August PMI results are consistent with the long-standing expectation here that global industrial momentum would bottom around Q3 2019 but narrow money trends have yet to signal an economic recovery. Turning points in industrial momentum are usually associated with a rotation in financial markets but the still-weak economic outlook suggests that any such change will be muted or delayed.

Global manufacturing PMI new orders were little changed for a second month in August, while order backlogs reversed a July fall – see first chart. The new orders-inventories differential – regarded as a leading indicator – dropped back but remains above a March low. These developments hint at a stabilisation of industrial momentum following an 18-month slide.

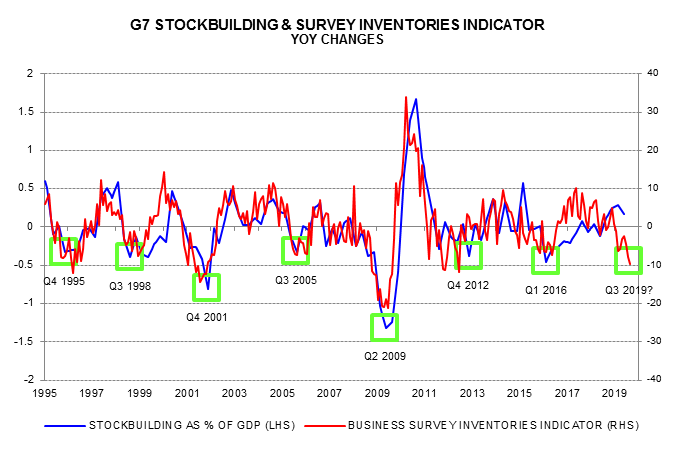

The view that momentum would reach a trough around Q3 was based partly on the stockbuilding cycle, which has an average duration of 3 1/3 years and last bottomed in H1 2016. The cycle is illustrated by the second chart, showing the contribution of stockbuilding to the annual change in G7 GDP. This was still positive in Q2, suggesting that the cycle downswing could last for several more quarters before reaching a trough.

Business surveys, however, are signalling a major inventories downdraft during H2 – the third chart shows a survey-based measure that correlates with and sometimes leads the GDP stockbuilding data. This indicator has fallen to levels consistent with a cycle low, which may be confirmed – after the event – by the GDP data for Q3 / Q4.

The reasons for doubting that a low in industrial momentum associated with a trough in the stockbuilding cycle will be followed by an economic recovery are 1) global real narrow money growth remains weak and 2) the business investment cycle remains in a downswing and may not bottom until H1 2020.

On 1), global six-month real narrow money growth fell back in July and early indications for August are disappointing – US weekly numbers have been weak and global six-month consumer price inflation appears to have remained elevated.

On 2), a trough in the investment cycle is usually marked by the annual change in G7 business investment turning significantly negative and undershooting the annual change in real operating profits, which recovers first. Based on Q2 data, these conditions may not be met for several more quarters – fourth chart.

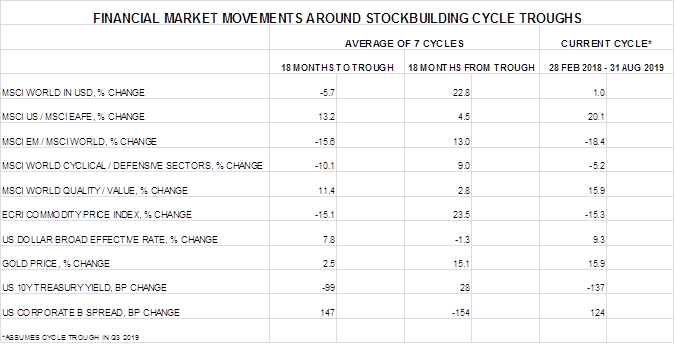

Financial market trends typically reverse around stockbuilding cycle troughs. The table shows that the pattern of returns during the current cycle downswing – assuming a Q3 trough – has been similar to an average of seven previous cycles. In particular, US equities and quality stocks have outperformed, emerging markets have been under pressure, the US dollar has strengthened and Treasury yields have fallen.

A view that the stockbuilding cycle is bottoming would normally imply that investors should rotate portfolios in favour of international / EM equities, value stocks, foreign currencies, commodities and credit, while reducing exposure to defensive US / quality equities and “safe” bonds. With an economic recovery likely to be delayed, however, such a shift could be premature.

Global equities, unusually, have risen during the current stockbuilding cycle downswing – an additional reason for thinking that defensive trends in markets may be incomplete.

A possible approach is to adjust exposure to areas that have already out- or underperformed by more than average for stockbuilding cycle downswings while retaining an overall cautious strategy. This would suggest, for example, reducing US / quality in favour of EM and value equities while retaining an underweight in cyclical sectors.

There is also a case for focusing a portfolio shift in countries / regions, such as Euroland, where money growth has picked up convincingly, implying an earlier economic recovery.