OECD leading indicators confirming global economic acceleration

The OECD today released three months’ worth of data on its composite leading indicators for OECD countries and major emerging economies, following a bizarre decision to suspend publication over the summer because of supposed Brexit-related uncertainty. The indicators signal an emerging markets-led pick-up in global growth, confirming the message from recent narrow money trends.

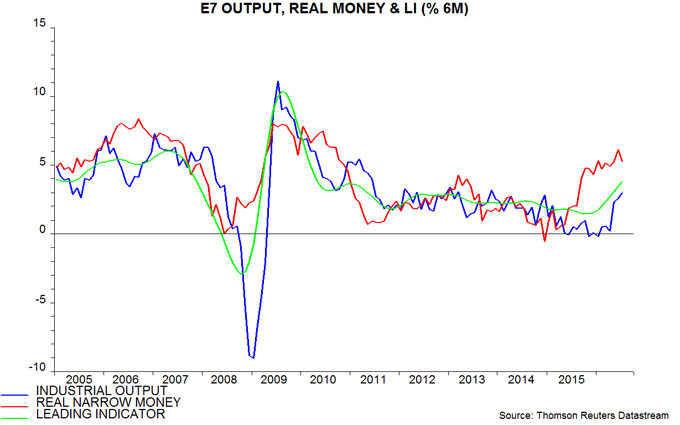

The first chart shows six-month changes in G7 plus emerging E7 industrial output, real narrow money and a leading indicator derived from the OECD country data. Real narrow money growth started to pick up in late 2015, with leading indicator momentum following in early 2016. Industrial output has shown signs of life in June / July, while the leading indicator has gained further strength.

The second and third charts show the E7 and G7 groupings separately. The upswing in the aggregate leading indicator has been driven by the E7 component but G7 weakness has abated, with G7 narrow money trends suggesting further improvement. The E7 pick-up has been broadly based among the constituent countries but China has been a major contributor, consistent with earlier narrow money buoyancy – fourth chart.

Reader Comments (1)

China's narrow money appears to have started increasing significantly in late spring/early summer 2015, yet industrial output has made little response to this immense increase in money supply and could be viewed as moving sideways from Autumn 2015 until late spring/early summer 2016 at which time it has started responding.

Perhaps the time lag of industrial output responses to changes in narrow money supply is lengthening to 1 year.