UK economic news remains consistent with a recession having started in Q2.

The CBI’s expected growth indicator – a GDP-weighted average of future output or sales responses from its monthly surveys of manufacturing, distribution and other service industries – is estimated to have plunged into contraction territory in August; the CBI will release the August result over the weekend – see first chart.

An early recession warning was a contraction of real M1 holdings of private non-financial corporations (PNFCs) in the six months to February, signalling likely business retrenchment. July monetary data released today show that the six-month change remained negative last month – second chart.

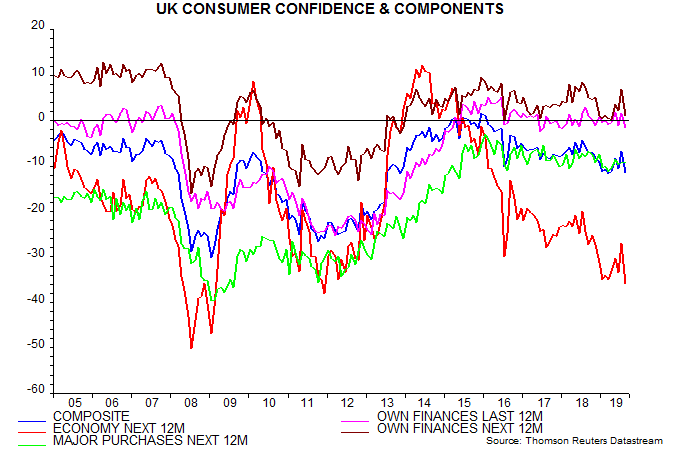

Household real M1 holdings are still growing but have slowed, with further weakness likely as a softer labour market curbs income growth. Households were markedly more pessimistic about recent and prospective trends in their finances in the August GfK / EU Commission consumer survey, contributing to a large drop in the composite confidence index – third chart.