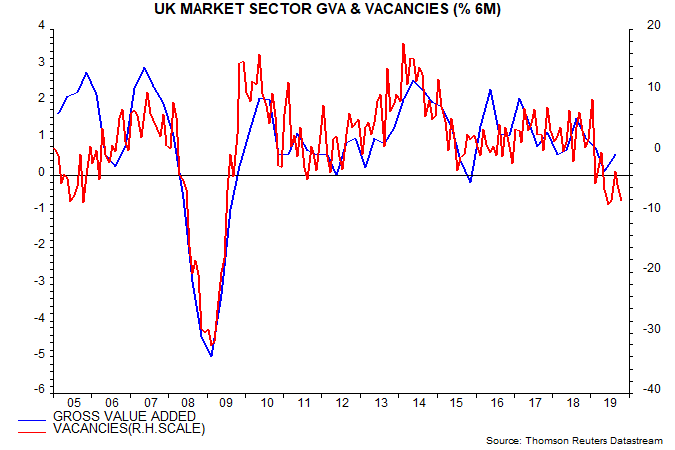

Vacancies are a coincident indicator of GDP and have fallen this year at the fastest pace since the 2008-09 recession, also suggesting contracting output – second chart.

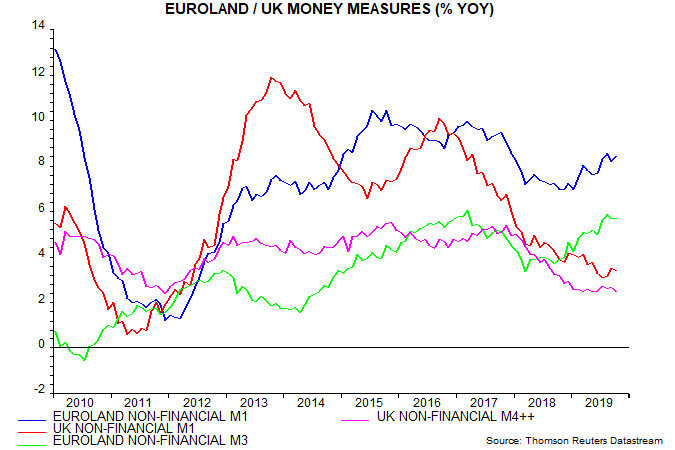

Monetary trends, meanwhile, remain weak. Annual growth rates of narrow and broad money have stabilised but are falling further below rising rates in Euroland – third chart. The UK economy has lagged in 2019 – GDP is currently estimated to have risen by 0.65% between Q4 2018 and Q3 2019 versus a Euroland increase of 0.86% – and relative money trends suggest a widening performance gap.

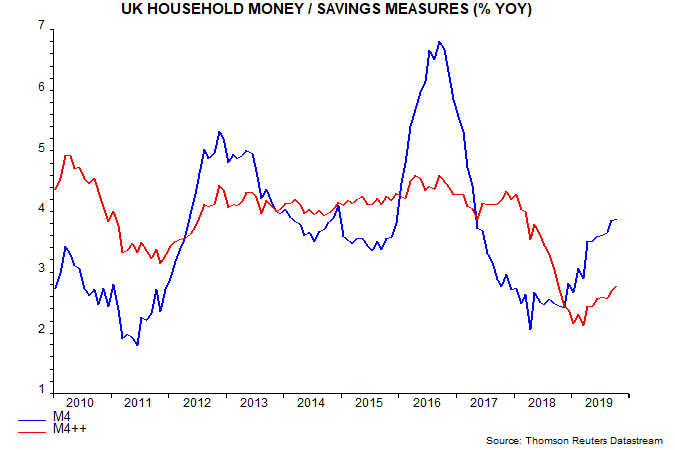

Within aggregate broad money, growth of household M4 holdings has recovered, leading some to suggest that consumer spending prospects are improving. This acceleration, however, mainly reflects a diversion of household savings from mutual funds to bank / building society accounts, which may signal rising risk aversion. Retail mutual fund inflows totalled £1.5 billion in the 12 months to September, down from £27.0 billion in the previous 12 months. Growth of an expanded measure of household money / savings incorporating mutual funds and National Savings (“M4++”) has risen by less and remains historically weak – fourth chart.

Reader Comments