Labour market watch: global vacancies weakness

UK labour market trends remain consistent with the view here that the economy has entered a recession.

This view was seemingly undermined by Monday’s news of a 0.3% monthly rise in GDP in July. The monthly numbers, however, are volatile and revisions tend to be downwards when the economy is weakening – at the start of the 2008-09 recession, GDP was initially estimated to have risen by 0.2% in Q2 2008 but is now reported to have declined by 0.7%.

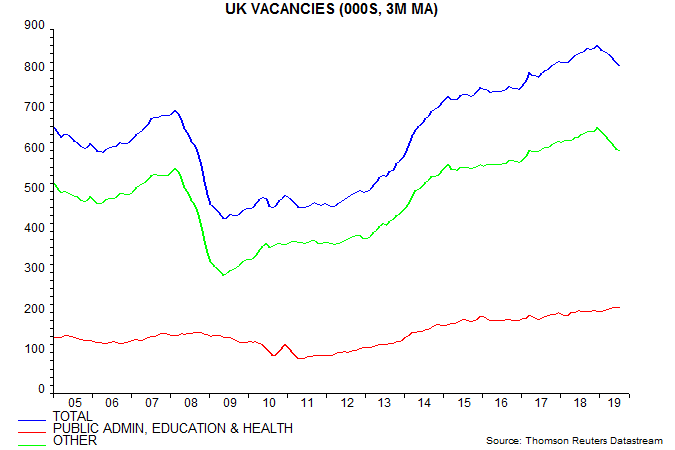

Aggregate hours worked, measured on a three-month rolling basis, fell by 0.4% between April and July. Such a three-month decline is not unusual but a further drop in the stock of vacancies suggests that weakness will extend – see first chart.

The percentage fall in vacancies is now similar to a decline before the 2011-12 double dip scare. Weakness then was due to public sector job cuts but the current reduction is being driven by private employers, suggesting that it reflects contracting activity (as opposed to fiscal consolidation) – second chart.

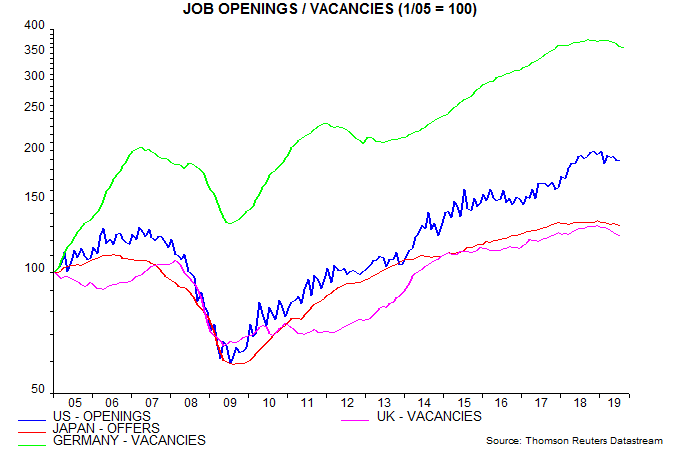

Vacancies or job openings / offers are now falling simultaneously in the US, Japan, Germany and UK for the first time since the 2008-09 recession – third chart.

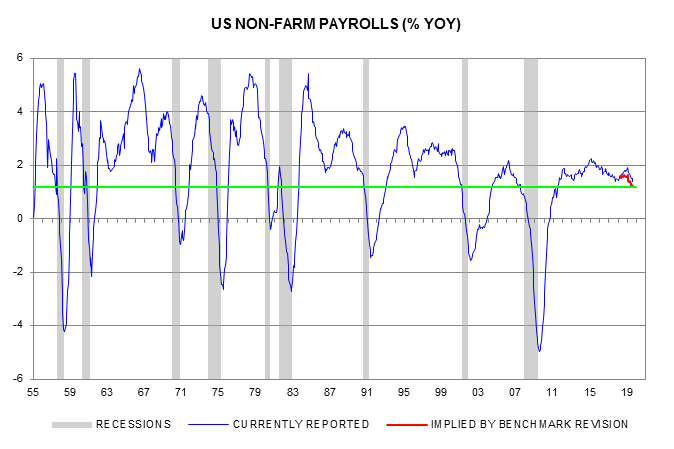

Annual growth of US non-farm payrolls fell to 1.4% in August, the lowest since 2017. Current data, however, do not incorporate a BLS estimate that the payrolls rise between March 2018 and March 2019 was overstated by 501,000 – revised figures will be issued in February 2020. Assuming that monthly payrolls changes between April 2018 and March 2019 were 42,000 (501,000 divided by 12) lower than currently reported, the “true” annual growth rate for August was 1.2%. Since the mid 1950s, falls in annual payrolls growth to this level have occurred only in the context of recessions – fourth chart.

Reader Comments