Chinese money trends remain moderately favourable but the economy has been held back by covid disruption and now faces an export threat from global recession. Stocks, meanwhile, have been hit by a ramping up of the Biden administration’s war on Chinese tech along with President Xi’s take-over of economic policy-making, which investors have viewed as negative for longer-term growth prospects. “Excess” money has accumulated in the bond market and has the potential to flow into the economy and equities if the covid drag fades and policy-makers signal a continued commitment to private-led economic expansion.

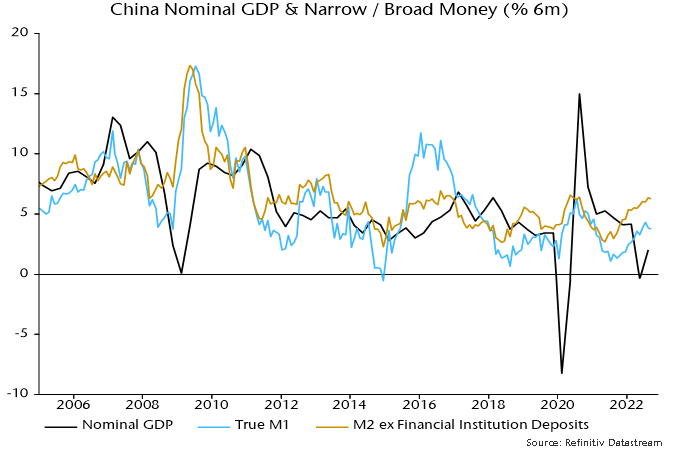

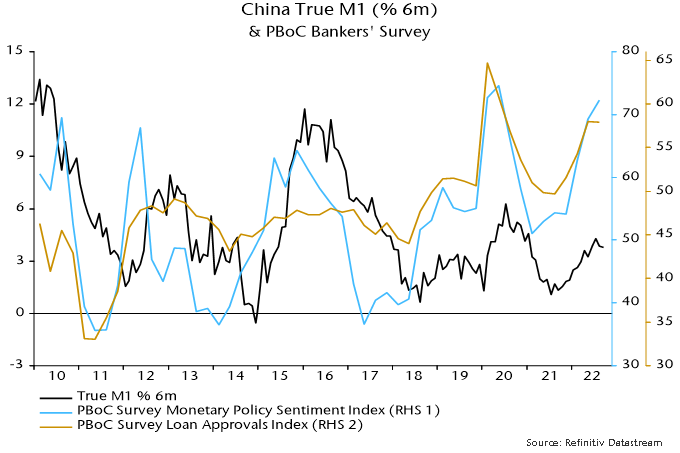

Six-month growth rates of nominal narrow and broad money have risen significantly over the past year, with the recovery reflected in a rebound in two-quarter nominal GDP expansion in Q3 despite further covid lockdowns – see chart 1. August / September numbers hint at a peak in money growth but continuing policy support, including directions to banks to expand lending, argues against a relapse – chart 2.

Chart 1

Chart 2

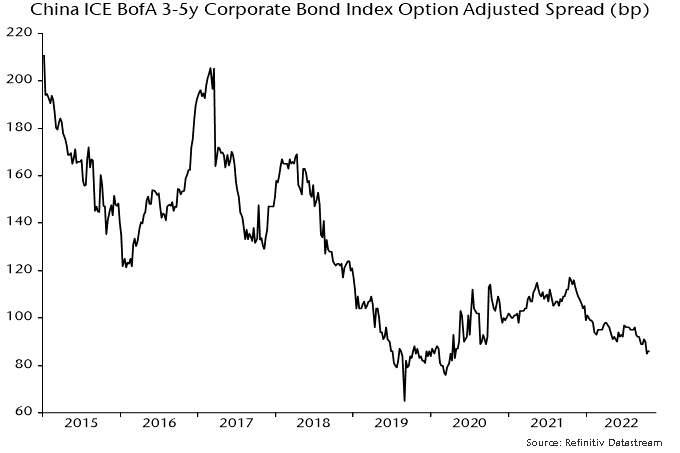

The faster growth of money than GDP, and of broad money relative to narrow, indicates that the transmission of monetary stimulus is incomplete and “excess” money is currently trapped in the financial system. The key reason for the impaired transmission, of course, is the zero covid policy. With economic activity suppressed, excess money has flowed into the bond market, reflected in a fall in government yields despite the global surge and a tightening of onshore credit spreads – chart 3.

