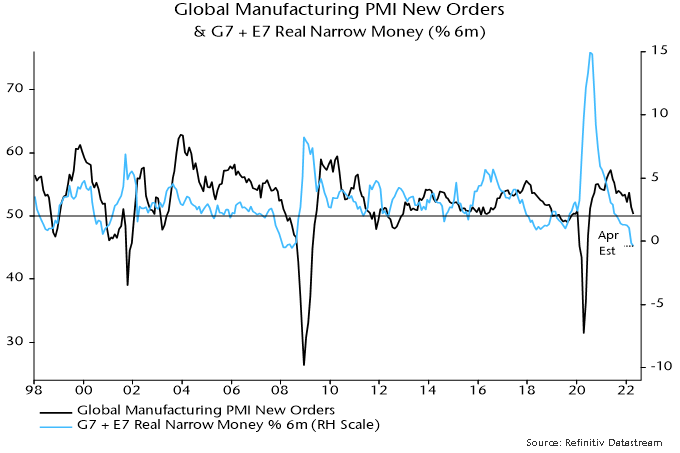

Global* six-month real narrow money momentum turned negative in March and is estimated to have fallen slightly further in April, based on monetary and CPI data covering two-thirds and 90% of the aggregate respectively – see chart 1.

Chart 1

Current weakness is more pronounced than before the 2001 recession and almost on a par with early 2008 before the escalation of the financial crisis.

The leading relationship with the global manufacturing PMI new orders index suggests a sizeable further decline in the latter with no recovery before Q4. A move below 45 would confirm a recession.

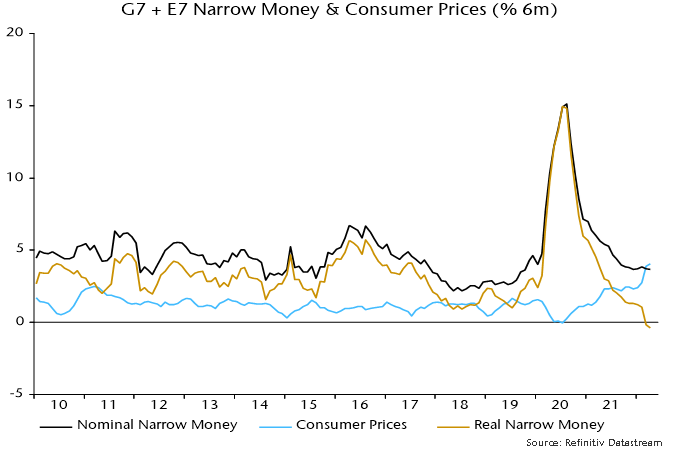

The further fall in real narrow money momentum in April reflected another rise in global six-month CPI inflation, with small CPI slowdowns in the US and Eurozone more than offset by pick-ups in China, Japan (Tokyo data) and the UK (estimated), among others – chart 2.

Chart 2

Six-month nominal narrow money growth has been moving sideways since December. With CPI inflation probably peaking, real money momentum could be bottoming. Any recovery, however, could be limited by a renewed nominal money slowdown as central bank policy tightening proceeds.

*G7 plus E7. E7 defined here as BRIC plus Korea, Mexico and Taiwan.