The baseline scenario in our previous quarterly commentary was that global economic momentum, having bottomed in Q3 2019, would remain weak in early 2020 before strengthening towards mid-year. Recent monetary and cycle evidence has reinforced our caution about near-term prospects while suggesting that a significant reacceleration will be delayed until H2. With recovery hopes now high, and central bank actions unlikely to be as market-supportive as during H2 2019, equities and other cyclical assets may be at risk of a set-back.

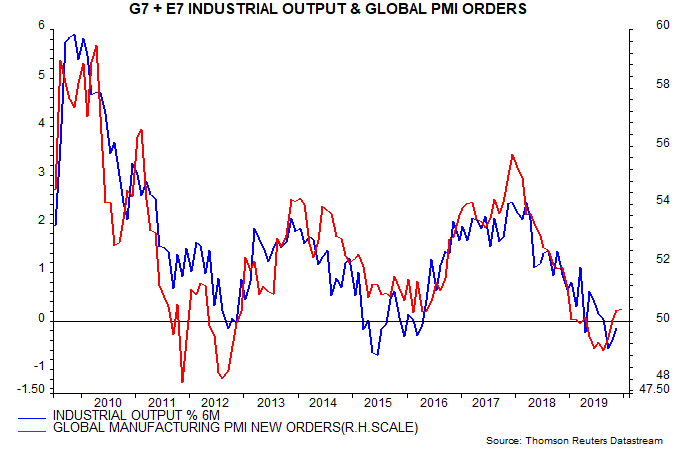

Coincident data support the view that economic momentum bottomed in Q3. The Markit global manufacturing PMI new orders index recovered from a seven-year low of 49.0 in August to 50.4 in November, moving sideways in December. The six-month change in G7 plus emerging E7 industrial output bottomed at -0.6% in September, though appears to have remained negative through November – see first chart.

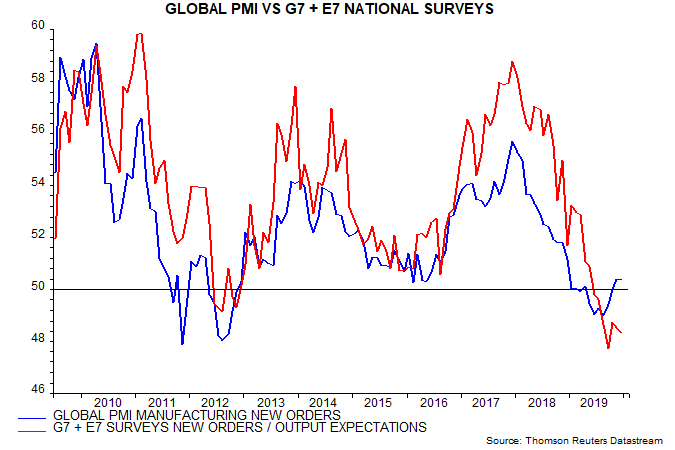

The PMI new orders index remains weak by historical standards, suggesting barely positive industrial momentum. National business surveys, moreover, are giving a more downbeat message: a composite of forward-looking components of G7 plus E7 national surveys, calculated on a PMI basis, has yet to regain the 50 level – second chart. The US ISM and Chinese NBS surveys, in particular, are lagging well behind their Markit counterparts.

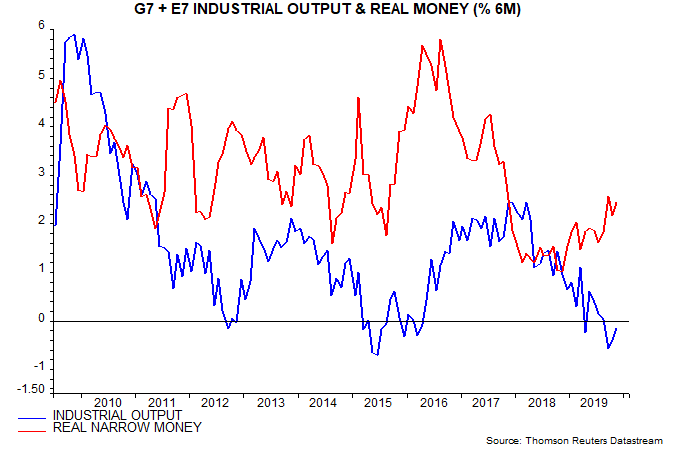

The forecast of a Q3 low in economic momentum was based partly on monetary trends: six-month growth of G7 plus E7 real narrow money bottomed in November 2018 and leads activity by about nine months on average – third chart. Real money growth showed limited recovery through August 2019, leading us to expect economic news to remain weak in early 2020. Our previous commentary, however, expressed hope that money trends would pick up convincingly in late 2019, warranting optimism about economic prospects for mid-2020 and beyond.

