Lagging Chinese money growth isn't concerning

Money measures have surged in most major economies. Narrow money outperforms broad money as a leading indicator of economic activity. Annual growth of the official M1 measure in June was 35.9% in the US, 22.0% in Canada, 15.2% in the UK, 12.6% in the Eurozone and 12.3% in Japan.

Brazil, amazingly, topped the US surge with 38.3% annual growth.

China, however, has lagged – official M1 growth was 6.5% in June and 6.9% in July. This contrasts with the run-up to the 2016-17 global economic mini-boom, when Chinese M1 growth moved ahead of most other countries, reaching a peak of 25.4% versus around 10% for the G7 majors.

For some, Chinese money trends are a key missing link in the global economic rebound story, warranting investors staying underweight cyclical assets and overweight “defensives”.

This is a somewhat strange argument – why should Chinese money data give a better signal for global economic prospects than a global M1 aggregate growing at a record pace despite Chinese sluggishness?

In any case, the suggestion that Chinese narrow money trends are giving a negative signal for Chinese, let alone global, economic prospects, is judged here to be incorrect, for the following reasons.

1. Direction trumps magnitude when assessing the M1 signal. Chinese annual M1 growth has risen from zero in January 2020 to its current 6.9%.

2. The Chinese M1 measure, inexplicably, departs from global convention by omitting household demand deposits, data for which are, however, released monthly. “True” M1, incorporating these deposits, grew by an annual 8.3% in June with the official M1 number suggesting a rise to 8.6% in July*.

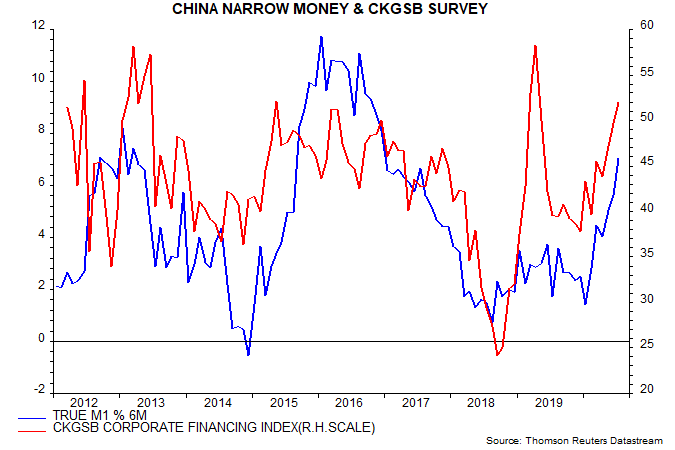

3. Relatively sluggish annual growth reflects weakness in H2 2019 and conceals solid sequential expansion since early 2020. Six-month growth of true M1, seasonally adjusted, was an estimated 7.0% in July, or 14.5% annualised.

4. The recent acceleration has been stronger in real terms because of a sharp fall in six-month consumer price momentum driven by declining energy costs and a slowdown in pork prices.

5. Narrow money acceleration has been accompanied by an easing of credit conditions, reflected in the corporate financing component of the Cheung Kong Graduate School of Business (CKGSB) survey of private firms – see chart. Credit conditions tightened sharply after April 2019 as regional banks faced funding difficulties and restricted loan supply, with a knock-on negative impact on economic activity and narrow money demand. The strong rebound in the CKGSB index supports economic optimism and suggests a further rise in six-month true M1 growth.

*The household demand deposits number for July yet to be released – the estimate assumes that annual growth of such deposits remained at 12.0%.

Reader Comments