UK money data reassuring, no case for rate cut

UK monetary data for July showed no negative impact from the Brexit vote. Narrow and broad money rose solidly on the month, while bank lending continued to expand. The suggestion is that the economy remains on a growth path with little risk of a recession. There is no monetary case for a further cut in Bank rate.

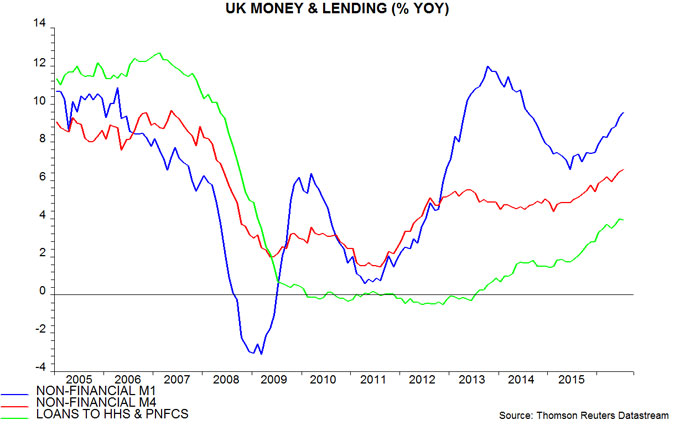

The favoured narrow and broad money measures here are “non-financial” M1 and M4, comprising money holdings of households and private non-financial corporations (PNFCs). These measures grew by 1.0% and 0.6% respectively in July, while bank lending to households and PNFCs gained 0.2%. Non-financial M1 rose by 9.6% in the latest 12 months, with non-financial M4 up by 6.6% – see first chart.

An oncoming recession would be expected to be signalled by a contraction of narrow money holdings, associated with households and firms revising down spending plans and / or receiving less income than expected. Both household and PNFC M1 rose solidly in July, by 1.0% and 1.1% respectively.

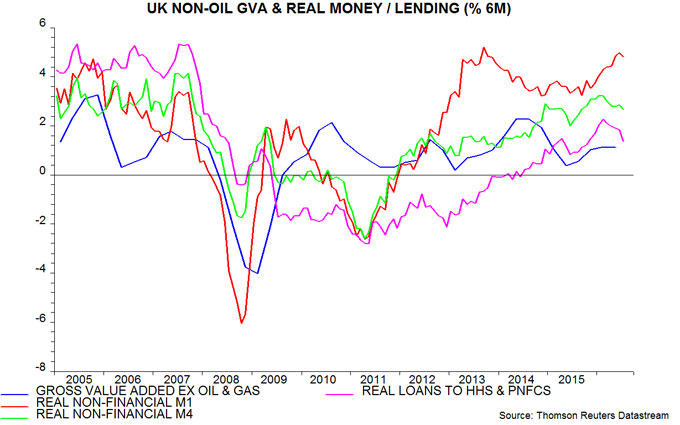

The forecasting approach here focuses on the six-month change in real (i.e. inflation-adjusted) non-financial M1. A rise in this measure in late 2015 correctly signalled that GDP / gross value added (GVA) momentum would pick up into mid-2016. Real non-financial M1 growth may have peaked in June but remained strong in July – second chart.

Six-month growth of real non-financial M4, meanwhile, has fallen since February 2016 but remains above its average in recent years.

Taken together, these developments suggest that GDP / GVA expansion will moderate from its first-half pace while remaining respectable.

Economic behaviour, of course, has only started to adjust to Brexit uncertainties and monetary trends could weaken significantly over coming months. For the moment, however, recession risk appears low: the six-month change in real non-financial M1 has turned negative before all previous recessions over the past 60 years.

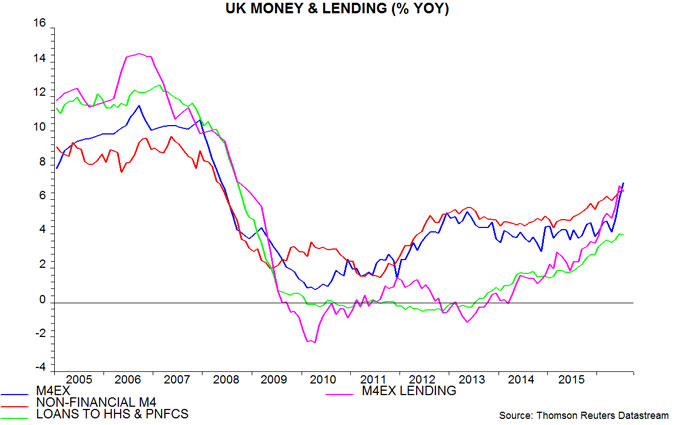

Annual growth of the Bank of England’s preferred broad money measure, M4ex, surged to 6.9% in July, above the 6.6% expansion of non-financial M4 – third chart. M4ex includes financial-sector money holdings, which have picked up strongly, rising by an annual 9.3% in July. This pick-up follows an extremely rapid increase in bank lending to the financial sector, annual growth of which peaked at 36.1% in June. The strength of both lending and deposits has been concentrated in “fund management activities” and may reflect the implementation of liability-driven investment strategies on behalf of pension funds. These financial-sector developments, in any case, are probably of little significance for future spending on goods and services.

Reader Comments