Real narrow money growth did rise further but, at 2.4% (not annualised) in November, remains below the 3% level we judge necessary to signal an economic recovery, in the sense of a return to trend or above-trend expansion. The 3% pre-condition appears undemanding: real money growth has averaged 3.2% since the GFC (i.e. over 2010-18) and reached over 4% before the recoveries in 2012-13 and 2016-17.

The suggestion, therefore, is that global economic growth will remain below-trend at least through mid-2020, in turn implying softer labour markets, continued profits weakness and vulnerability to negative shocks, such as an oil price spike or renewed trade conflict.

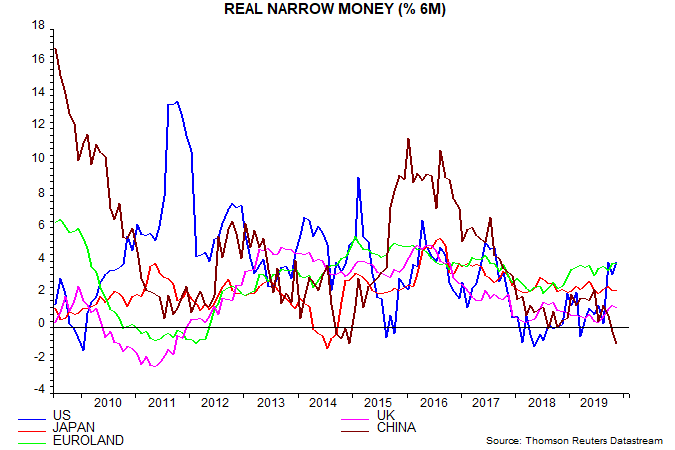

Our global real narrow money measure has been dragged down by a deepening contraction in China – fourth chart. A recovery in Chinese nominal money growth in early 2019 went into reverse following the failure of several regional banks and an associated tightening of credit conditions, while consumer price inflation was pushed up by a surge in pork prices following devastation to hog stocks from African swine fever.

A further cut in reserve requirement ratios at the start of 2020 is unlikely to alleviate the credit shortage, which reflects smaller banks’ funding difficulties and economic risk aversion rather than insufficient banking system liquidity. The corporate financing component of the Cheung Kong Graduate School of Business survey, measuring ease of access to external finance, fell further into end-2019. Real money trends will be boosted by a normalisation of CPI inflation but the timing is uncertain.

US real narrow money growth was weak through August 2019 but rose sharply in September, maintaining the higher level through Q4. This is a positive signal for US economic prospects but not before mid-2020 – near-term risks are judged to lie on the downside, reflecting incomplete inventory adjustment, slowing consumption and Boeing’s suspension of 737 MAX production, which is expected to cut manufacturing output by about 1%.

Euroland money trends remain solid but dependence on exports and business investment suggest that a growth pick-up will be delayed until global economic conditions improve. UK real money growth has recovered slightly but is still low – we await December / January data for a post-election signal but do not expect a further pick-up given the MPC’s refusal to cut rates. The BoJ has also bucked the global trend towards easing: both central banks are relying, probably unwisely, on fiscal stimulus providing an economic lift.

