August PMIs: US / Euroland convergence

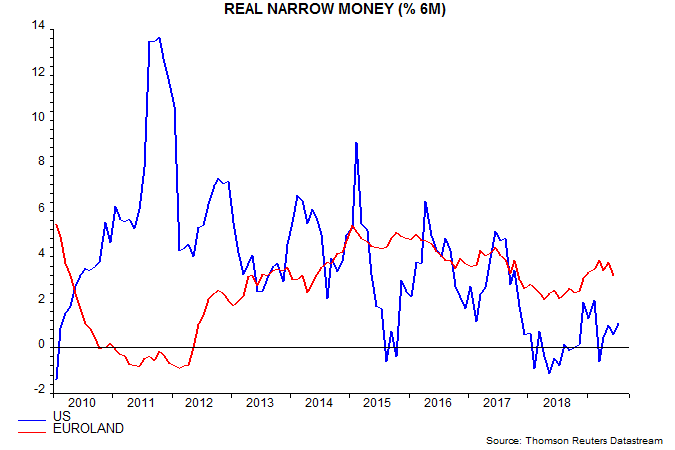

Narrow money trends have been signalling US economic weakness but a stabilisation of momentum in Euroland, with no recession – see, for example, here. August flash PMI results are consistent with this scenario.

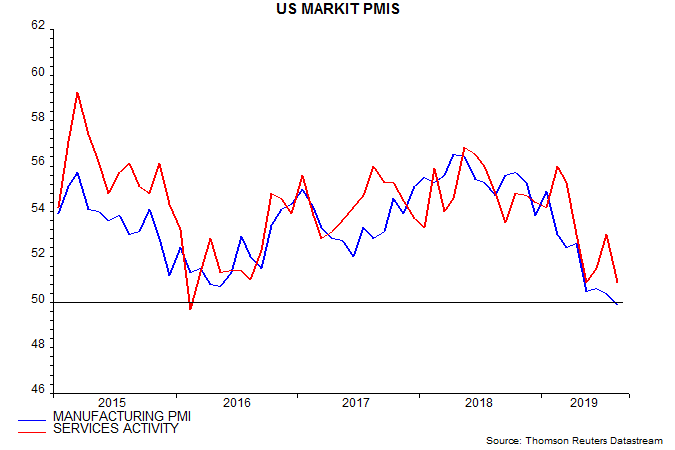

The US composite output index fell sharply in August, returning to its May low. The Euroland index bottomed in January and edged higher in August, moving back above the US level – see first chart.

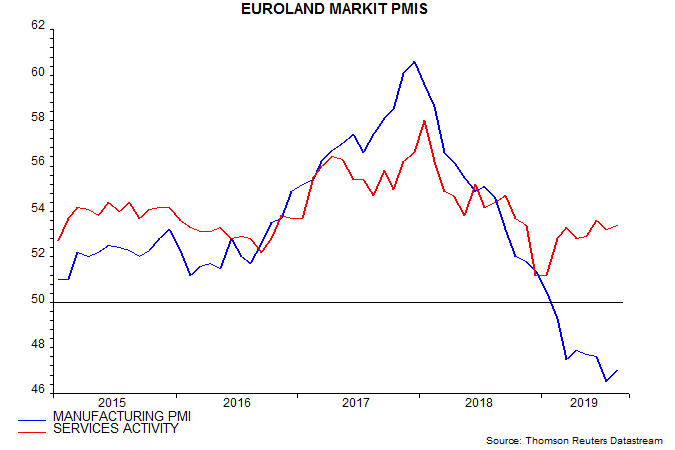

The US output fall was driven by services activity but the manufacturing PMI slipped below 50, with the new orders component at a 10-year low – second chart.

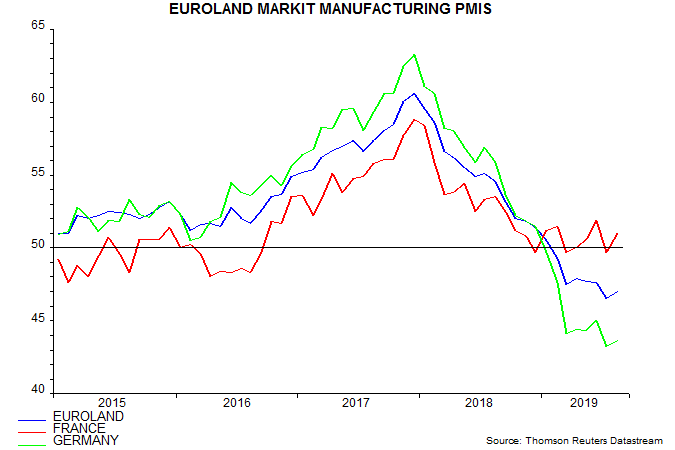

The Euroland manufacturing PMI remains much weaker but edged up in August; services activity, meanwhile, is stronger than in the US – third chart. Manufacturing woes continue to be focused on Germany, reflecting the economy’s sensitivity to negative trends in the auto sector, global capex and China. The French manufacturing PMI is the strongest among the G7 – fourth chart.

US six-month real narrow money growth edged up in July but remains well below the latest Euroland reading, for June – fifth chart. Euroland growth, however, has cooled recently and a further decline in July data released next week would question the scenario of economic stabilisation.

Reader Comments