UK money trends still suggesting downside risk

UK real money contraction warned of 2022 economic stagnation and 2023 recession. Weakness has abated but real money measures have yet to resume expansion, casting doubt on hopes of a sustainable economic recovery.

The latest ONS numbers are consistent with a recession having started in Q2 2023. Among key features of the GDP release:

-

Gross value added (GVA) at basic prices peaked in Q1 2023, falling by 0.03% in Q2, 0.16% in Q3 and 0.34% in Q4.

-

The cumulative decline in GVA / GDP of 0.5% between Q2 and Q4 is inconsistent with a description of the economy as “flatlining”.

-

Similarly, claims that the consumer has been holding up are no longer tenable given a 1.0% cumulative contraction in household consumption between Q2 and Q4.

-

GDP / GVA fell by 0.2% and 0.3% respectively in the year to Q4, meeting a stronger recession definition than the two-quarter rule (in contrast to Japanese GDP also released today).

-

Nominal as well as real GDP fell in Q4, with the GDP deflator rising at a 2.0% annualised pace between Q2 and Q4.

The suggestion of cyclical peak in Q1 2023 is supported by the LFS employment measure, which reached a high in the three-month period centred on March. (The LFS aggregate is 10% larger than the PAYE employment series, reflecting coverage of self-employment.) Aggregate hours worked also peaked then, falling 1.5% through November.

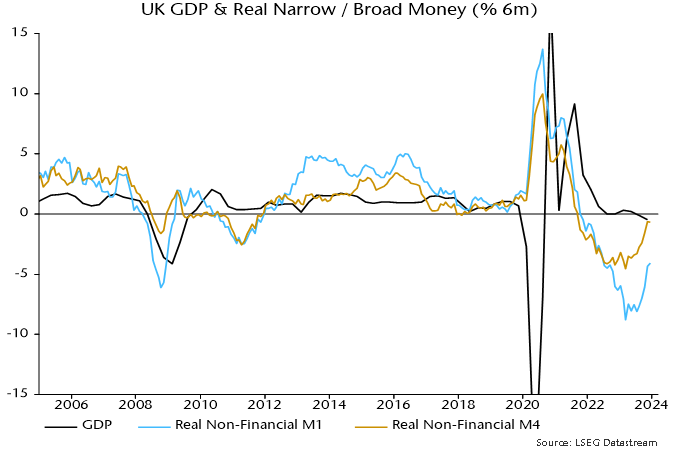

Real money measures began to contract in H2 2021. GDP stagnated from Q2 2022, consistent with the usual lag. The six-month rates of decline of real narrow and broad money reached a peak in March 2023, warning of H2 economic contraction – see chart 1.

Chart 1

Six-month real money momentum has recovered significantly but has yet to turn positive. Slowing inflation has been a key driver, while nominal broad money is no longer contracting. Economic weakness may abate in H1 2024 but current monetary trends appear inconsistent with a meaningful recovery. Early rate cuts are urgently required to limit still-significant downside risk and head off an extended inflation undershoot.

Reader Comments (1)

Indeed, until vacancies bottom out I find it hard to be particularly optimistic. For the UK and other economies.