UK real money contraction slows

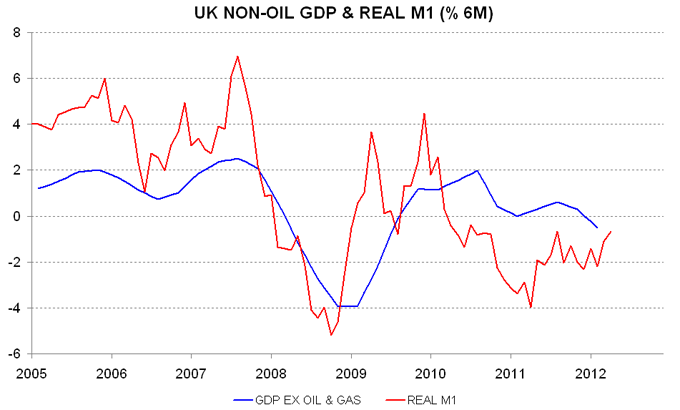

The UK monetary backdrop is less weak than a year ago but suggests sluggish economic growth at best.

Recent broad money developments, on first inspection, seem favourable – the Bank of England’s preferred M4ex measure rose by 1.7% in the six months to April while the 12-month increase reached a three-year high of 3.8%. M4ex, however, may have been inflated by UK residents moving funds out of foreign currency accounts into sterling, probably because of worries about the euro. An expanded measure incorporating foreign currency deposits (excluding those held by financial intermediaries) grew by just 0.1% in the latest six months.

Narrow money M1 rose by 0.5% in the six months to April – still soft but better than a 0.9% contraction in the same period a year ago.

Real money trends have benefited from a significant drop in inflation since then – the year-ago six-month CPI increase was boosted by the January 2011 VAT hike. Real M1 is still falling on a six-month basis but the rate of decline is back to the levels of early 2010 – see chart.

Reader Comments