PMI / monetary data confirming global “double dip”

A recovery in global economic momentum into the spring has gone into reverse, with monetary trends suggesting that weakness will intensify during H2.

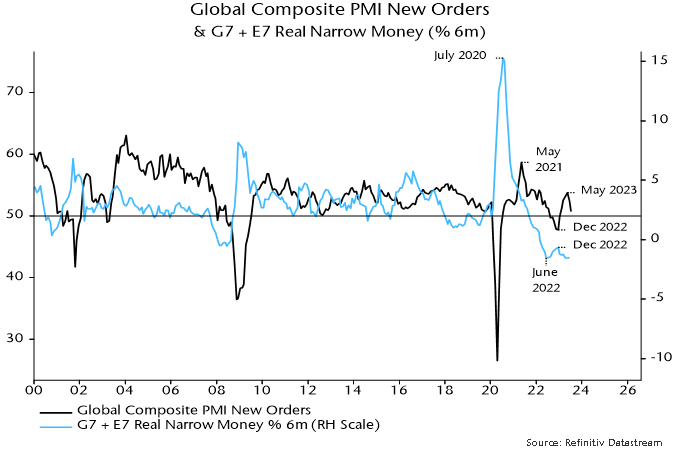

The global composite PMI new orders index fell sharply again in July and has now retraced half of its December-May rise – see chart 1. The relapse was foreshadowed by a decline in global six-month real narrow money momentum from a local peak in December 2022. Real money momentum retested its June 2022 low in April and has since moved sideways, suggesting a further slide in the PMI index into early Q4 followed by stabilisation.

Chart 1

The December-May recovery in global PMI new orders was boosted by several non-monetary factors, including release of pent-up demand for services, China’s reopening and gas price relief in Europe. With similar tailwinds unlikely during H2, the orders index may retest or break the December 2022 low.

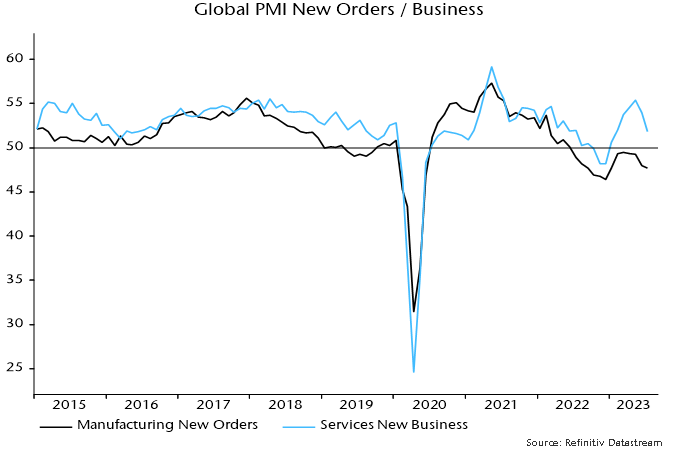

The July orders decline was paced by a slowdown in services new business, although manufacturing demand also weakened further – chart 2. The services-manufacturing gap remains wide and is expected to close via the former moving into contraction, with manufacturing possibly stabilising as the stockbuilding cycle bottoms.

Chart 2

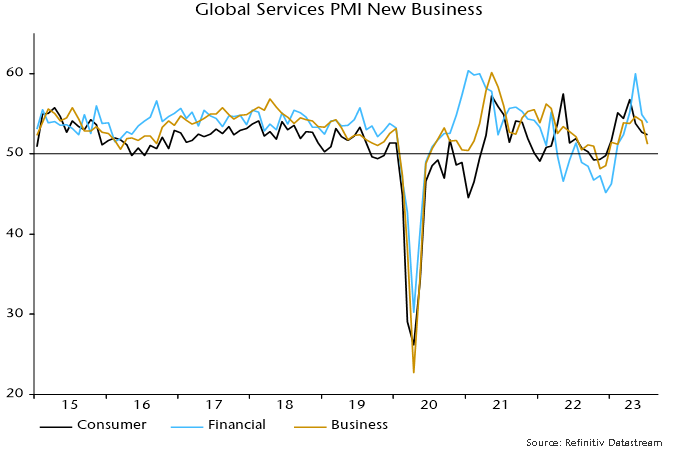

The July PMI orders decline was broadly based across sectors. Within manufacturing, consumer goods joined investment and intermediate goods in contraction – chart 3. Services demand slowed across consumer, financial and business segments – chart 4.

Chart 3

Chart 4

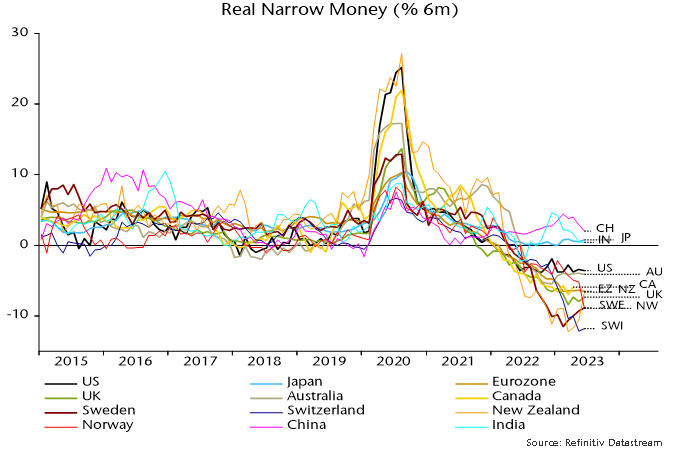

Six-month real narrow money momentum remains weakest in Europe and has slowed in China and India – chart 5. With policy tightening still feeding through, and recent oil price strength acting to slow a decline in six-month CPI momentum, global real money momentum may fail to recover during Q3.

Chart 5