Capex weakness to drive PMI double dip

The global manufacturing PMI new orders index – a timely indicator of global goods demand – was little changed below 50 (49.4) in April, a weaker result than had been suggested by DM flash results.

Inventories indices for finished goods and production inputs, meanwhile, rose further to their highest levels since November. Accordingly, new orders / inventories differentials – which often lead at turning points – fell for a second month.

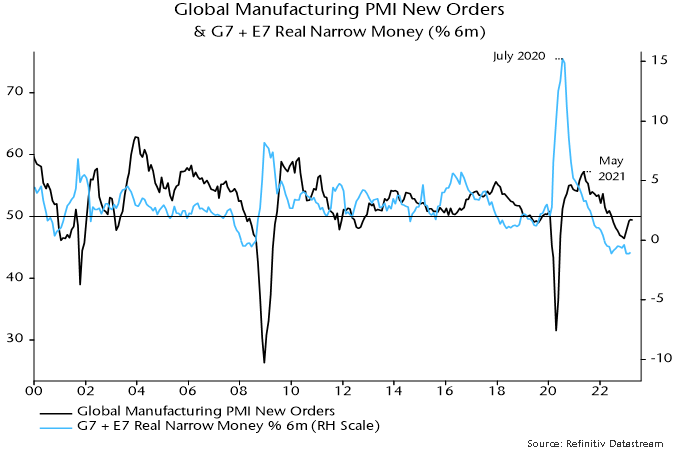

These results are consistent with the forecast here that a recovery in PMI new orders since December 2022 would fizzle out in H1 and reverse into H2, with a possibility of a break below the December low. The basis for the forecast was a relapse in global (i.e. G7 plus E7) six-month real narrow money momentum around end-2022. Real money momentum moved sideways in March at around its June 2022 low – see chart 1.

Chart 1

A downswing in the stockbuilding cycle was a key driver of earlier PMI weakness. A further drag is in prospect but the down phase of the cycle is well advanced, with incoming data and average cycle length suggesting a low during H2.

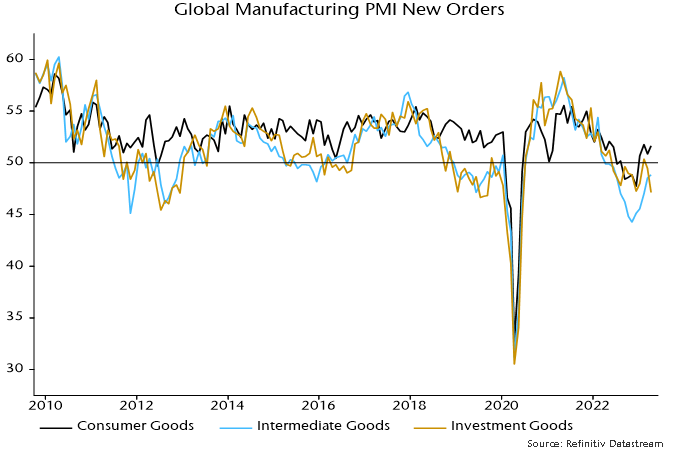

Business capex is emerging as a new source of global goods demand weakness. The capital goods component of PMI new orders reached a new low in April – chart 2.

