UK corporate money trends key for assessing recession risk

The EU referendum result will have a negative impact on UK economic prospects but there is little basis, at present, for assessing the magnitude of the effect.

The negative impact will occur through two key channels: an uncertainty effect on business investment and hiring, and a possible tightening of financial conditions.

The uncertainty effect alone is probably insufficient to trigger a recession. GDP was judged here to be growing at a rate of about 2.25% per annum before the shock, based on monetary trends and the most recent “hard” data. A 10% cut in private investment over the next 12 months relative to previous plans – possibly an aggressive assumption – would subtract 1.4 percentage points from GDP growth, i.e. insufficient to push the economy into contraction.

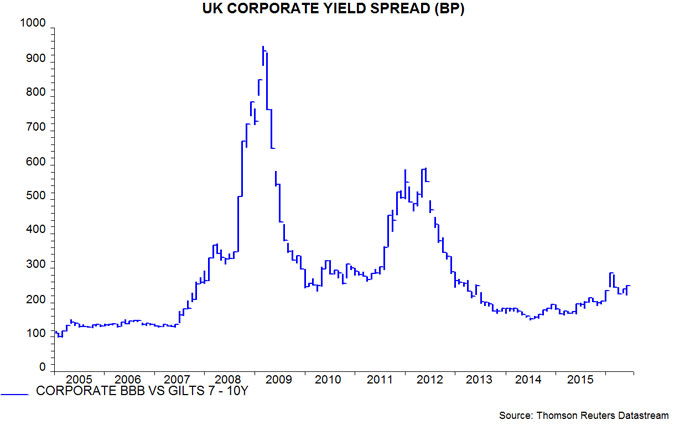

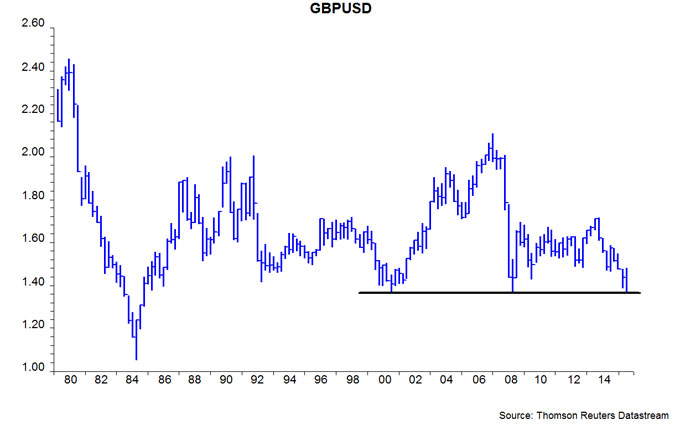

Financial conditions could tighten significantly but have yet to do so. Corporate bond spreads remain contained – see first chart – and equities have yet to breach their February low in sterling terms. The Bank of England, moreover, is likely to deliver a precautionary easing move by August. The exchange rate has so far taken the strain of the referendum result, with the sterling-US dollar rate falling to the mid-1.30s for the third time in 15 years – second chart.

Assuming no significant change in financial conditions, a reasonable base case is that GDP growth over the next 12 months will be 1.0-1.5 percentage points lower than otherwise. So, for example, 2017 growth could be 1% instead of 2.25%.

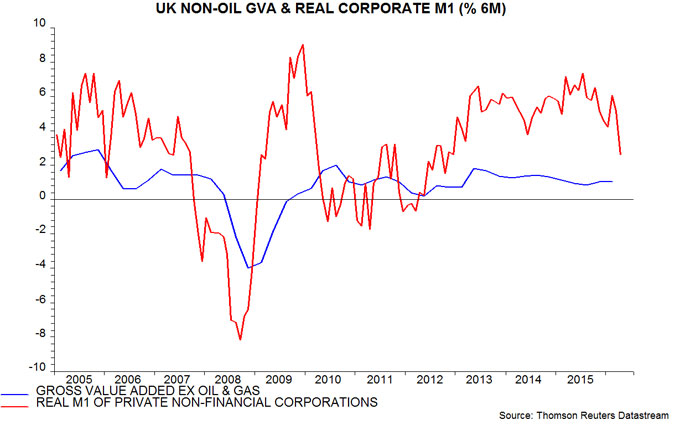

The approach here will be to adjust this base case forecast depending on corporate money trends, which should give early warning of any major retrenchment. Corporate real narrow money M1 has contracted before recessions historically, also weakening before the 2011-12 slowdown – third chart. Six-month growth fell in April, possibly reflecting pre-referendum caution; May data will be released on Wednesday.

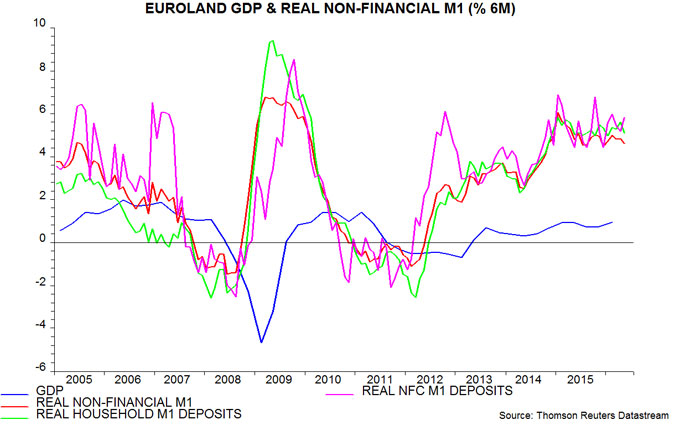

The direct spillover effect of UK economic weakness on the rest of the European Union will be minor: exports to the UK account for only 3% of rest of EU GDP. The much bigger risk, again, is financial contagion. Monetary trends, as in the UK, were giving a positive signal for economic prospects before the shock: real non-financial M1 growth, and its corporate component, remained strong in May – fourth chart.

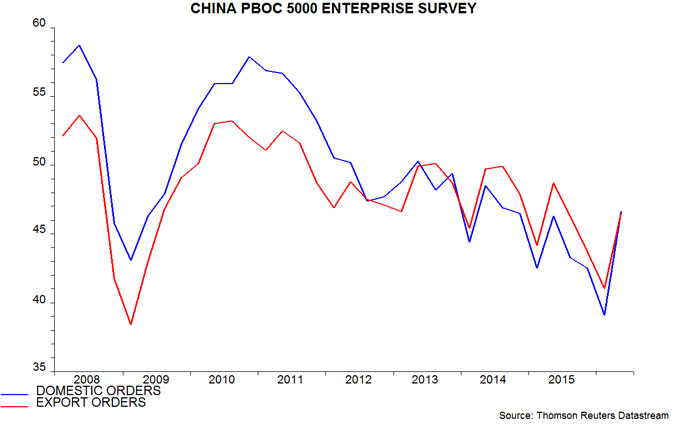

Recent data are consistent with the view here that US / Chinese economic growth is picking up at mid-year; the latest quarterly PBoC survey of enterprises, for example, reports an improved assessment of orders – fifth chart. The direct global impact of weaker UK / European prospects will be small and offset by looser central bank policies. A constructive assessment will be maintained barring a reversal of recent global narrow money strength.

Reader Comments