Eurozone / UK July money numbers offer further support to the assessment here that ECB / Bank of England policy tightening has been excessive and – unless reversed swiftly – will cause unnecessarily severe economic weakness and a medium-term inflation undershoot.

The latest releases are astonishing in several respects.

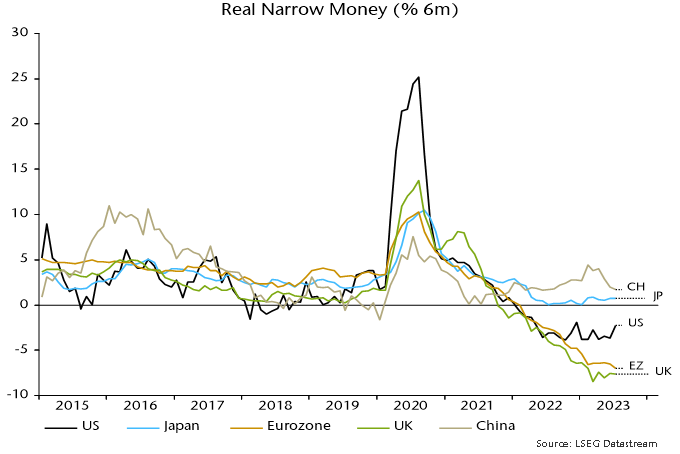

Six-month real narrow money momentum hit a new low in the Eurozone in July and is even weaker in the UK despite a recent boost from falling six-month CPI inflation. Readings are much worse than elsewhere and historically extreme – see charts 1-3.

Chart 1

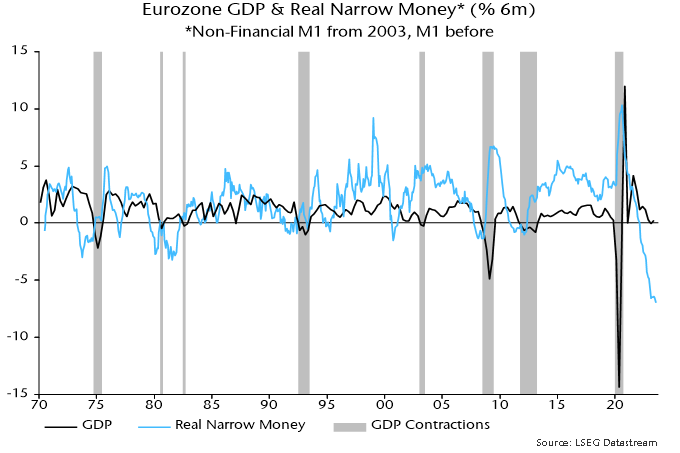

Chart 2

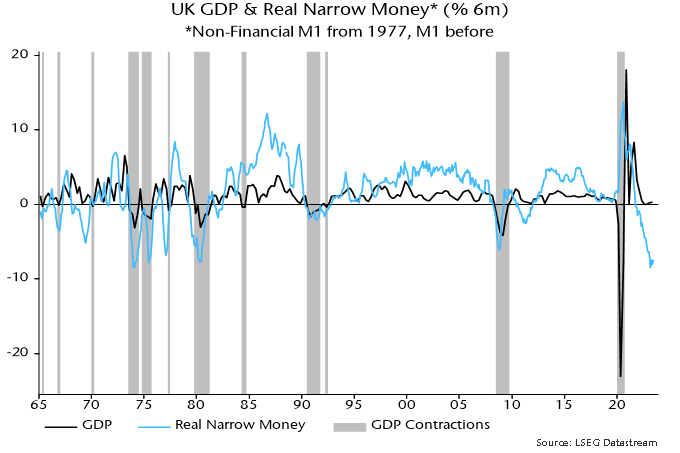

Chart 3

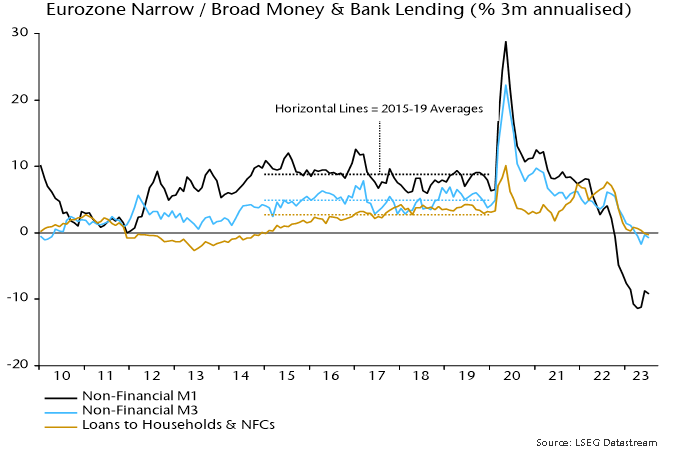

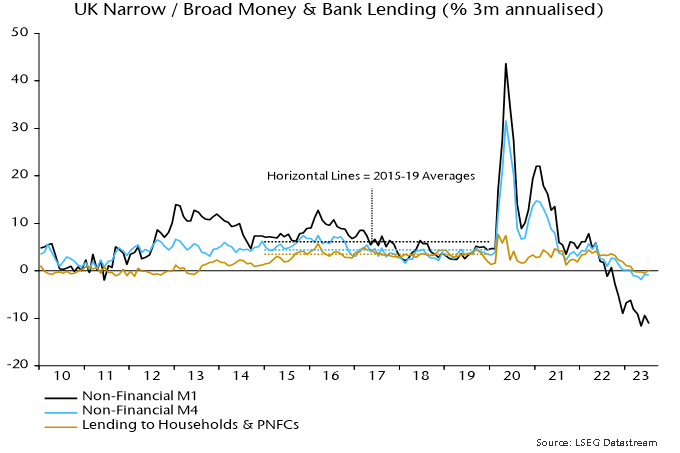

Broad money has followed narrow into nominal contraction. The preferred broad measures here, i.e. Eurozone non-financial M3 and UK non-financial M4, fell at annualised rates of 0.8% and 0.9% respectively in the three months to July – charts 4 and 5.

