UK corporate liquidity squeeze focused on property sector

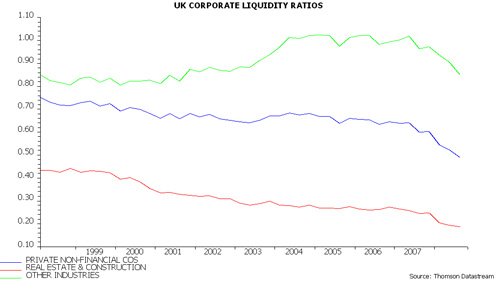

As previously reported, the liquidity ratio of private non-financial corporations – their M4 money holdings divided by bank borrowing – is at its lowest since 1991.

Bank of England data published today permit an analysis of liquidity ratios by industry. The low level of the aggregate ratio mainly reflects weakness in the real estate and construction industries.

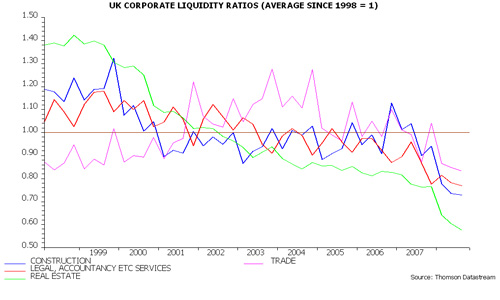

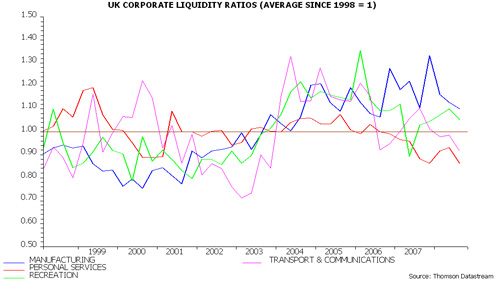

“Normal” levels of the liquidity ratio vary by industry so it is more informative to monitor developments relative to a long-term average. The first two charts below show industry ratios relative to averages since 1998, when the Bank of England data began. In addition to construction and real estate, liquidity has deteriorated significantly in “legal, accountancy, consultancy and other business activities” – closely linked to property and financial markets.

By contrast, the liquidity ratio in manufacturing is above its post-1998 average and much higher than before the industrial recession in 2001.

The third chart shows the aggregate ratio for private non-financial corporations split between real estate and construction and other industries. The other industries ratio has declined sharply recently but has yet to fall beneath its level before the 2001 economic downturn.

The less dramatic liquidity deterioration outside real estate and construction may temper coming declines in business investment and employment. However, the industry skew is bad news for banks – real estate and construction loans account for 54% of their sterling lending to private non-financial corporations, having grown at an 18% annualised rate over the last five years.

Reader Comments