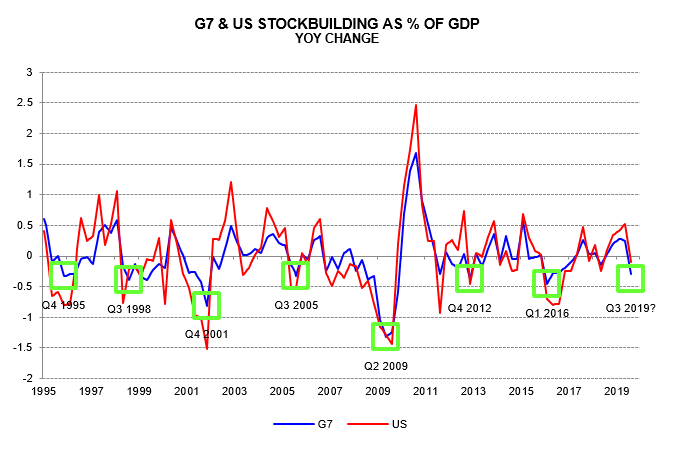

The signal from monetary trends of weak near-term global economic prospects is supported by cycle analysis. Our previous commentaries suggested that the global stockbuilding and business investment cycles would bottom out in Q3 2019 and Q1 2020 respectively. We maintain these datings but now expect a recovery in the stockbuilding cycle to be delayed until Q2 2020, implying that the net impact of the two cycles will remain negative in early 2020.

The fifth chart shows the contribution of stockbuilding to annual GDP growth for the G7 and US alone. The G7 contribution was significantly negative in Q3 2019, consistent with the cycle being at or near a low. The cycle has averaged 3.5 years in recent decades and a Q3 low would be an exact 3.5 years from the previous low in Q1 2016.

The G7 stockbuilding drag in Q3, however, reflected extreme weakness in Germany and the UK, while the US contribution was only slightly negative. The US drag is expected to intensify in Q4 and Q1, delaying a recovery at the G7 level.

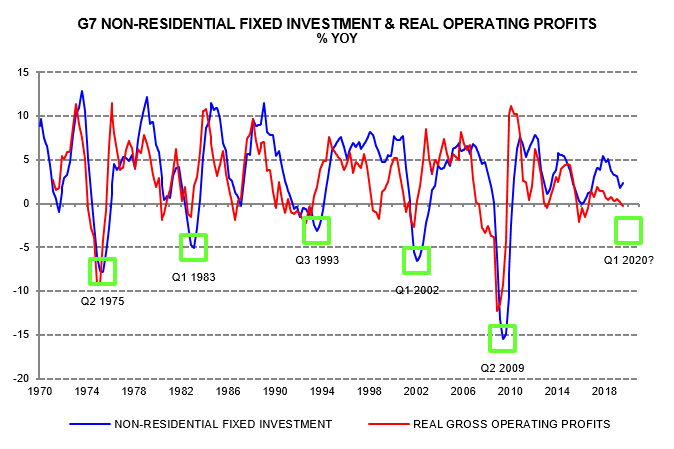

The G7 business investment cycle last bottomed in Q2 2009 and has a maximum length of 11 years, implying a low by Q2 2020 at the latest. Based on experience in recent decades, a cycle low is likely to involve the annual change in investment turning negative and undershooting the annual change in real operating profits – sixth chart. The annual investment change was still positive and ahead of the profits change in Q3, supporting the expectation of further weakness into H1 2020.

What does the economic scenario described above imply for market prospects? As explained in previous commentaries, market behaviour has often shifted from defensive / risk-off to pro-cyclical / risk-on around stockbuilding cycle lows. Solid equity market performance in Q4, along with outperformance of cyclical sectors / EM and underperformance of safe bonds, are consistent with the assessment that the cycle bottomed in Q3.

With a stockbuilding recovery now judged likely to be delayed until Q2 2020 or later, however, these pro-cyclical market trends could stall or reverse near term.

Markets were also boosted in Q4 by renewed Fed and ECB balance sheet expansion. The Fed, however, made clear that its actions were intended to relieve a shortage of bank reserves and did not represent a resumption of QE. With money markets remaining calm into end-2019, the Fed may curtail repo operations after January and cease Treasury bill purchases early in Q2, suggesting that its balance sheet is peaking.

Absent further central bank stimulus, markets may struggle to sustain recent gains. In our framework, a favourable “excess” money environment is indicated by global real narrow money growing faster than both industrial output and its long-run average. The latter condition remains unfulfilled and equity returns have been below average when this has been the case historically.

We remain inclined to expect economic growth to strengthen in H2 2020 as the stockbuilding and business investment cycles enter recoveries and lower interest rates reenergise the longer-term housing cycle upswing; such a scenario would be confirmed by a rise in global real money growth above the 3% threshold. A strong pick-up would present different challenges for markets: with spare capacity limited, above-trend economic expansion would be likely to feed through swiftly to inflation, forcing central banks to choose between early policy tightening and accommodating a medium-term overshoot of targets.