US loan officer survey signalling credit / economic weakness

The Fed's January senior loan officer survey provides further evidence of a deterioration in US economic prospects, signalling a tightening of loan supply and – more significantly – markedly weak credit demand.

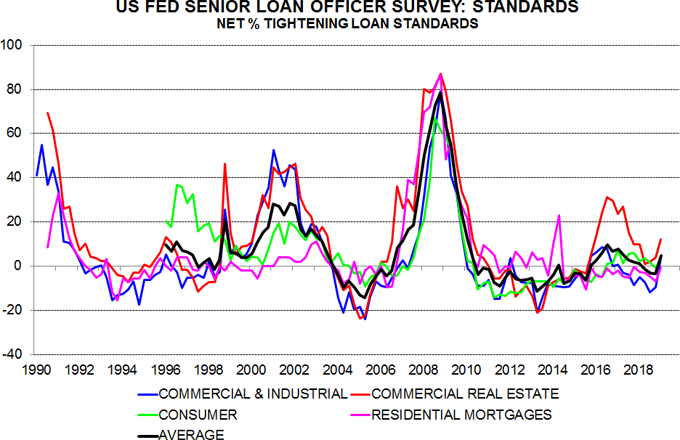

The net percentage of banks tightening lending standards rose across all four major loan categories in the latest three months. An unweighted average of these balances turned positive, reaching the highest level since May 2017 – see first chart.

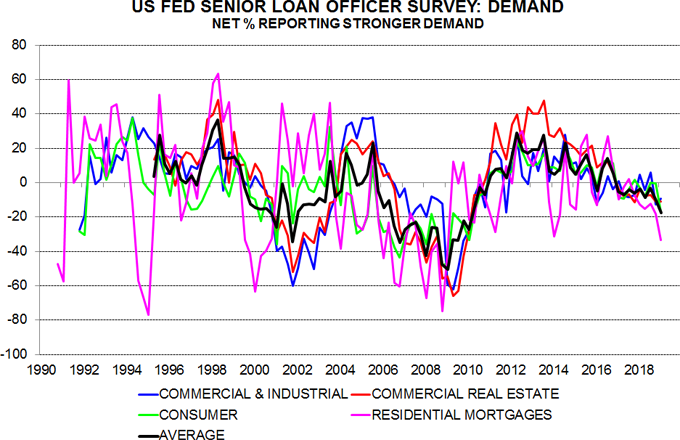

An average of the balances reporting stronger credit demand, meanwhile, moved deeper into negative territory, reflecting sharply weaker responses for residential mortgages and consumer loans – second chart.

The standards average rose above 20 before the last two recessions, while the demand average fell below -20. The standards measure remains well below the critical level but the demand measure now stands at -18 – third chart.

The January survey included special questions about banks’ outlook for 2019, assuming economic growth in line with the consensus. The responses suggest a further rise in the standards average to 11, with the demand average falling to -19. Banks are expecting additional demand weakness and tightening of standards for C&I and commercial real estate loans but a recovery in housing credit demand, probably reflecting the fall in mortgage rates at end-2018.

The current weakness of the credit demand average suggests that first-half GDP growth will undershoot the consensus forecast – fourth chart. A growth shortfall would probably result in a further ratcheting up of lending standards.

Credit demand indicators also weakened notably in the latest ECB and Bank of England lending surveys, discussed previously here and here.

Reader Comments