Chart 2

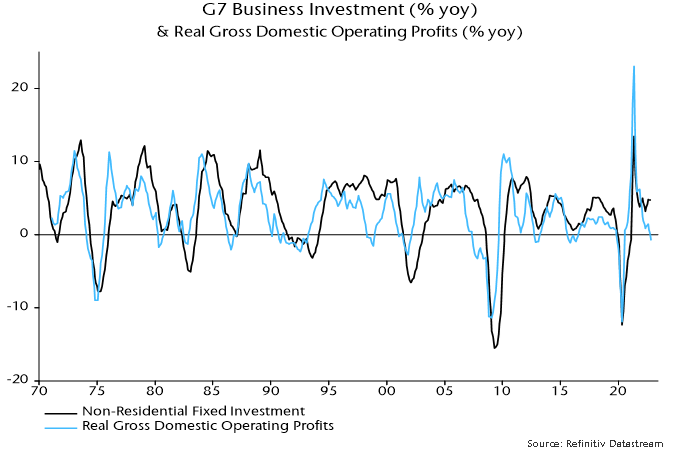

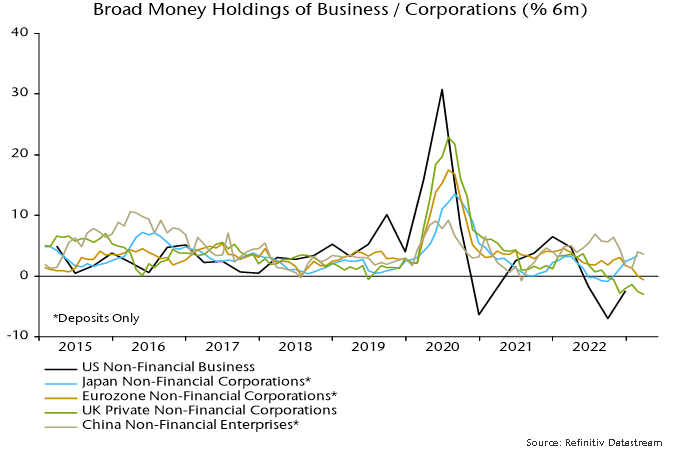

A contraction in business investment is consistent with a squeeze on real profits in late 2022 – chart 3 – and weak corporate money trends: business broad money holdings have fallen in nominal terms recently in the US, Eurozone and UK – chart 4.

Chart 3

Chart 4

Other evidence of a capex downturn includes:

-

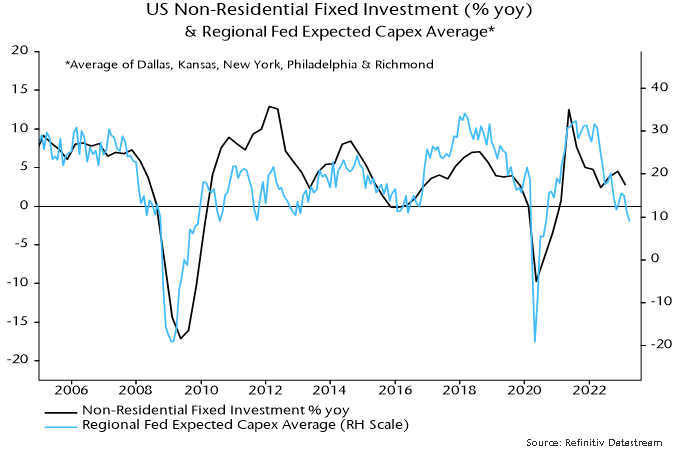

Weak capex intentions in regional Fed manufacturing surveys (and the NFIB small firm survey) – chart 5.

-

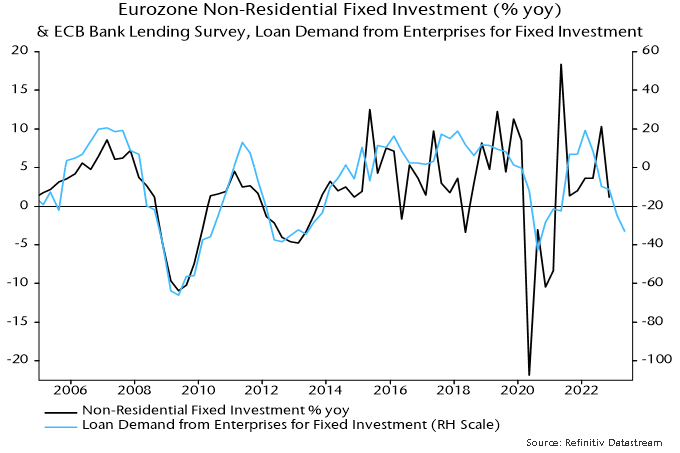

Weak enterprise loan demand for fixed investment in the ECB bank lending survey – chart 6.

