US money base pick-up suggesting market recovery

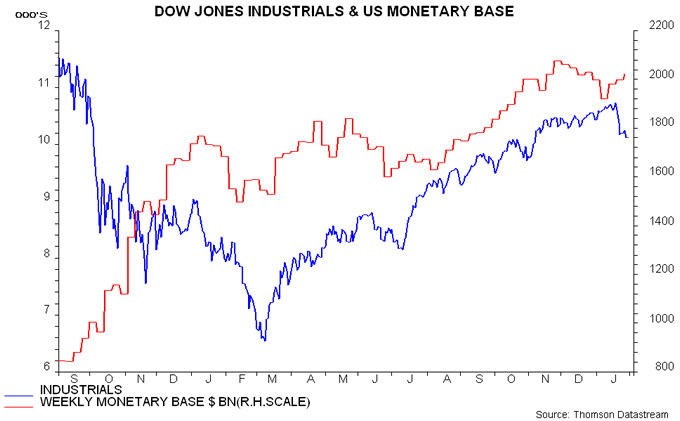

Previous posts discussed the notion – originally advanced by Andy Kessler in a Wall Street Journal article last year – that changes in the Fed’s liquidity supply, reflected in the US monetary base, were driving market movements. The recent swoon in equities and rally in the dollar followed a contraction in the base between late November and early January – see first chart.

Previous commentary downplayed, wrongly, the significance of this decline because it reflected a build-up of cash in the US Treasury’s account at the Fed, partly due to TARP repayments, rather than efforts by the central bank to drain liquidity. This effect was expected to reverse in early 2010 as the Treasury ran down its cash balance to finance the swollen deficit.

The latter process is under way and the monetary base has risen for three consecutive weeks. The Treasury’s balance in its “general account” at the Fed has fallen from $187 billion at the end of December to $127 billion yesterday but should decline significantly further over coming weeks – the balance averaged about $45 billion last autumn. Coupled with the cash injection from securities purchases, this should more than offset any liquidity contraction caused by an unwinding of the Fed's special operations.

The equity market set-back has resulted in sentiment measures shifting from overbought to – in some cases – significantly oversold. The annual rate of change of G7 real M1 remains, for the moment, above that of industrial output, implying a still-supportive macro liquidity backdrop. With the US monetary base recovering, the odds favour a rally in markets into the spring, possibly accompanied by a reversal or consolidation of the dollar’s recent gains.

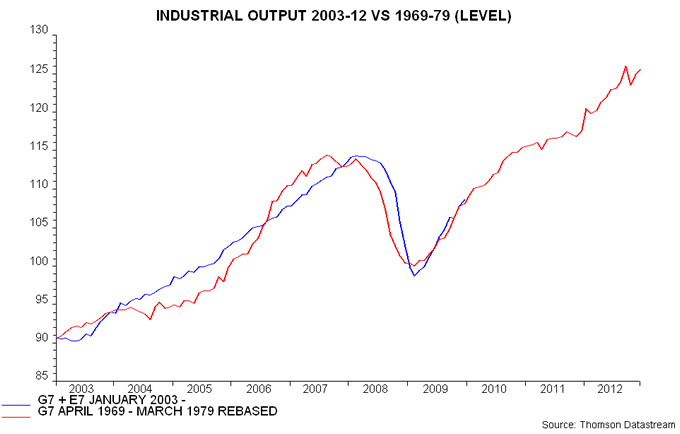

This assessment would be wrong if the economy were tipping over into a “double dip” – liquidity would then flow into bonds rather than equities while the dollar might benefit from a flight to (perceived) safety. The recovery, however, appears on track, with early figures suggesting another solid gain in G7 plus emerging E7 industrial output in December – second chart.

Reader Comments