Global money data still weak

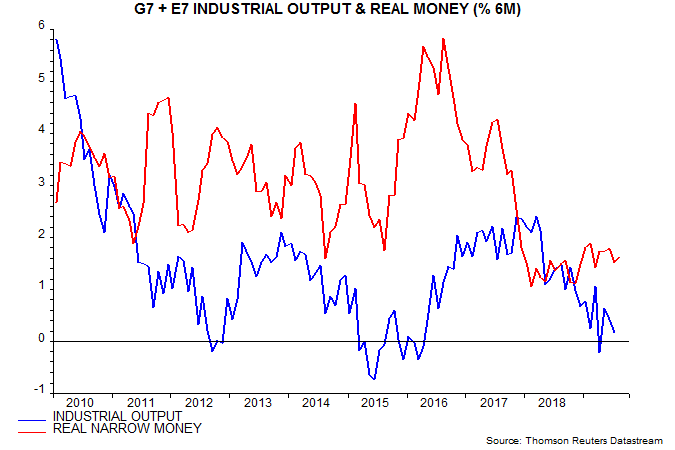

Global six-month real narrow money growth appears to have been little changed in August, suggesting a further extension of weak economic prospects into Q2 2020.

August monetary data have been released for the US, China, Japan, India and Brazil, together accounting for two-thirds of the G7 plus E7 aggregate tracked here. August CPI numbers, meanwhile, are available for all countries bar the UK and Canada*. Assuming unchanged money growth / inflation rates for missing countries, G7 plus E7 six-month real narrow money expansion is estimated at 1.6% versus 1.5% in July – see first chart.

Real money growth remains well below the 3% level judged to be consistent with an economic recovery. A fall below 1% would suggest a full global recession.

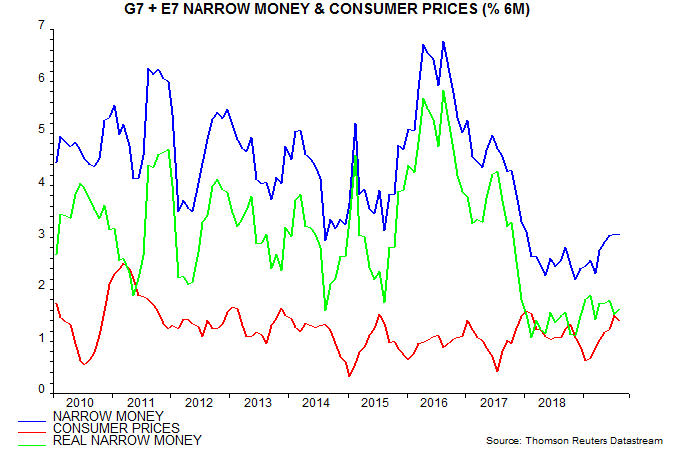

The small August change conceals a partial recovery in China after a sharp July drop, offset by a US relapse to zero – second chart. The Fed’s Q2 financial accounts out on Friday will provide further information about US monetary trends, including sectoral details and data necessary to calculate M3**. Japanese real narrow money growth was little changed in August, while Euroland / UK data will be released on 26 / 30 September.

Global six-month real narrow money growth reached a high for the year of 1.9% in February. The slippage since then reflects a pick-up in six-month consumer price inflation, which has offset a modest rise in nominal money expansion – third chart.

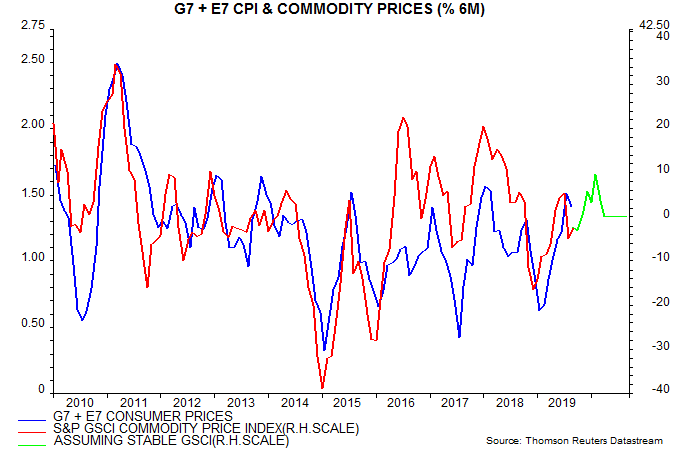

Will the jump in oil prices since the weekend result in a further inflation squeeze on real money growth, pushing it down to the 1% recession warning level? The fourth chart projects forward the six-month rate of change of the GSCI commodity price index in US dollars assuming that the index remains at Monday’s level, which was 8.0% up from Friday. The relationship with G7 plus E7 six-month CPI inflation suggests that the latter will moderate in the very near term before rebounding to slightly above a July high around end-2019.

The oil price rise, therefore, makes an early rise in global real narrow money growth to the 3% recovery level less likely but would need to extend significantly further to generate a recession warning.

*Tokyo only for Japan.

**Some analysts claim to be able to calculate M3 from available monthly data but the methodology involves estimation and potential double counting.

Reader Comments