UK Q2 GDP strong, money data awaited for H2 assessment

Posts in December and March argued that UK growth was in an upswing phase, contrary to mainstream forecasts of a slowdown or even stagnation. Today’s news that GDP grew by 0.6% in the second quarter confirms that momentum had strengthened before the EU referendum but the outlook, of course, has been transformed by the result of the vote. The judgement here about the damage to economic prospects will depend importantly on post-referendum monetary trends, with end-June data to be released on Friday.

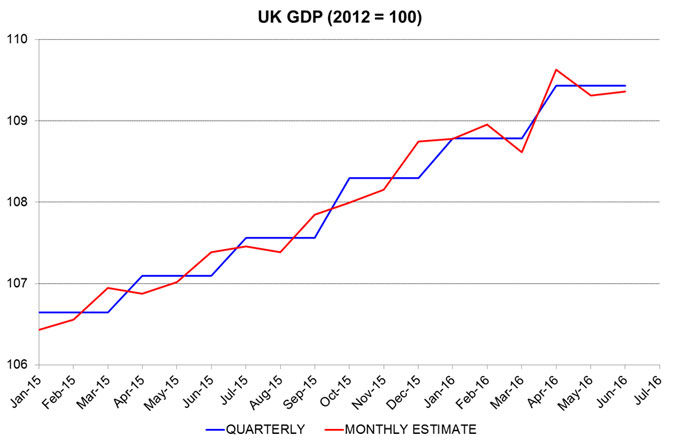

The strong second-quarter result reflected another solid gain in services output coupled with a rebound in industrial production after weakness over the winter. Monthly output data imply that GDP rose sharply in April but retreated in May, with the Office for National Statistics projecting a small increase in June. April strength was payback for weak March activity, which was probably affected by the early timing of Easter – see first chart.

The GDP result highlights the danger of relying on survey evidence to assess economic developments. The compiler of the purchasing managers’ surveys had predicted growth of just 0.2% last quarter, based on its “composite PMI”. The flash July results released last week, it now claims, indicate that GDP is on course to fall by 0.4% in the current quarter.

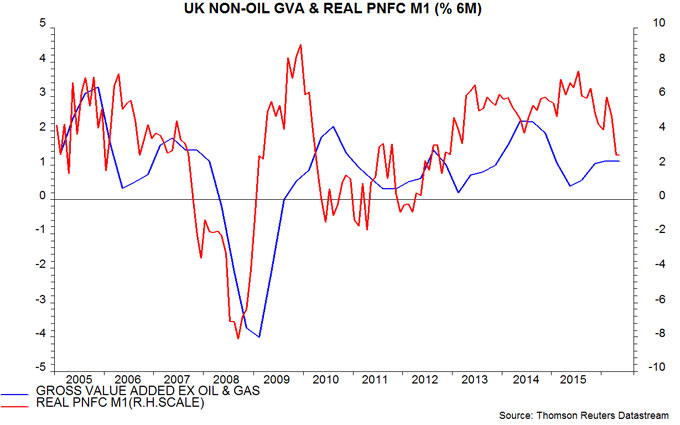

The working assumption here is that the economy is unlikely to weaken sharply against a backdrop of rising global growth and stable financial conditions. A firm assessment, however, will depend on narrow money developments in July / August. As previously discussed, a slowdown in corporate* real narrow money this spring suggested that economic prospects were dimming; a post-referendum move into contraction would support recession worries – second chart.

*Private non-financial corporations (PNFCs).

Reader Comments