Fade the PMI bounce

The global manufacturing PMI new orders index – a timely indicator of industrial momentum – registered a surprise small rise in September, with weaker results for major developed economies foreshadowed in earlier flash surveys offset by recoveries in China and a number of other emerging markets.

Does this signify an end to the recent slowdown phase, evidenced by a fall in PMI new orders between May and August? The assessment here is that the rise should be discounted for several reasons.

First, it was minor relative to the August drop. The September reading was below the range over October 2020-July 2021.

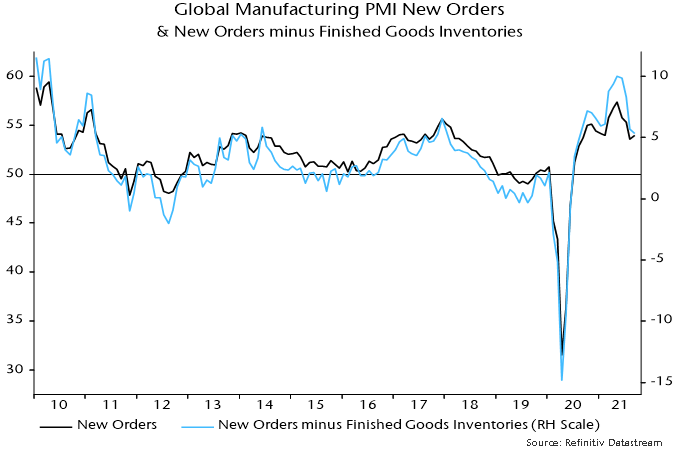

Secondly, the increase appears to have been driven by inventory rebuilding. The new orders / finished goods inventories differential, which sometimes leads new orders, fell again – see chart 1.

Chart 1

Remember that orders growth is related to the second derivative of inventories (i.e. the rate of change of the rate of change). Inventories are still low and will be rebuilt further but the pace of increase – and growth impact – may already have peaked.

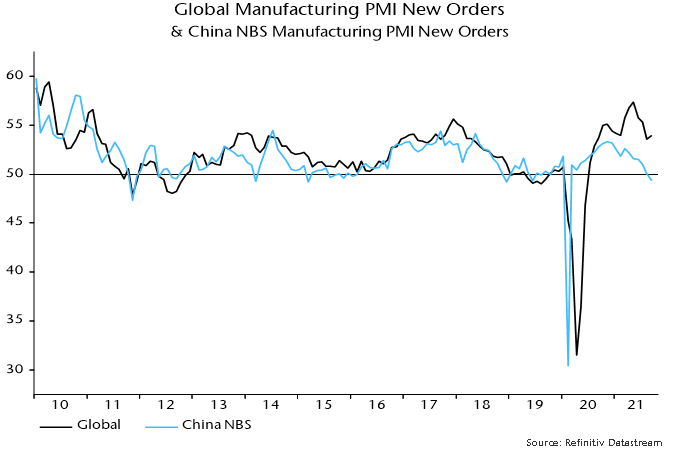

Thirdly, the recovery in the Chinese component of the global index was contradicted by a further fall in new orders in the official (i.e. NBS) manufacturing survey, which has a larger sample size. The latter orders series has led the global index since the GFC – chart 2.

Chart 2

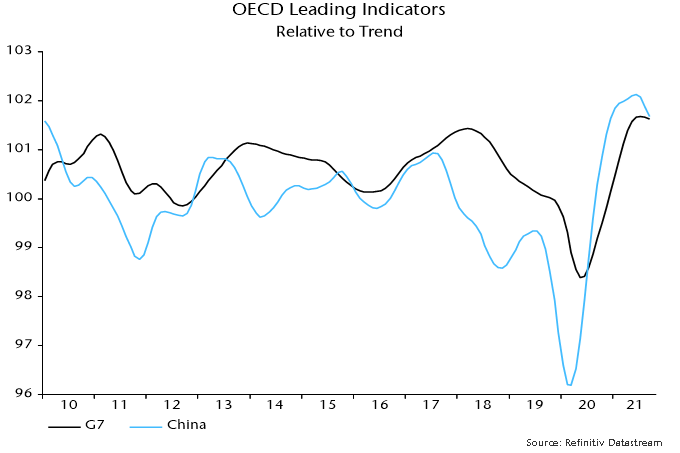

Fourthly, the OECD’s composite leading indicators for China and the G7 appear to have rolled over and turning points usually mark the start of multi-month trends. The series in chart 3 have been calculated independently using the OECD’s published methodology and incorporate September estimates (the OECD is scheduled to release September data on 12 October). The falls in the indicators imply below-trend and slowing economic growth.

Chart 3

Finally, additional August monetary data confirm the earlier estimate here that G7 plus E7 six-month real narrow money growth was unchanged at July’s 22-month low – chart 4. The historical leading relationship with PMI new orders is inconsistent with the latter having reached a bottom in September. The message, instead, is that a further PMI slide is likely into early 2022, with no signal yet of a subsequent recovery.

Chart 4

Reader Comments (2)

Real narrow money will be interesting, especially with regards to the inflation outlook.

Potential for negative excess money given inventory building going on?

Is it possible that the declining money growth is the result of the supply bottlenecks as more money is being "used" in the whole supply chain because input shortages and longer delivery times lengthen the production cycle? At the same time these PMI's remain rather elevated as final demand is still there, it just takes longer to fulfill the orders?