UK vacancies still weakening

A stabilisation in the stock of UK vacancies in the three months to February compared with the prior three months has been cited as evidence that labour demand is holding up despite survey indications of job cuts.

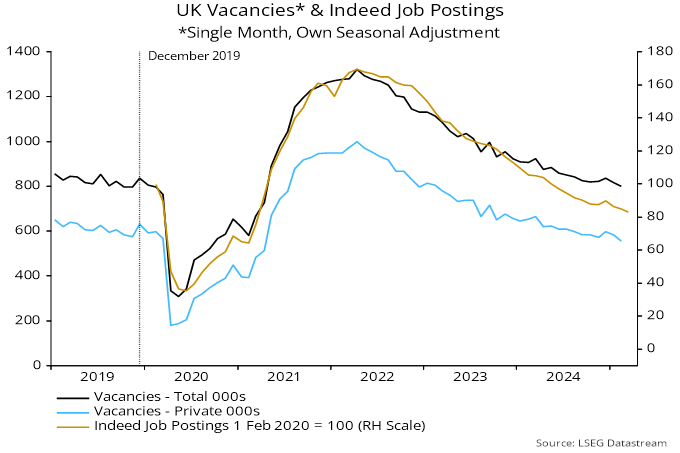

Analysis of “experimental” single-month data, however, indicates that stability of the three-month average conceals a small rise in vacancies in November / December that has more than reversed in January / February*. The February single-month number was the lowest since April 2021 and 4% below the pre-pandemic (i.e. December 2019) level – see chart 1.

Chart 1

The timely Indeed job postings series also recorded a small increase at end-2024 before falling back in January / February, with the decline continuing in the first half of March (daily information is available through 14 March).

The fall in the single-month vacancies series in January / February was more than accounted for by a decline in non-government-related postings, i.e. openings in public administration, education and health are estimated to have risen after seasonal adjustment. The single-month “private sector” series was 12% below its December 2019 level in February.

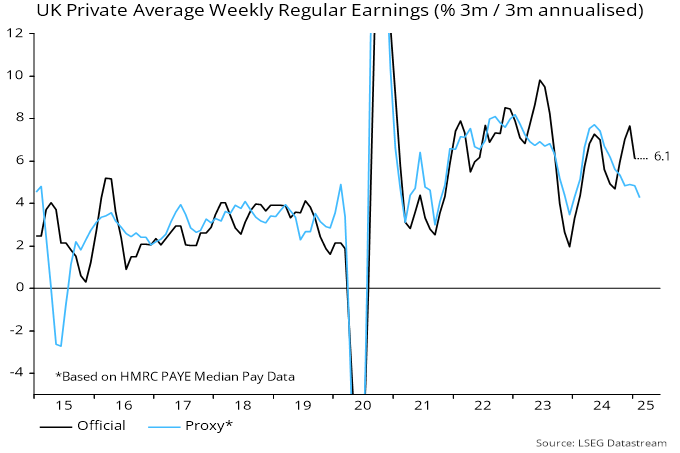

Three-month on three-month growth of private sector regular pay remained strong in January but momentum of an employment-weighted average of PAYE data on median pay levels across industries is tracking lower, suggesting better official earnings news ahead – chart 2.

Chart 2

*The single-month numbers require seasonal adjustment. A three-month average of the resulting series closely matches official numbers.