EM leading global inflation decline

Why believe the “monetarist” forecast that recent G7 monetary weakness will feed through to low inflation in 2024-25?

Monetary trends correctly warned of a coming inflationary upsurge in 2020 when most economists were emphasising deflation risk.

The forecast of rapid disinflation is on track in terms of the usual sequencing, with commodity prices down heavily, producer prices slowing sharply and services / wage pressures showing signs of cooling.

A further compelling consideration is that the monetary disinflation expected in G7 economies has already played out in emerging markets.

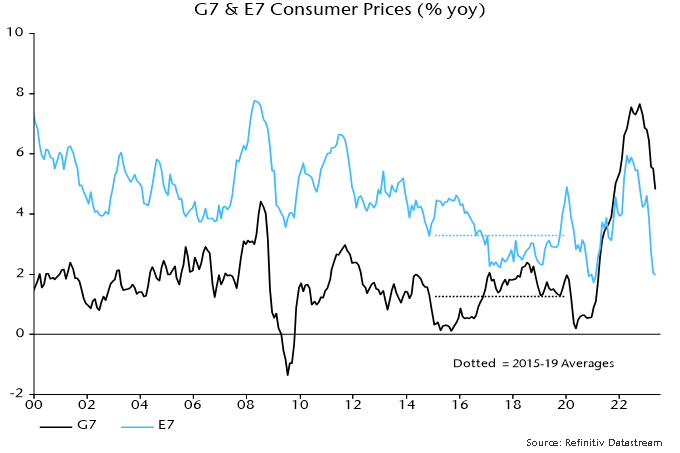

A GDP-weighted average of CPI inflation rates in the “E7” large emerging economies* crossed below its pre-pandemic (i.e. 2015-19) average in March, falling further into May – see chart 1.

Chart 1

The E7 average is dominated by China but inflation rates are also below or close to pre-pandemic levels in Brazil, India and Russia.

Inflation rose by much less in the E7 than the G7 in 2021-22, opening up an unprecedented negative deviation that has persisted.

The recent plunge in the E7 measure reflects a significant core slowdown as well as lower food / energy inflation.

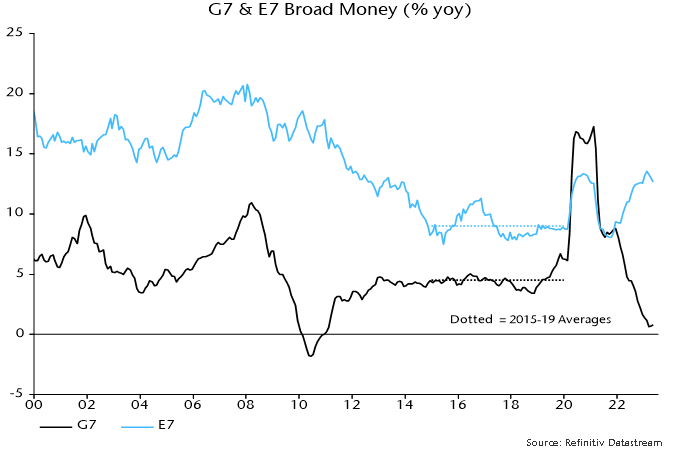

The divergent G7 / E7 experiences are explained by monetary trends. Annual broad money growth rose by much less in the E7 than the G7 in 2020 and returned to its pre-pandemic average much sooner – chart 2.

Chart 2

E7 broad money growth crossed below the pre-pandemic average in May 2021. CPI inflation, as noted, followed in March 2023, i.e. consistent with the monetarist rule of thumb of a roughly two-year lead from money to prices.

G7 broad money growth crossed below its pre-pandemic average in August 2022 and has yet to bottom, suggesting a return of inflation to average in summer 2024 and a subsequent undershoot.

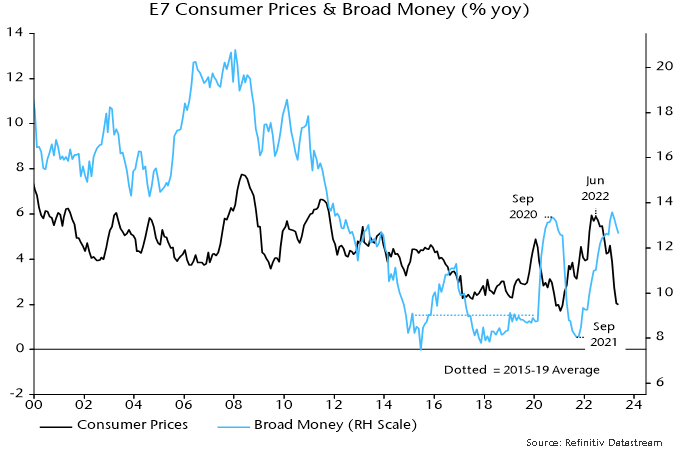

E7 disinflation, however, may be close to an end. Annual broad money growth has recovered strongly from a low in September 2021, signalling a likely inflation rebound during 2024 – chart 3. Broad money acceleration has been driven by China, Russia and Brazil.

Chart 3

E7 annual broad money growth is around the middle of its longer-term historical range and has eased since February. Chinese numbers may have been temporarily inflated by a shift in banks’ funding mix in favour of deposits.

The expected rise in E7 inflation may not extend far but restoration of a positive E7 / G7 differential is likely in 2024.

*E7 defined here as BRIC + Korea, Mexico, Taiwan.

Reader Comments (1)

It increasingly looks like when rates are finally cut, they will be done so very rapidly.