US corporate finances improving, supporting growth rebound

US corporate financing needs fell modestly in the first quarter, a development consistent with the view here – based on monetary trends – that the economy will regain momentum during the second half of 2016.

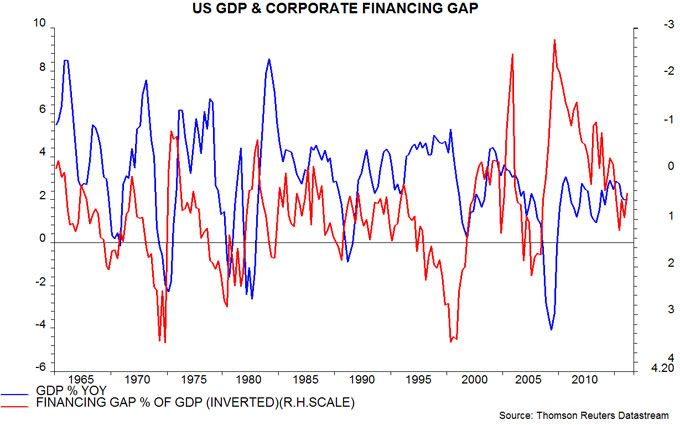

The Fed’s quarterly financial accounts show that the “financing gap” of non-financial corporations – defined as the difference between their capital spending and domestic retained earnings – was 0.5% of GDP in the first quarter, down from 1.0% in the fourth quarter of 2015 and a peak of 1.2% in the second quarter of last year.

The financing gap is an inverse long leading indicator of the economy, probably because unanticipated changes in financing needs cause companies to alter spending and employment plans. The seven US recessions over the past 50 years were preceded by a rise in the financing gap to more than 1.5% of GDP – see first chart.

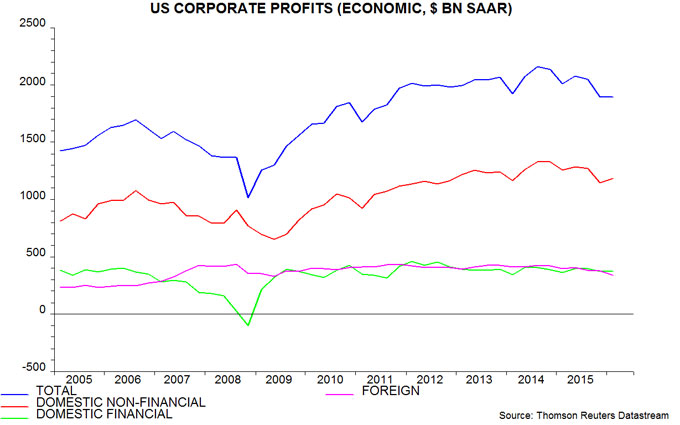

The fall in the financing gap in the first quarter was mainly due to a further reduction in capital spending (i.e. fixed investment plus stockbuilding). In addition, however, domestic profits recovered slightly after significant weakness during the second half of 2015 – second chart*.

The profits recovery may continue in the current quarter. The energy sector accounted for more than half of the fall during the second half of 2015 and the spot WTI oil price has averaged $46 a barrel so far in the second quarter versus $33 in the first. Productivity performance appears to have improved, relieving upward pressure on unit labour costs: the Atlanta Fed’s “nowcast” for GDP growth in the second quarter is currently 2.8%, implying a 0.7% non-annualised gain, while aggregate hours worked by private non-farm employees rose by only 0.1% April / May compared with the first-quarter average.

Foreign profits, meanwhile, will benefit from a positive translation effect from the weaker US dollar: the Fed’s trade-weighted index against other major currencies has averaged 89.5 so far in the second quarter versus 93.2 in the first, a 4.0% decline. (Foreign profits, however, enter the financing gap calculation only to the extent that they are repatriated.)

While corporate financing needs for operational purposes have declined, companies borrowed heavily to finance share buy-backs and cash takeovers in the first quarter. Equity buying net of issuance rose to 3.9% of GDP, the highest since the third quarter of 2011.

As expected given softer labour market news and the UK EU referendum, the Federal Open Market Committee (FOMC) was yesterday non-committal about the timing of another rate rise. The median expectation of the 17 meeting participants is still for two quarter-point increases by end-2016 but six now foresee a single rise versus one in March. The view here remains that the economy is on a firming trend and a move in September is plausible, unless the current “risk-off” phase in markets is sustained.

*”Economic” profits incorporate inventory valuation and capital consumption adjustments to reported profits.

Reader Comments