Chart 4

Chart 5

Broad money declines are rare: since 1970, the Eurozone / UK three-month changes were negative only for a brief period around the GFC, with the falls of similar magnitude to recently.

Money leads the economy while credit is coincident / lagging. Bank lending to households and non-financial firms is starting to contract, consistent with recessions being under way – charts 4 and 5.

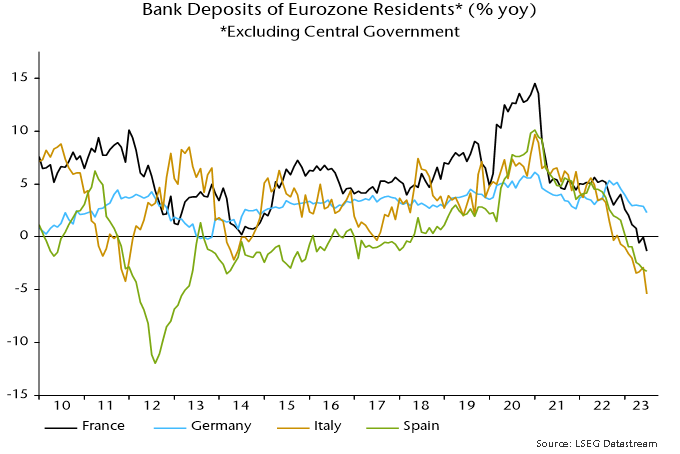

A further notable feature of the Eurozone data is a widening divergence between still-rising bank deposits in Germany and falls elsewhere – chart 6.

Chart 6

A similar core / periphery monetary divergence in 2011 warned of an escalating Eurozone crisis. The driver then was capital flight from the periphery, reflected in a ballooning of national central bank TARGET deficits / surpluses.

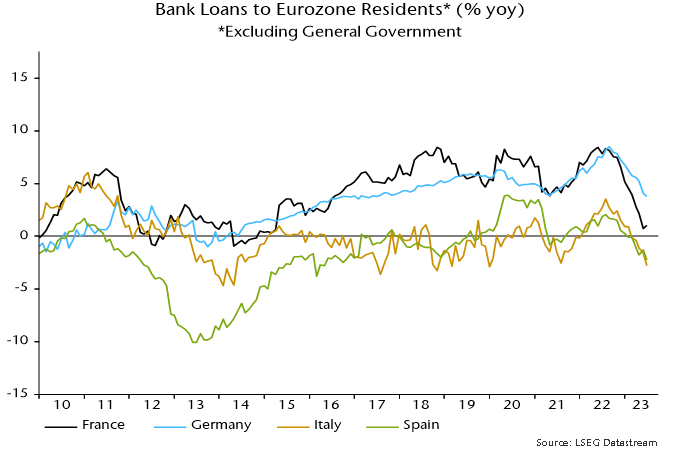

The Bundesbank’s TARGET surplus has fallen recently. Rather than capital flows, the relative resilience of German broad money is explained by less pronounced weakness in bank lending – chart 7.

Chart 7

So money / credit trends suggest that economic prospects in the rest of the Eurozone are at least as bad as in Germany.

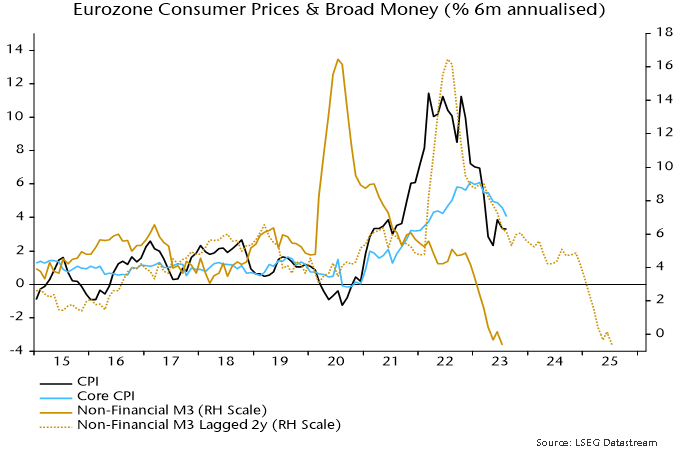

Eurozone six-month CPI momentum, meanwhile, continues to track a simplistic monetarist forecast based on the profile of broad money growth two years earlier – chart 8. Six-month headline momentum was unchanged at 3.3% annualised in August but core slowed further to 4.0%, a 17-month low.

Chart 8

The suggestion is that six-month headline momentum will reach 2% next spring, with the annual rate following during H2. A subsequent significant undershoot is indicated unless recent monetary weakness is reversed.