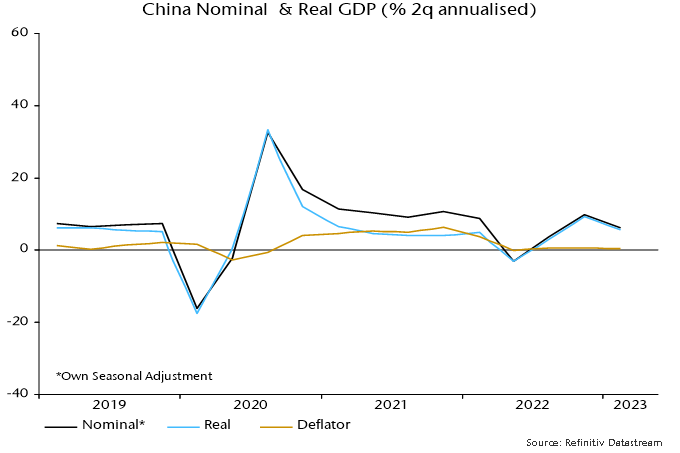

The Chinese economy has bounced back since reopening but the pick-up has arguably been underwhelming. GDP grew at a 9.1% annualised rate in Q1, according to official data, but this partly represents payback for a weak Q4. Growth averaged an unexceptional (by Chinese standards) 5.7% over the two quarters.

Inflationary pressures remain weak despite the activity rebound. Nominal GDP expansion was only marginally higher than real in Q4 / Q1 combined: the GDP deflator rose by just 0.4% annualised – see chart 1*.

Chart 1

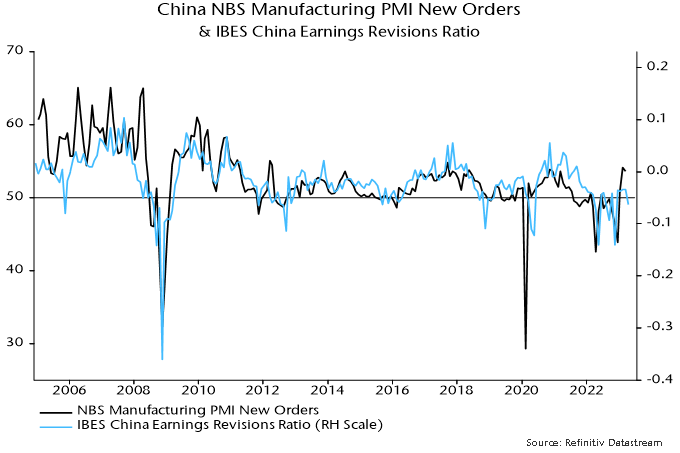

Muted nominal GDP growth has contributed to lacklustre profits, with the IBES China earnings revisions ratio diverging negatively from recent stronger official PMIs, questioning the sustainability of the latter – chart 2.

Chart 2

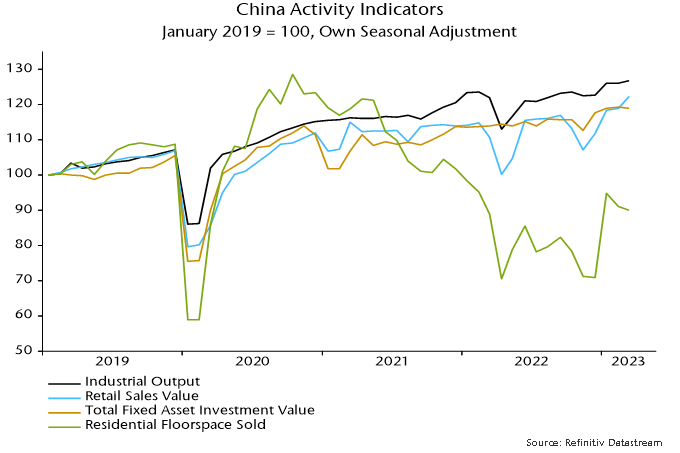

Monthly activity numbers for March were mixed and don’t suggest a pick-up in momentum at quarter-end. Retail sales were a bright spot but strength in industrial output, fixed asset investment and home sales has faded after an initial reopening bounce – chart 3.

Chart 3

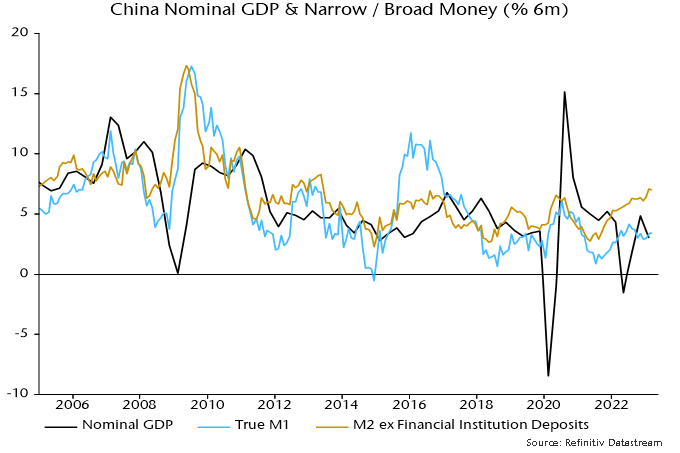

Moderate nominal GDP expansion is consistent with recent narrow money trends: six-month growth of true M1 (which corrects the official M1 measure to include household demand deposits) remains range-bound and slightly below its 2010s average – chart 4**.

Chart 4

Broad money growth, as the chart shows, is significantly stronger. However, examination of the “credit counterparts” indicates that a rise since late 2021 has been driven mainly by banks switching to deposit funding and reducing other liabilities – domestic credit expansion has been stable.

The judgement here is to place greater weight on narrow money trends, which currently suggest a moderate recovery that probably requires additional policy support to offset external headwinds.

*Official unadjusted nominal GDP seasonally adjusted here; GDP deflator derived from comparison with official seasonally adjusted real GDP.

**March true M1 estimated pending release of demand deposits data.