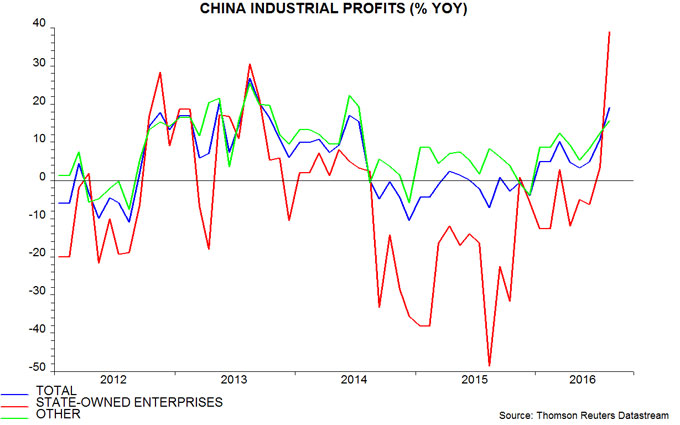

Chinese industrial profits surged in August, providing further confirmation that the economy is strengthening, as signalled by monetary trends since late 2015.

Profits rose by 19% in August from a year before, the fastest annual growth rate since 2013. The August result was flattered by a favourable base effect but underlying growth is well into double-digits. Profits of state-owned enterprises were 39% higher in August than a year before, though had slumped by 49% in the previous 12 months – see first chart.

A fall in profits in 2015 contributed to weakness in private fixed asset investment through summer 2016. Previous posts suggested that this year’s profits rebound, and an accompanying pick-up in growth of enterprise money holdings, would feed through to a revival in investment later in 2016 and in 2017. August investment results provided tentative support for this view, with the annual change in the private component recovering to a four-month high.

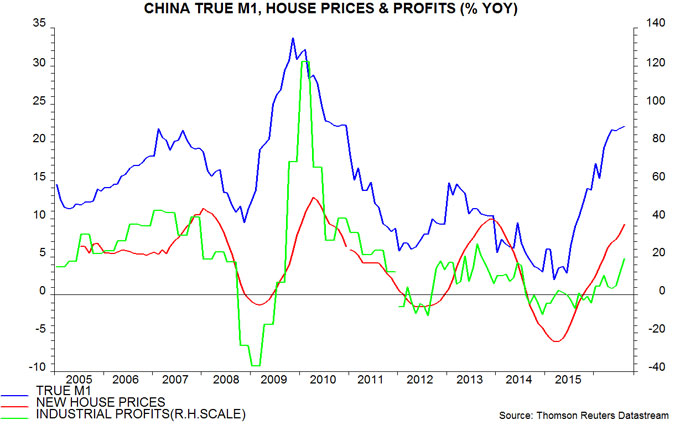

Monetary reflation is following the usual pattern. The surge in narrow money began in spring 2015 and was immediately reflected in a change in trend of house prices. A recovery in profits followed from late 2015. Annual narrow money growth rose to a new high in August, suggesting that annual house price inflation and profits growth are still some way from peaking – second chart.

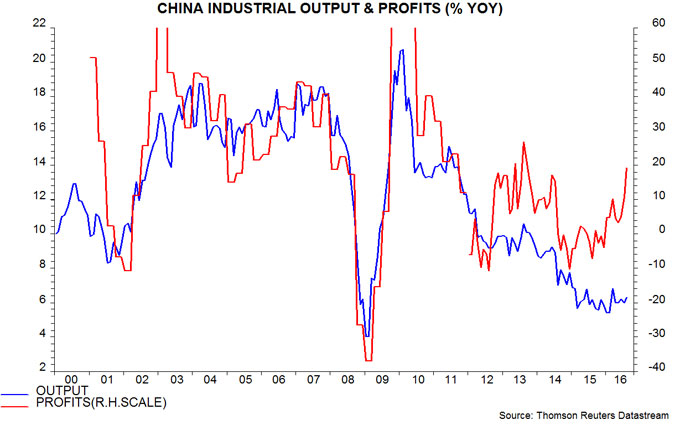

The usual pattern implies that investment and industrial output growth will now strengthen: profits and output cycles have been closely entwined historically – third chart. Stronger industrial activity, in turn, would be expected to feed through to a further recovery in pricing power and faster nominal GDP expansion.

In this scenario, monetary policy would probably shift from its current easing bias towards modest tightening, suggesting a reduction in capital outflows and re-emergence of upward pressure on the exchange rate from the large current account surplus.