Euroland money update: economic prospects improving?

Euroland January money numbers were reassuring, arguing against recession worries and suggesting that economic momentum will revive during 2019 – barring external shocks.

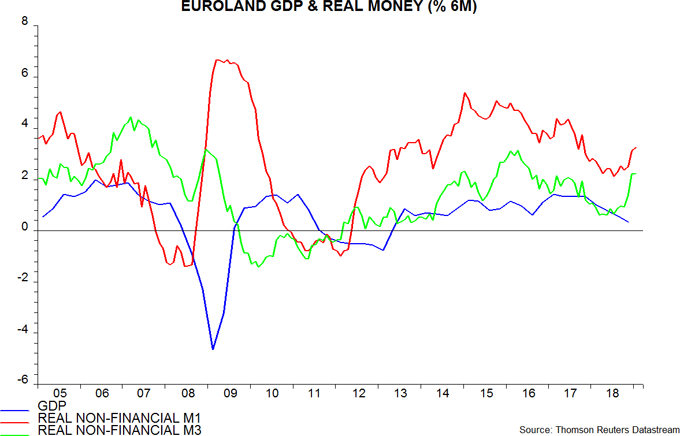

Six-month growth of real narrow money – as measured by non-financial M1 deflated by consumer prices – rose further in February, reaching a 15-month high. Real broad money (non-financial M3) expansion was stable at a two-and-a-half-year peak. The growth rates have risen since July 2018, suggesting an improvement in GDP momentum from around April, assuming a typical nine-month lead – see first chart.

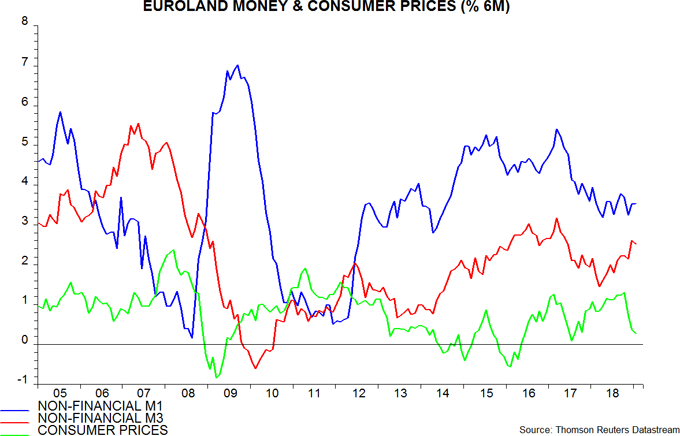

Real money trends, admittedly, have been boosted by a sharp fall in six-month inflation, which is likely to reverse into the second half. Nominal narrow money growth, however, has been stable at a respectable level since early 2018, while broad money expansion has picked up – second chart. The inflation boost to real money growth should be reflected in economic momentum later this year even if it proves temporary.

Sectoral numbers show that the rise in real narrow money growth has been driven by the household component, while corporate expansion remains weak – third chart (NFC = non-financial corporate). Economic resilience, therefore, is likely to depend on stronger consumer spending, which in turn requires companies to maintain employment levels despite recent weaker demand and downward pressure on profits.

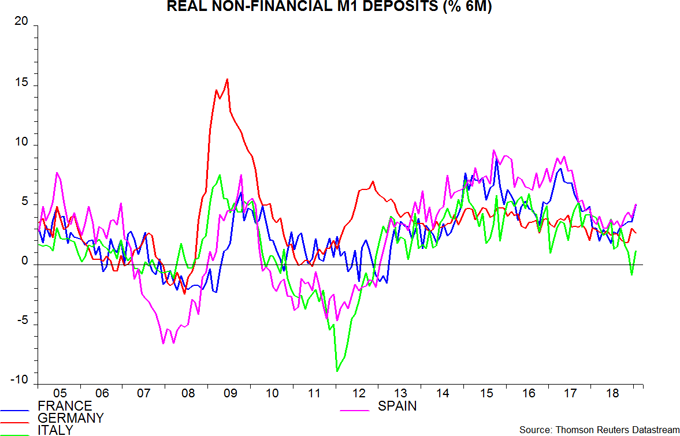

At the country level, Italian real narrow money momentum recovered in January but continues to lag significantly, while growth in France and Spain has strengthened, suggesting improving economic prospects – fourth chart.

Reader Comments (1)

Nominal money is flat. Inflation reviving pretty strongly.

M3 pretty useless indicator per first chart. Also M3/M1 ratio?

NFC M1 tends to lead the other components?

Weakness from the US not feeding through to the EU yet. China set to weaken further also?

Euroland (or Germany at least) effected a lot by the external balance which is likely to deteriorate further, given China/US.

Looks more like stabilisation at current low level of output growth, then further weakness likely in nominal M1 as the year continues and rising inflation.