Eurozone money trends still weakening

Eurozone flash PMIs this week were less bad than expected, bolstering a growing consensus that economic prospects are improving. Monetary trends continue to argue the opposite.

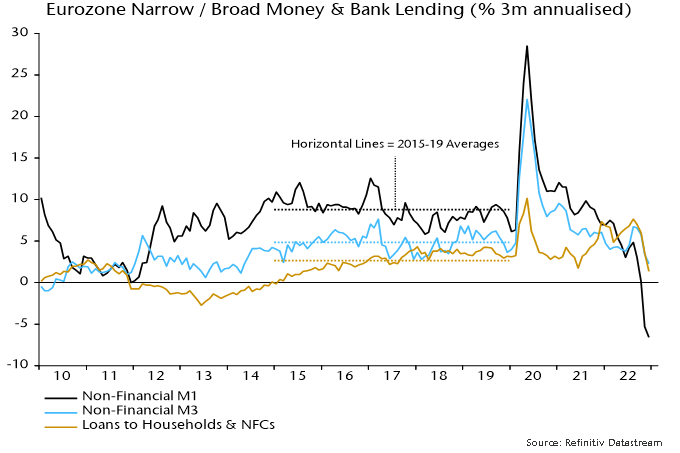

The preferred narrow money measure here – non-financial M1 – fell for a fourth consecutive month in December in nominal terms. Bank lending also contracted on the month, while the broad non-financial M3 measure grew by just 0.1%.

The three-month rate of contraction in narrow money is a record in data back to 1970. Three-month growth of non-financial M3 is down to 2.3% annualised, less than half its 2015-19 average. Bank loan growth is also now below its corresponding average – see chart 1.

Chart 1

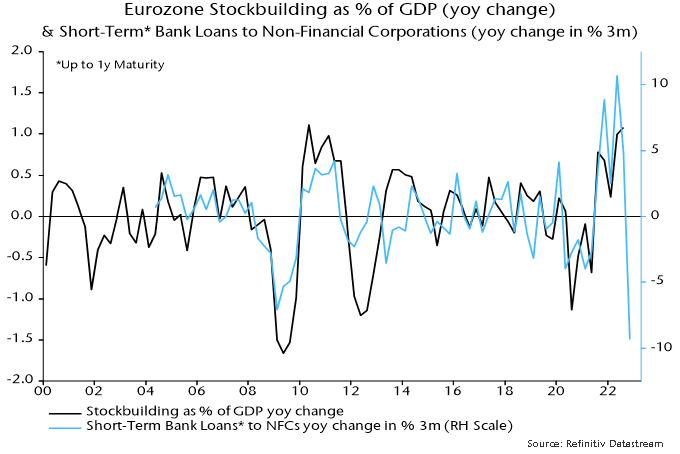

Bank lending weakness is being driven by repayment of short-term corporate loans, consistent with a violent downswing in the stockbuilding cycle – chart 2.

Chart 2

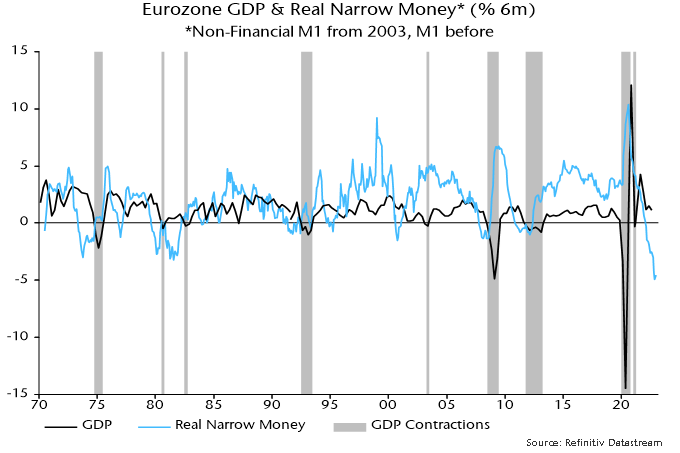

The six-month rate of decline of real narrow money was little changed from November’s record despite a sharp drop in six-month CPI momentum – chart 3.

Chart 3

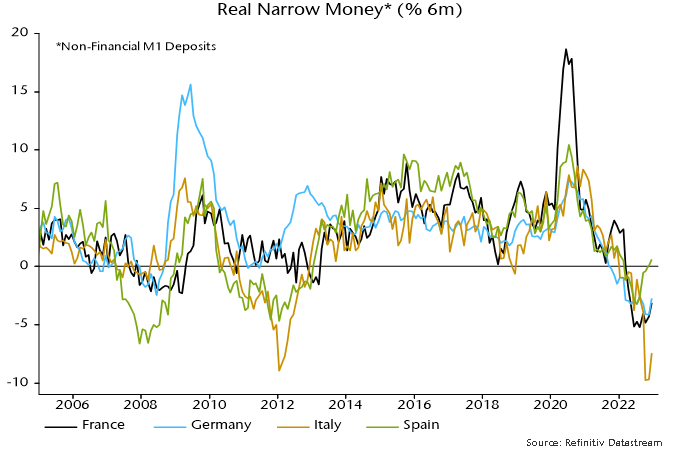

The rate of contraction of real M1 deposits remains fastest in Italy, reflecting both weaker nominal money trends and higher inflation. Spanish positive divergence is mainly due to a much sharper recent CPI slowdown.

Chart 4

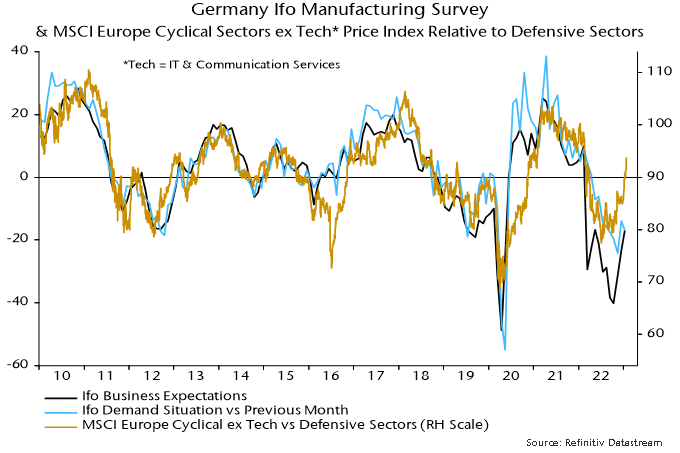

Echoing the better PMI news, German Ifo manufacturing expectations rose for a third month in January. The new demand index, however, has recovered by less and fell back this month – chart 5. European cyclical equity market sectors have outperformed on soft landing hopes and are vulnerable if business surveys now stall, as suggested by monetary trends.

Chart 5

Reader Comments (3)

Not encouraging. I believe your piece from October 6th sums up the current predicament of the global economy nearly perfectly.

"The risk, therefore, is that housing weakness and its lagged effects on the rest of the economy will offset any recovery impetus later in 2023 from a turnaround in the stockbuilding cycle. A rapid reversal in interest rates may be necessary to avert this scenario."

We haven't had that reversal though it seems highly probable we will later in 2023.

Hi Simon, I’m seeing someone post a chart of copper vs. US CPI, trying to suggest a 2-3 month lead, and a subsequent inflation resurgence. Interested in your take on this! Thanks!

Reading the tea leaves has become harder. Depressing financial news from EU cannot and will not stop America's reshoring. That seems like a secular tsunami force that may last decades and has just started. Working powerfully in the background it might help minimize the effects in the US of any EU deep recession.