Chinese money trends suggesting PMI relapse

Hopes of a rebound in Chinese industrial output growth have been boosted by a pick-up in the Markit manufacturing PMI to the top of its range in recent years. Weak money trends suggest that these hopes are premature and the PMI will fall back.

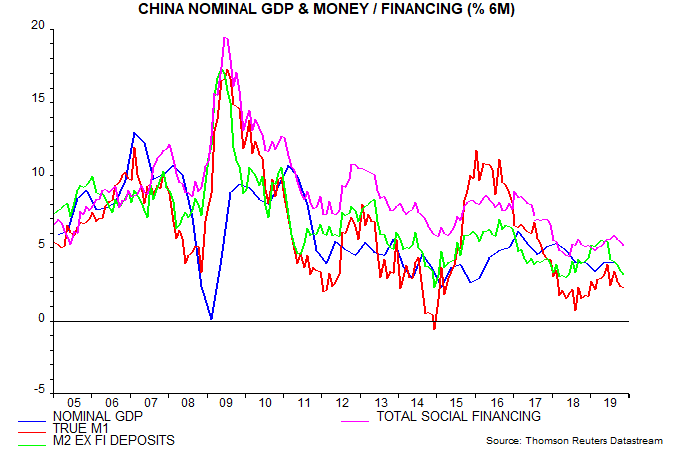

November money and credit numbers released today were disappointing. Six-month growth of true M1 is estimated to have slipped further below its June peak, with broad money and total social financing also losing momentum – see first chart.

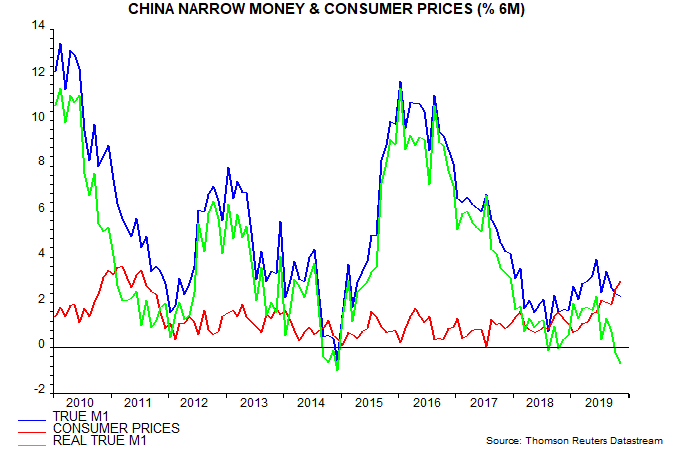

The weakness is more pronounced in real terms, i.e. relative to the consumer price index, which has been boosted by surging pork prices. The six-month change in real true M1 moved deeper into negative territory last month – second chart.

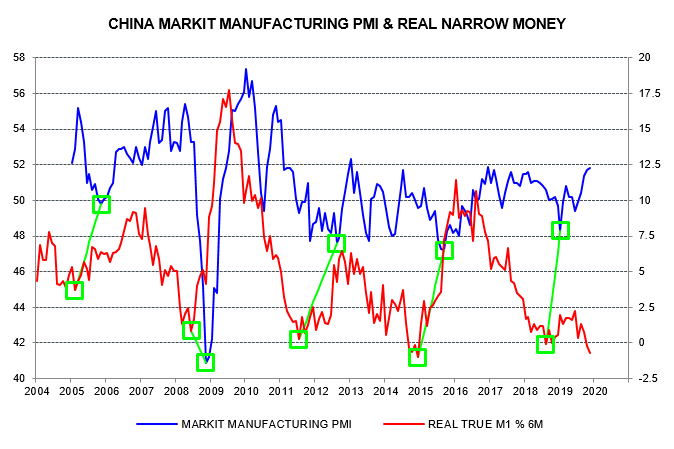

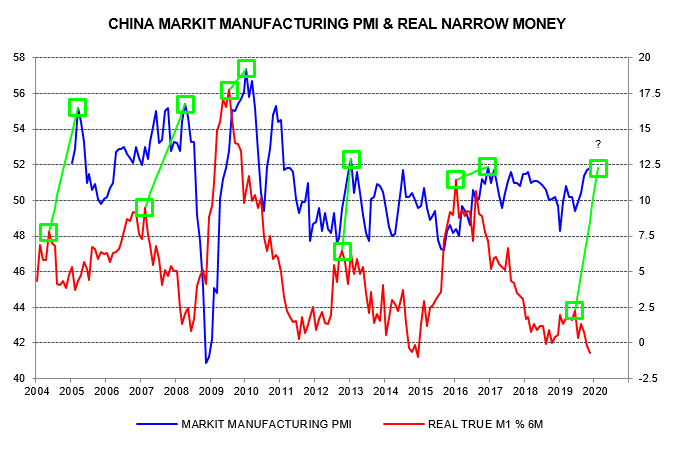

The third and fourth charts show that turning points in six-month real M1 momentum have signalled turning points in the Markit manufacturing PMI since the latter’s inception, with an average lead time of 8 months at the highlighted troughs and peaks. The rise in the PMI to a 35-month high in November was foreshadowed by a pick-up in real money growth between October 2018 and June. The subsequent monetary slowdown suggests that the PMI will weaken during H1 2020.

The inflation drag on real money is probably peaking and could reverse sharply in early 2020. Credit creation, meanwhile, will probably pick up, partly reflecting another surge in issuance of local government special bonds, although private firms may continue to struggle to obtain bank loans. These developments could lay the monetary foundation for a more durable recovery in economic momentum in H2 2020.

Reader Comments