-

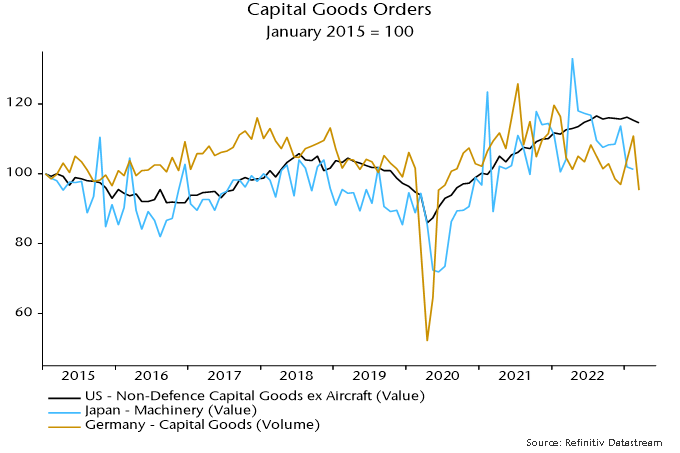

Falling capital goods / machinery orders in the US, Japan and Germany – chart 7.

Chart 5

Chart 6

Chart 7

Chart 7

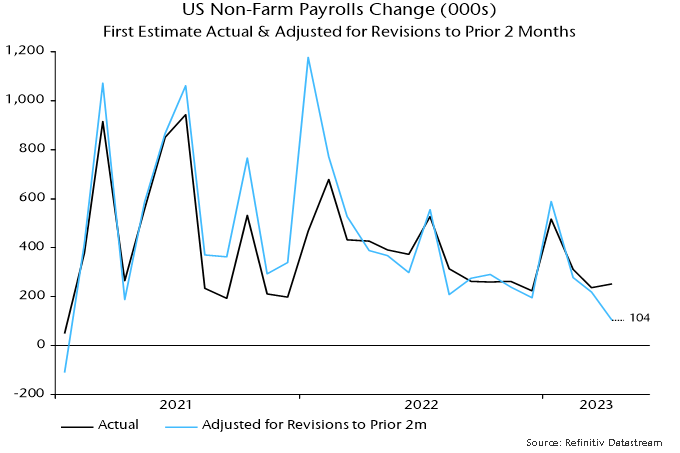

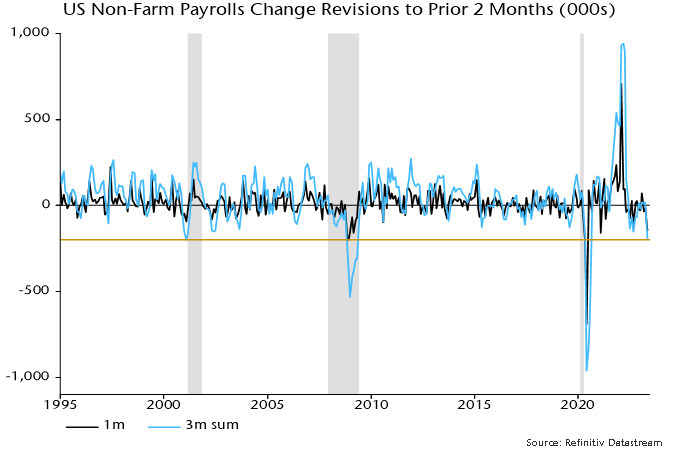

Capex retrenchment is usually accompanied by a fall in labour demand. Adjusted for negative revisions to the prior two months, the addition to US non-farm payrolls in April was 104,000, the smallest since January 2021 – chart 8. Revisions in the last three reports cumulate to -200,000, a level rarely reached outside recessions – chart 9.

Chart 8

Chart 9

Reader Comments (1)

When else have we seen broad money contract nominally?

I can only think of one. Will it be different this time? Hopefully!