Global money update: cavalry arriving?

Global monetary trends suggest demand support for economic activity in late 2025 / early 2026. Such support could offset the negative impact of the US trade policy shock. Growth could bounce back solidly should tariffs be scaled back.

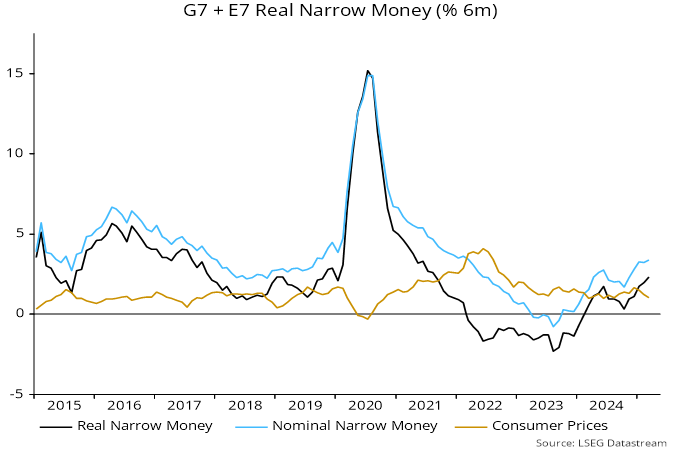

Global (i.e. G7 plus E7) six-month real narrow money momentum is estimated to have risen further in March, reaching its highest level since August 2021, based on monetary data for countries accounting for three-quarters of the aggregate. Nominal money growth appears to have ticked up in March while six-month consumer price momentum slowed – see chart 1.

Chart 1

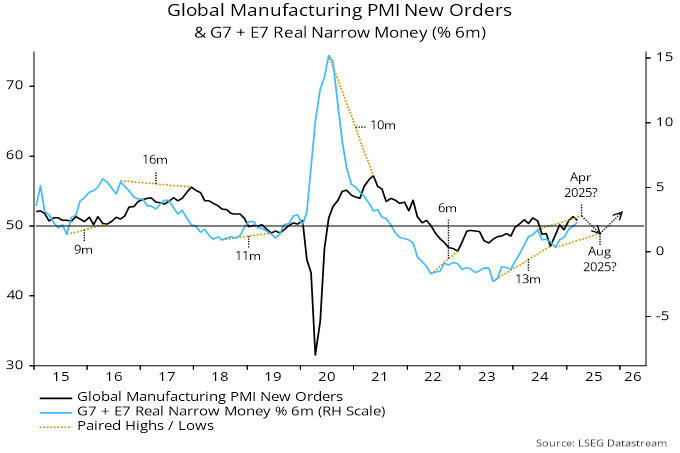

A fall in global real money momentum between June and October 2024 was expected here to be reflected in an economic slowdown in spring / summer 2025 – chart 2. The US policy shock, therefore, is occurring at an inopportune time, threatening a much more serious downturn.

Chart 2

Real money reacceleration since late 2024, however, suggests a short, sharp hit to economic activity rather than a sustained recession. A recovery in domestic demand could outweigh net export weakness by late 2025, particularly if the tariff regime that eventually emerges is less onerous than currently feared, or at least allows businesses to plan with less uncertainty.

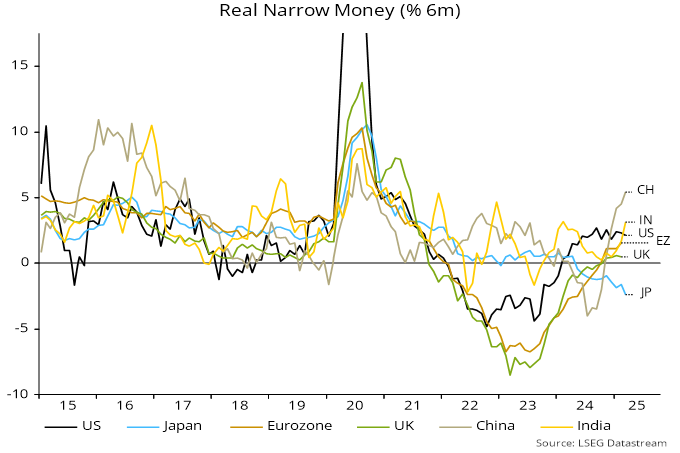

The estimated March rise in global six-month real narrow money momentum was driven by China and India, with the US little changed and Japanese weakness becoming more extreme – chart 3. (Eurozone and UK March numbers will be released next week.)

Chart 3

Could the monetary pick-up reverse? US broad – and possibly narrow – money growth has been supported by an enforced run-down of the Treasury’s cash balance at the Fed, which will be rebuilt if / when agreement on lifting the debt ceiling is reached.

Tariffs will have a temporary impact on CPI numbers, squeezing real money momentum. Still, effects should be small outside the US and offset by recent weakness in energy prices.

The trade shock, meanwhile, is resulting in faster monetary policy easing outside the US, reflecting both economic fears and US dollar weakness.

Prospective influences, therefore, are mixed and a further rise in global real money momentum appears as likely as a relapse.

We probably should be concerned about a monetary relapse. It also looks like new job flow is inflecting sharply lower on Indeed across regions again.