UK GDP: worsening growth / inflation trade-off

The preliminary GDP estimate for the fourth quarter was disappointing, showing growth of only 0.1%, although there are grounds for expecting an upward revision. A key issue is whether supply-side weakness is contributing to the sluggish recovery – this implies a deterioration in the growth / inflation trade-off.

Key points:

- GDP was held back by a decline in North Sea production: gross value added excluding oil and gas rose by 0.2%.

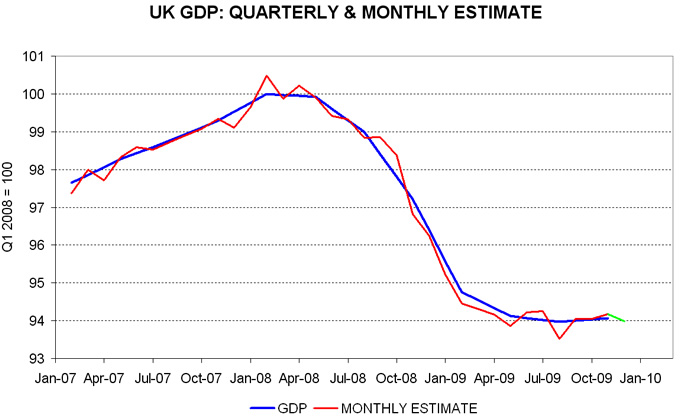

- The preliminary estimate appears to incorporate an assumption of a fall in GDP in December after rises in September and November and a flat October. A monthly GDP proxy based on services and industrial output data was 0.2% above its third-quarter average in October / November combined – see chart. The assumed December decline is based on limited information and may be revised away. (The third-quarter preliminary estimate also incorporated a fall in the final month of the quarter, subsequently revised to an increase.)

- Quarterly growth of only 0.1% sits uneasily with labour market data. The last post drew attention to a significant rise in vacancies in the fourth quarter; in addition, aggregate hours worked in the economy grew by 0.7% in the three months to November from the previous three months. Barring a significant upward revision to GDP, this suggests a further fall in productivity last quarter: official figures show a 1.6% decline in economy-wide output per hour in the year to the third quarter. Poor productivity performance has contributed to the recent rise in inflation by pushing up unit labour costs despite slowing wage growth.

- The key policy variable for the MPC is not real but nominal GDP – a fourth-quarter nominal estimate will be published in a month's time (26 February). In the third quarter, nominal GDP rose by 1.1%, or 4.5% annualised, even as real output contracted by 0.2%. Inflation indicators suggest another strong increase last quarter despite a disappointingly small recovery in real activity.

Reader Comments