Chart 3

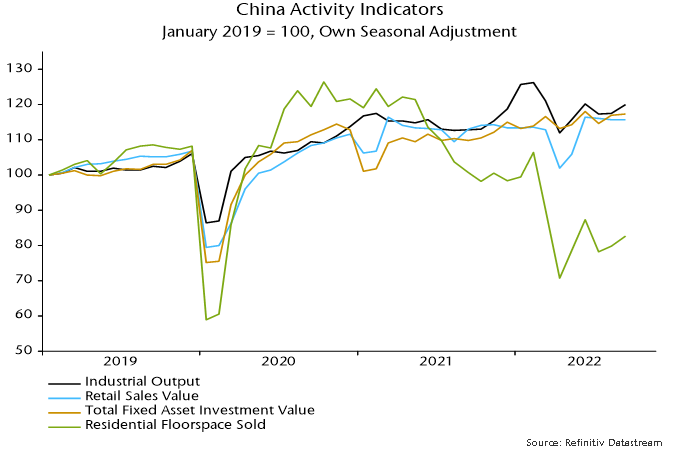

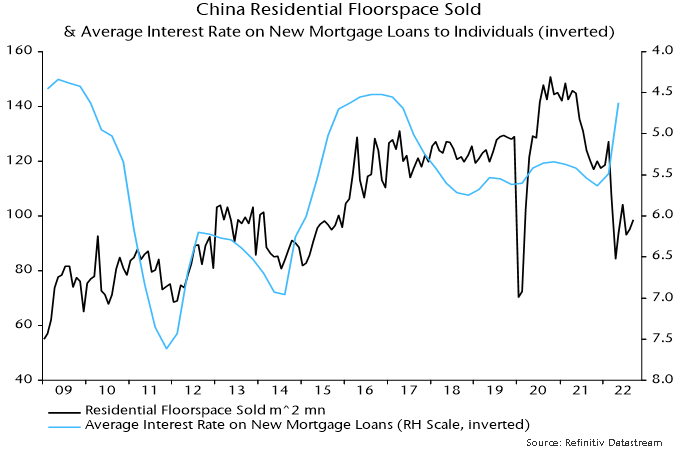

The economy, nevertheless, has been less weak than many feared, as confirmed by the Q3 GDP number and September monthly activity data, showing a pick-up in industrial output and a stabilisation of new home sales – chart 4. A H1 fall in the interest rate on new mortgages and other easing measures are supporting housing market activity, with secondary sales reportedly growing strongly – chart 5.

Chart 4

Chart 5

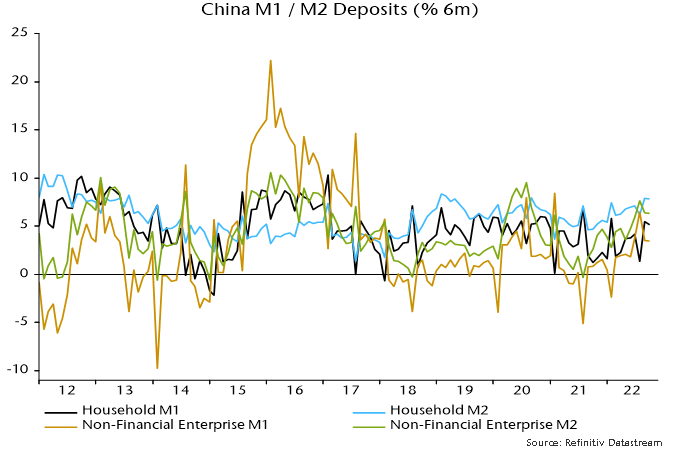

Retail sales remain weak but household money holdings are growing solidly, suggesting fire-power to lift spending if / when covid disruption eases – chart 6.

Chart 6

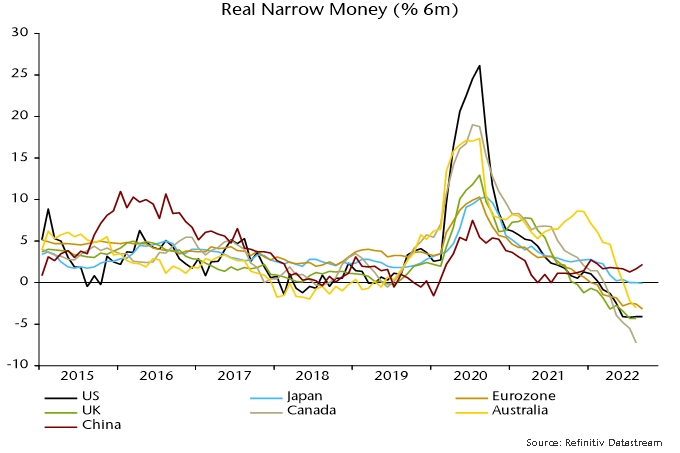

Six-month growth of Chinese real narrow money contrasts with contractions in most major economies – chart 7. The level of growth, however, is modest by historical standards, suggesting moderate economic expansion at best: current growth, for example, has been consistent with a manufacturing PMI new orders index of about 50 – chart 8.

Chart 7

Chart 8

Export weakness due to global recession could drag the PMI lower, as occurred during the GFC. The Chinese reading, however, would be expected to hold up relative to global PMI new orders, which may be heading to 40.

The moderately positive message for economic prospects from real money trends is supported by a recent recovery in a composite leading indicator calculated here, which attempts to mirror the components of the OECD’s US leading indicator – chart 9.

Chart 9