US inventory cycle yet to bottom

The modest revival in the global manufacturing PMI in late 2019, on the view here, partly reflects a bottoming out of the global stockbuilding (inventory) cycle. US inventory adjustment, however, appears incomplete and may prevent a recovery in the global cycle until later in 2020.

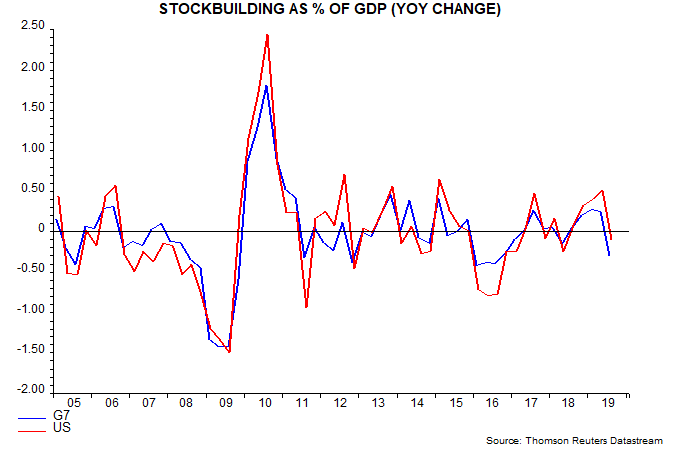

The first chart shows the contribution of stockbuilding to annual GDP growth in the G7 and the US alone. The G7 drag in Q3 was the largest since 2016, when the global cycle last bottomed. This reflects extreme weakness in Europe – particularly Germany and the UK. The US contribution, by contrast, was only slightly negative in Q3.

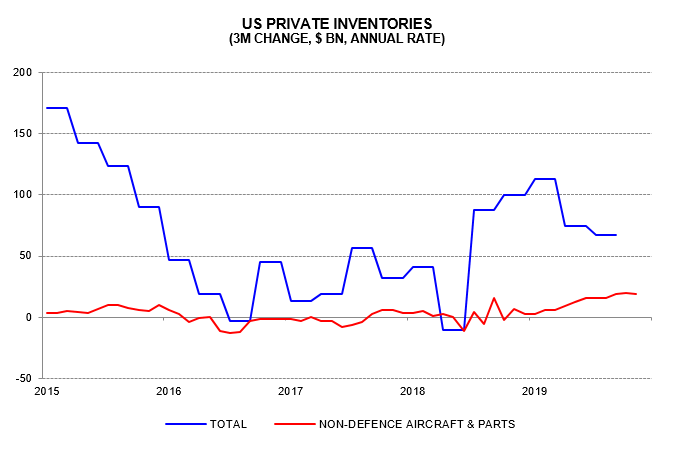

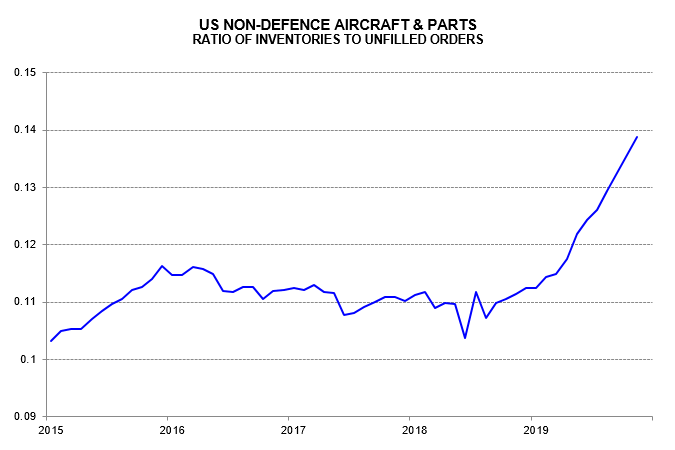

Why has US adjustment lagged? Some firms may have maintained higher inventories of Chinese goods in anticipation of further tariff increases. Another contributing factor has been Boeing continuing production of the 737 MAX last year despite sales being halted. Non-defence aircraft and parts accounted for nearly 30% of the economy-wide rise in inventories in Q3 – second and third charts.

The suspension of 737 MAX production from this month will halt the rise in inventories in the sector and reverse it when shipments eventually resume – possibly in Q2. A reasonable working assumption is that the change in non-defence aircraft and parts inventories will swing from +$18 billion at an annualised rate in Q4 2019 to -$18 billion in Q2 2020. This would equate to a shift of 0.175% of GDP over two quarters, or 0.35% at an annualised rate. The overall GDP impact would be smaller because a resumption of shipments would be reflected in other GDP components (i.e. exports and business investment).

Strong US money growth in late 2019 warrants optimism about economic prospects for later in 2020 but earlier monetary weakness and the inventory overhang suggest near-term disappointment.

Reader Comments